Blog

Dec 5, 2025

In June 2024, Evolve Bank & Trust disclosed a data breach affecting 16.9 million customers—names, Social Security numbers, account numbers, and birth dates exposed. That same year, a ransomware attack at a cloud IT service provider brought down 60 U.S. credit unions simultaneously. Meanwhile, nearly 20% of Schwab-affiliated advisors signaled they're evaluating adding or changing custodians.

These aren't isolated incidents. They're symptoms of a structural vulnerability in the RIA channel—one that's pushing resilience from back-office concern to boardroom imperative.

The Cost of Downtime Has Never Been Higher

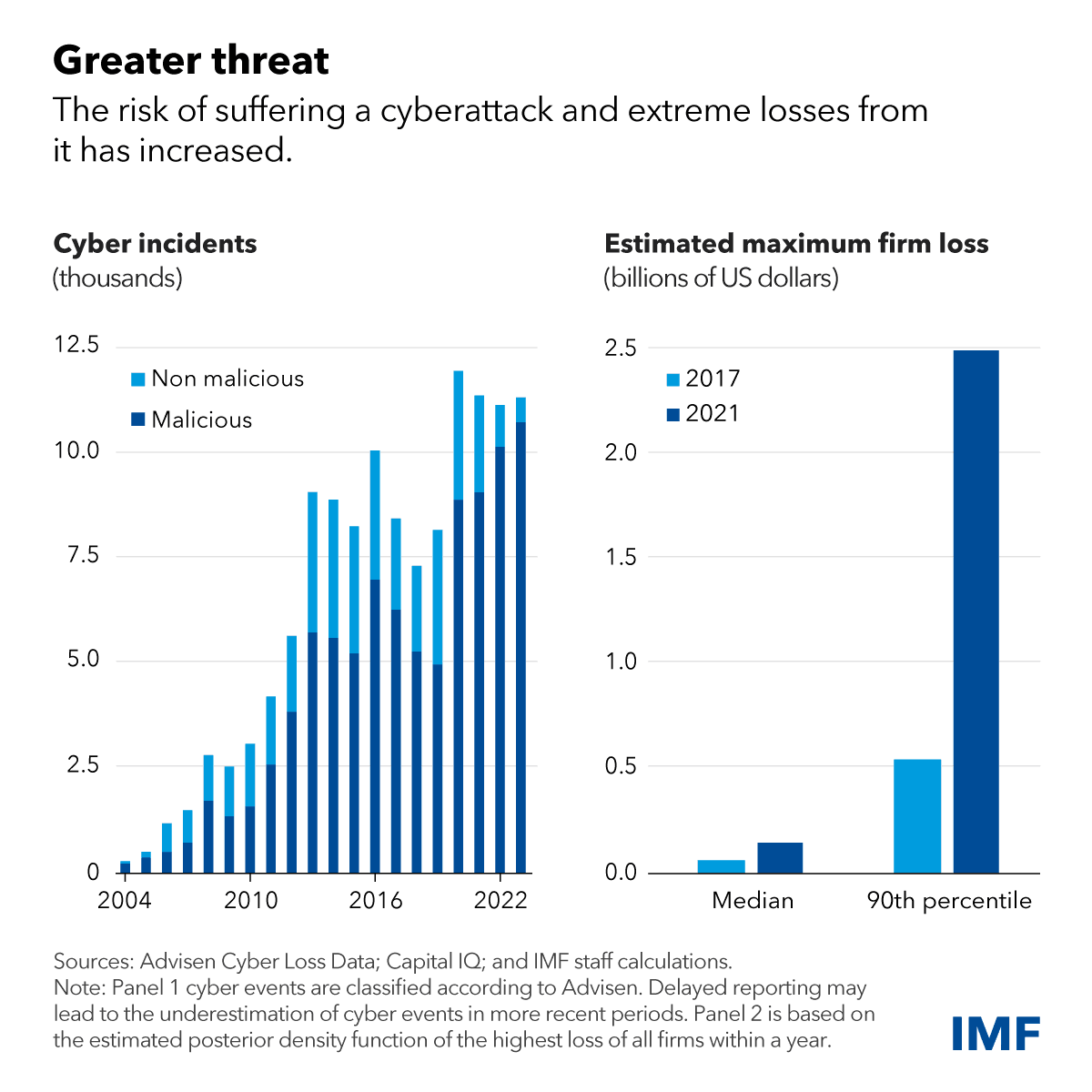

Financial services firms now shoulder an average data breach cost of $6.08 million, 22% above the global average. But the real damage extends far beyond dollars. Client trust erodes. Regulatory scrutiny intensifies. Operational paralysis spreads.

The math is straightforward: financial institutions take an average of 168 days to identify a breach and 51 days to contain it. That's seven months of exposure—seven months when attackers move laterally, compromise additional systems, and exfiltrate sensitive data.

For RIAs managing client assets in the hundreds of millions or billions, this timeline is unacceptable. Yet many firms remain dangerously underprepared. Only about half of countries surveyed maintain a national, financial sector-focused cybersecurity strategy or dedicated regulations.

Why Multi-Custodian Strategies Are No Longer Optional

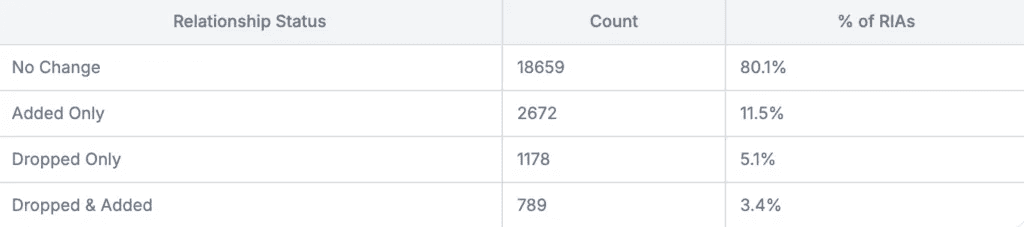

The 27.2% of RIAs now using two or more custodians aren't hedging for competitive pricing alone. They're building redundancy against operational failure.

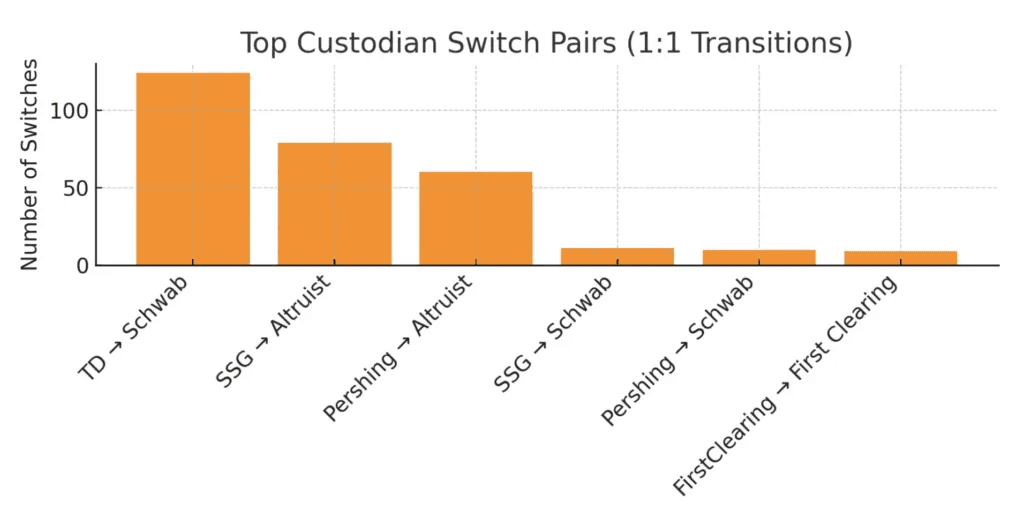

When Schwab absorbed TD Ameritrade, advisors watched closely. Service quality concerns surfaced. Integration hiccups emerged. The lesson? Concentration risk isn't just about assets—it's about infrastructure dependency.

A multi-custodian approach delivers three core benefits:

Operational redundancy: When one platform experiences downtime, business continues on another

Negotiating leverage: Competition for custody relationships improves service quality and technology offerings

Client optionality: Different custodians excel at different capabilities—international trading, alternative assets, UHNW services

But diversification introduces complexity. Inconsistent transaction categorization across custodians can miscalculate advisor payouts. Missing cost basis data compromises client performance reports. Timing mismatches between custodians create reconciliation headaches that consume hours of staff time.

Smart firms solve this through technology, not manpower. Unified data governance platforms eliminate format inconsistencies. Automated reconciliation catches errors before they compound. Real-time monitoring flags discrepancies immediately.

The Resilience Checklist: Scaled by AUM

Operational resilience isn't uniform. A $150 million RIA and a $1.5 billion firm face materially different risk profiles. Here's how the requirements scale:

Firms Over $100M AUM: Building the Foundation

Technology Stack

Cloud-based CRM and portfolio management with automatic failover

Multi-factor authentication across all systems

Daily encrypted backups with 30-day retention minimum

Documented vendor security protocols

Custody & Continuity

Primary custodian relationship with clear SLAs

Written business continuity plan addressing temporary and extended interruptions

Annual testing of disaster recovery procedures

Alternative communication channels for client contact

Cybersecurity Baseline

Quarterly vulnerability assessments

Annual third-party penetration testing

Employee phishing simulation and training

Incident response plan with defined escalation paths

Firms Over $1B AUM: Enterprise-Grade Resilience

Technology Stack

Zero-trust architecture with conditional access policies

Security Information and Event Management (SIEM) system with 24/7 monitoring

Privileged access management for system administrators

Quarterly tabletop exercises simulating breach scenarios

Custody & Continuity

Dual-custodian model with complementary capabilities

Dedicated disaster recovery site with failover in <4 hours

Weekly backup testing and quarterly full recovery drills

Crisis management team with pre-assigned roles and external communications protocols

Cybersecurity Advanced

Continuous threat exposure management (CTEM) program

Managed detection and response (MDR) service

Board-level cybersecurity expertise and quarterly briefings

Cyber insurance with adequate coverage for business interruption

The gap between these tiers isn't just operational—it's existential. Firms with mature incident response capabilities save an average of $248,000 annually compared to those without.

What Regulators Are Watching

The SEC expects robust business continuity plans as part of an RIA's fiduciary obligation, even though the 2016 proposed rule was never finalized. State regulators have moved faster—NASAA's model rule requires written business continuity and succession plans for state-registered advisors.

The message is clear: demonstrate preparedness or face heightened scrutiny. Recent enforcement actions target firms that:

Failed to protect client data despite known vulnerabilities

Lacked adequate vendor due diligence procedures

Couldn't restore operations within reasonable timeframes

Missed mandatory breach disclosure deadlines

SEC amendments in late 2023 require financial organizations to disclose material cybersecurity incidents. New York's NYDFS regulations now mandate reporting of ransomware attacks hitting material network segments within 24 hours, along with extortion payments.

Compliance isn't just defensive. Well-documented resilience programs become competitive differentiators when prospective clients conduct due diligence.

The Third-Party Problem

Cyberattacks targeting supply chain partners create cascading failures across the financial ecosystem. RIAs depend on custodians, portfolio accounting systems, CRM platforms, and data aggregators—each representing a potential vulnerability.

The 2024 SitusAMC breach highlighted how little-known vendors supporting critical infrastructure can become attack vectors. Financial services maintains the best digital defenses of any sector, but third-party exposure remains difficult to assess and control.

Best practices include:

Annual vendor security assessments using standardized frameworks

Contractual requirements for breach notification timelines

Regular reviews of vendors' own business continuity capabilities

Limiting data sharing to only what's operationally necessary

Where Modern Infrastructure Closes the Gap

The old model—manual processes, siloed systems, reactive security—can't scale to meet today's threat environment. Modern RIA infrastructure must be:

Unified: Single source of truth for client data that eliminates reconciliation errors across custodians and systems

Automated: Workflows that detect anomalies, trigger alerts, and execute responses without human intervention

Tested: Regular validation that backup systems actually work when needed, not just theoretical preparedness

Transparent: Real-time visibility into system health, user access, and potential vulnerabilities

Platforms built on these principles don't just reduce risk—they create operational leverage. Advisors spend less time on administrative tasks and more on client relationships. Compliance becomes continuous, not episodic. Growth doesn't require proportional staffing increases.

The Bottom Line

Building resilience isn't about paranoia. It's about recognizing that operational excellence now depends on infrastructure excellence. The firms thriving in 2025 aren't necessarily the largest or longest-established—they're the ones that treated technology, custody strategy, and cybersecurity as integrated components of their value proposition.

The question isn't whether your firm will face a disruption. Ransomware attacks in financial services hit 65% of institutions in 2024, up from 64% in 2023. The question is whether you'll recover in hours or months.

For RIAs managing client capital at scale, that difference determines survival.

Related

Get Started

Experience the full power of our SaaS platform with a risk-free trial. Join countless businesses who have already transformed their operations. No credit card required.

FAQs