Blog

Dec 30, 2025

The Advisor Playbook for January: What Actually Matters in the First 30 Days of 2026

January is not a planning month—it's an execution month. The advisors who succeed in Q1 aren't the ones frantically building new strategies in response to December's market action. They're the ones who enter January with clear priorities, established processes, and a systematic approach to what deserves attention versus what demands discipline to ignore.

The first 30 days of the year represent a critical window. Client attention peaks, portfolio reviews cluster, and operational momentum either builds or stalls for the entire quarter. Getting January right isn't about prediction—it's about preparation, prioritization, and resetting the narrative after a month of market noise.

What Deserves Immediate Attention

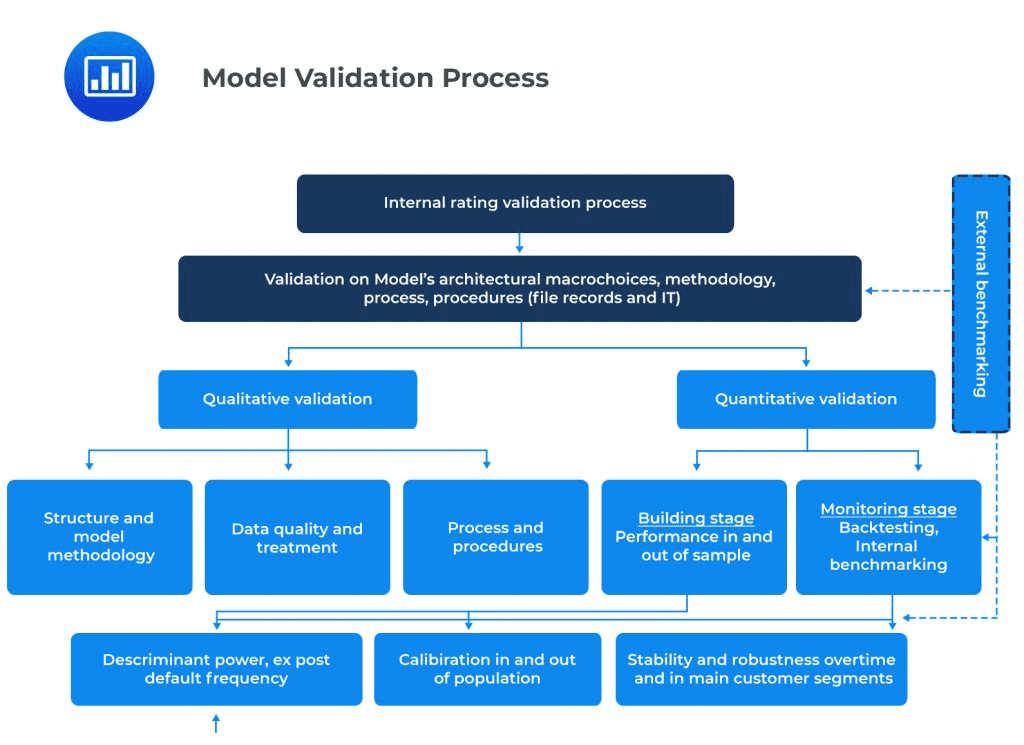

Portfolio Model Validation

The start of the year is model review season—not because markets changed fundamentally in December, but because this is when you have the clearest view of how your allocations actually performed under stress across a full calendar year.

Research from Morningstar Direct analyzing 10,000+ advisor portfolios found that advisors who conducted formal model reviews in January identified an average of 2.3 allocation drifts per model that required adjustment—ranging from overweight exposures that accumulated through rebalancing delays to style drifts in underlying funds that no longer matched original mandates.

The tactical questions that matter:

Style consistency: Did your "growth" allocations actually deliver growth characteristics, or did managers drift into value territories during market volatility?

Factor exposures: What unintended factor tilts emerged from individual security selection across your models?

Correlation assumptions: Did your diversification assumptions hold during the year's stress periods, or did correlations converge when you needed them separated?

Vanguard's research on portfolio construction documented that 40% of advisors who skip formal January model reviews discover allocation problems only after clients raise performance concerns—a reactive dynamic that undermines confidence.

January model validation isn't about wholesale changes. It's about confirming that your portfolio infrastructure still maps to your stated investment philosophy before client conversations intensify.

Assumption Auditing: The Numbers That Drive Everything

Every financial plan runs on assumptions: return expectations, inflation projections, withdrawal rate sustainability, tax treatment forecasts. January is when you validate whether those assumptions still reflect current market realities or whether they've drifted into hope-based planning.

J.P. Morgan's 2025 Long-Term Capital Market Assumptions revised expected 10-year equity returns downward by 60 basis points and fixed income returns upward by 40 basis points compared to their 2024 baseline—modest changes that compound dramatically across multi-decade plans.

The advisor who updates these assumptions in January and re-runs client plans gains two advantages: first, you identify which clients now face materially different probability-of-success metrics and can address it proactively. Second, you demonstrate the ongoing active management of their financial plan rather than treating it as a static document.

Research published by the Journal of Financial Planning found that clients whose advisors updated plan assumptions annually rated their advisor's value 30% higher than clients whose plans remained static—even when the assumption changes were minor.

The assumptions that warrant January scrutiny:

Expected returns by asset class (especially fixed income in a normalized rate environment)

Inflation expectations (distinguishing between near-term and long-term projections)

Tax law implementation (as new regulations phase in or sunset provisions approach)

Longevity projections (updated annually based on evolving actuarial data)

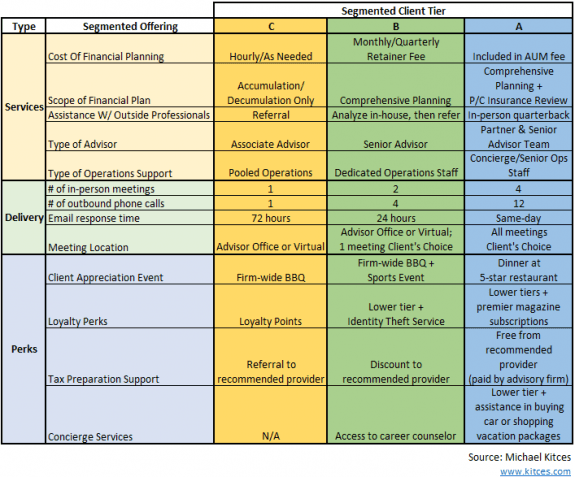

Client Segmentation: Service Model Alignment

January is when advisor calendars are most malleable—before client review season locks in the schedule. This makes it the optimal time to validate that your service model still aligns with client needs and firm economics.

Cerulli Associates' 2024 Advisor Metrics study found that 65% of advisors operate with outdated client segmentation models, delivering uniform service regardless of household complexity, AUM, or profitability.

The mechanics of effective segmentation aren't subjective:

Revenue per client: Not just AUM but total relationship revenue including planning fees, referrals generated, and multi-generational engagement

Service hours required: Track actual time spent per household over the trailing twelve months—you'll likely discover that your most demanding relationships aren't your largest

Growth trajectory: Which client relationships are naturally expanding (business sale proceeds, inheritance events, career progression) versus static?

Fidelity's RIA Benchmarking Study documented that advisors who formally re-segment clients annually and adjust service models accordingly achieve 20% higher revenue per partner compared to peers—not through aggressive growth but through operational efficiency.

The January segmentation review shouldn't be punitive (firing small clients) but intentional: which households merit quarterly reviews versus annual check-ins? Who receives comprehensive planning versus investment-only services? Where does your calendar alignment match your stated priorities?

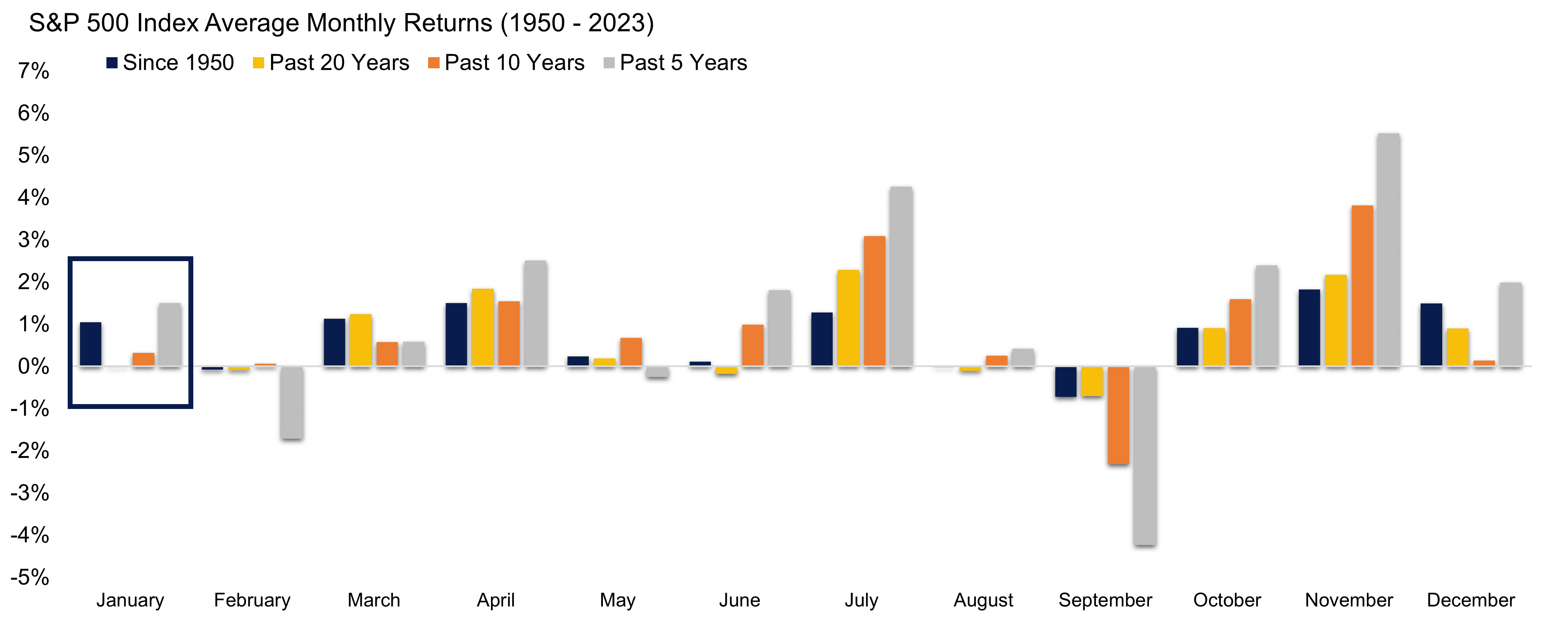

What to Intentionally Ignore

Early January Market Moves

The "January Effect"—the historical tendency for small-cap stocks to outperform in the first month—generates reliable media attention and client questions. The statistical reality: it's weakened dramatically over the past two decades and has zero predictive value for full-year performance.

Research from AQR Capital Management analyzing 95 years of market data found that January returns explain just 3% of variance in full-year equity returns—economically and statistically insignificant.

Yet advisors waste hours in January fielding client questions about whether to "catch" the January rally or reposition based on the month's first two weeks of trading. The disciplined response: acknowledge the pattern exists historically, explain why it doesn't inform our strategy, and redirect to what actually matters.

Fourth Quarter Earnings Noise

January is Q4 earnings season, creating concentrated newsflow about individual companies and sectors. For advisors managing diversified portfolios and index-based strategies, this granular data is almost entirely irrelevant to client outcomes.

Morningstar's analysis of advisor behavior found that advisors who actively discuss individual earnings reports with clients see 40% higher rates of client-initiated rebalancing requests—almost none of which improve outcomes and many of which create tax inefficiencies.

The appropriate January posture on earnings: monitor for systematic sector-wide issues that might inform thematic views, but avoid the trap of treating earnings beats or misses as actionable intelligence for diversified client portfolios.

Prediction Season

Every major bank, asset manager, and research shop publishes year-ahead predictions in January. These forecasts generate conversation but rarely generate value.

Research compiled by CXO Advisory Group tracking 6,582 market predictions from 68 experts over fifteen years found an average accuracy rate of 47%—worse than a coin flip. The predictions that prove most wrong are typically the most confident, creating client anchoring effects that persist throughout the year.

Your role isn't to synthesize Wall Street's consensus into a refined prediction. It's to acknowledge uncertainty, explain how your portfolio positioning accounts for multiple scenarios, and demonstrate why your process doesn't depend on forecast accuracy.

Resetting Client Narratives Post-December

The client who ended 2025 focused on December's market moves needs narrative reframing in January—ideally before their formal review meeting.

The Pre-Review Communication

Fidelity research on client engagement found that clients who received a brief written update before their annual review meeting had 35% fewer reactive questions during the meeting and 50% higher satisfaction scores afterward.

The effective January pre-review communication includes:

Full-year performance in context: Not just returns but returns relative to stated benchmarks and within the volatility parameters established in the IPS

What didn't change: A reminder of strategic positioning, risk tolerance alignment, and long-term plan metrics that remain on track

What we're monitoring: The 2-3 genuine forward-looking considerations that inform your 2026 posture—not predictions but variables worth watching

Reframing December's Noise

Clients remember December volatility or momentum more vividly than September's fundamentals. Your January conversation needs to explicitly reset timeframes.

The language that works: "December's 2.5% gain was technically accurate but primarily reflected year-end trading dynamics—light volume, institutional window dressing, tax-motivated flows. Our 2026 positioning is based on [specific thesis], which hasn't changed based on December noise."

Vanguard's research on advisor alpha estimates that behavioral coaching during periods of market distortion or noise adds approximately 150 basis points annually—with January representing one of the highest-value coaching windows because it sets the narrative framework for the entire year.

The Infrastructure That Makes January Work

Advisors who succeed in January share a common characteristic: they're not building the plane while flying it. The operational infrastructure to support January priorities—model analysis, assumption updates, segmentation reviews, client communications—already exists before the month begins.

Investment News' 2024 Technology Survey found that advisors using integrated portfolio management, financial planning, and CRM systems spent 40% less time on January operational tasks and reported 25% higher confidence in their Q1 client communication compared to peers using disconnected point solutions.

The systems-level requirements aren't exotic: you need portfolio analytics that surface drift and factor exposures automatically, financial planning software that allows batch assumption updates across your client base, and CRM workflows that trigger segmentation-appropriate communication cadences without manual calendar management.

January's workload doesn't decrease—it redirects from reactive firefighting to proactive client value delivery.

The 30-Day Outcome

By January 31st, the prepared advisor has accomplished five concrete objectives:

Validated portfolio models against full-year performance data and confirmed alignment with investment mandates

Updated planning assumptions across the client base and identified households requiring proactive plan adjustments

Refined client segmentation and aligned service delivery to household value and complexity

Reset client narratives away from December noise toward long-term strategic positioning

Established Q1 operational momentum through systematic processes rather than reactive responses

None of this requires market predictions, tactical brilliance, or perfect timing. It requires discipline, preparation, and infrastructure that supports execution.

The advisors who enter February with these foundations in place don't just survive Q1—they separate from peers who spent January reacting to noise instead of building for the year ahead.

Related

Get Started

Experience the full power of our SaaS platform with a risk-free trial. Join countless businesses who have already transformed their operations. No credit card required.

FAQs