Blog

Jan 8, 2026

Strong market performance should strengthen client relationships, yet research reveals a counterintuitive truth: 75% of advisory clients either switched advisors or considered doing so in 2023—a dramatic increase from 48% the previous year. This surge in client flight occurred despite favorable market conditions, tempered inflation, and remarkably low volatility.

The paradox isn't that performance doesn't matter. It's that when markets cooperate, clients start questioning whether they're paying for value they could capture elsewhere. Understanding why trust erodes during good years—and how to prevent it—separates advisors who build lasting practices from those chasing performance.

What Trust Actually Depends On (And It's Not Returns)

When Capintel surveyed 1,000 investors, 72% identified "someone I can trust" as the top quality they seek in an advisor—ranking above investing experience (50%), holistic planning ability (46%), and communication skills (34%). Most revealing: 61% indicated that loss of trust would be their primary reason for seeking a replacement.

Wealthtender's 2025 Voice of the Client Study analyzed thousands of client reviews and found:

What clients actually value:

89% of reviews center on relationship quality, planning advice, and emotional factors

Just 11% focus on investments or portfolio management

86% of reviews convey strongly positive sentiment when advisors excel at behavioral coaching

The research confirms what many advisors suspect but struggle to act on: technical competence is table stakes. Trust forms through consistent communication, personalized attention, and behavioral guidance—precisely the elements that get deprioritized when markets run smoothly.

The Communication Gap Widening During Bull Markets

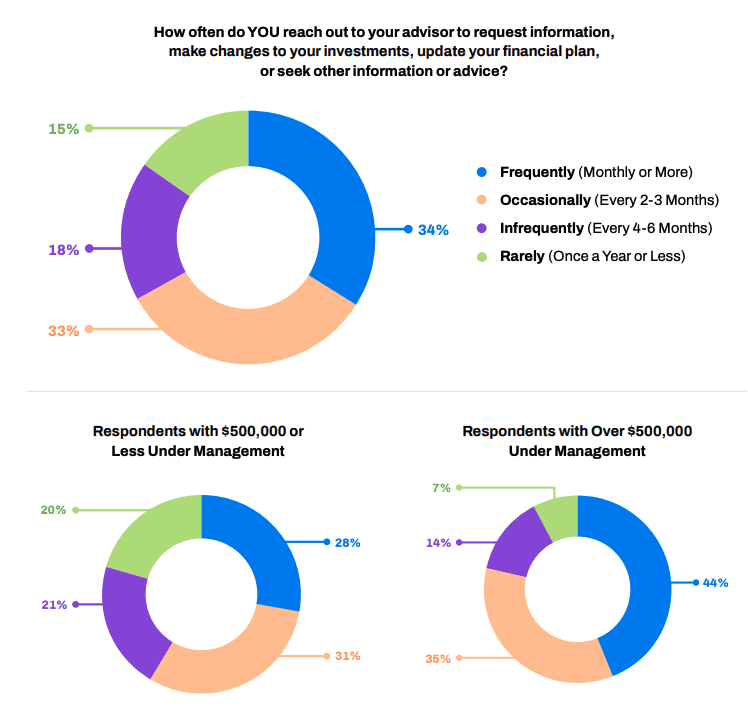

YCharts' detailed analysis reveals a troubling disconnect between advisor behavior and client expectations during strong market performance:

Client comprehension declining:

Only 64% of conversation content resonates with clients (down from 70% in 2023)

Infrequently contacted clients understand just 59% of discussions

Frequently contacted clients comprehend 71%—a 12-percentage-point advantage

Communication frequency directly impacts confidence:

71% of frequently contacted clients feel "very comfortable" with their financial plan during potential recessions

Only 22% of infrequently contacted clients share this confidence

85% say increased personalized communication would boost confidence in their advisor

88% report it would influence their decision to retain services

The pattern is clear: when markets perform well, advisors unconsciously reduce proactive communication. Clients interpret this silence as complacency or irrelevance, precisely when behavioral coaching matters most.

Behavioral Coaching: The Hidden Value Multiplier

Vanguard's research demonstrates that behavioral coaching accounts for nearly two-thirds of advisor value—approximately 150 basis points annually. SmartAsset's 2025 study calculated that advisors' behavioral coaching combined with technical planning generates 2.39% to 2.78% higher annual returns net of fees and inflation.

Yet behavioral coaching becomes hardest to deliver when clients need it most:

During bull markets:

Clients develop overconfidence in continued gains

Recency bias makes recent performance feel permanent

Risk tolerance creeps upward without conscious awareness

Rebalancing triggers emotional resistance

The advisor's challenge:

Explaining why diversification matters when concentration won you

Recommending prudent rebalancing when clients want to "let winners run"

Maintaining disciplined risk management during euphoria

Preventing future regret without dampening current optimism

Morningstar's research on advisor value found that clients bristle at coaching perceived as criticism. The key is framing behavioral guidance as collaborative risk management rather than correcting mistakes.

Visual 3 Recommendation: Vanguard behavioral coaching value chart showing how behavioral coaching adds 100-200 basis points to client outcomes

Setting Expectations That Survive Market Cycles

The most damaging trust erosion occurs when client expectations misalign with reality. J.D. Power's 2024 Investor Satisfaction Study revealed a significant 8-point increase in investor satisfaction—tracking directly with strong stock market performance. The report warned: "Investor satisfaction tracks closely with stock market performance, but for advisors who want to build long-term, sustainable relationships that can weather good markets and bad, they will need to build a deeper level of engagement."

Proactive expectation management:

Document realistic long-term return assumptions during initial planning

Revisit these assumptions regularly, especially after strong performance years

Frame current outperformance as fortunate rather than predictable

Use tools like Vanguard's Market Hindsight to show historical recovery patterns

Address concentration risk explicitly:

Show clients how portfolio drift has changed their actual risk exposure

Quantify the difference between their stated risk tolerance and current allocation

Explain fiduciary duty to maintain agreed-upon risk parameters

Present rebalancing as alignment rather than market timing

Morningstar's 2025 outlook specifically advises advisors to "set client expectations on how fixed-income funds will perform in a lower interest-rate environment" and "don't overthink short-term economic and political events like elections." The sentiment remains: expectations calibrated to reality survive volatility.

Communication That Strengthens Rather Than Assumes Trust

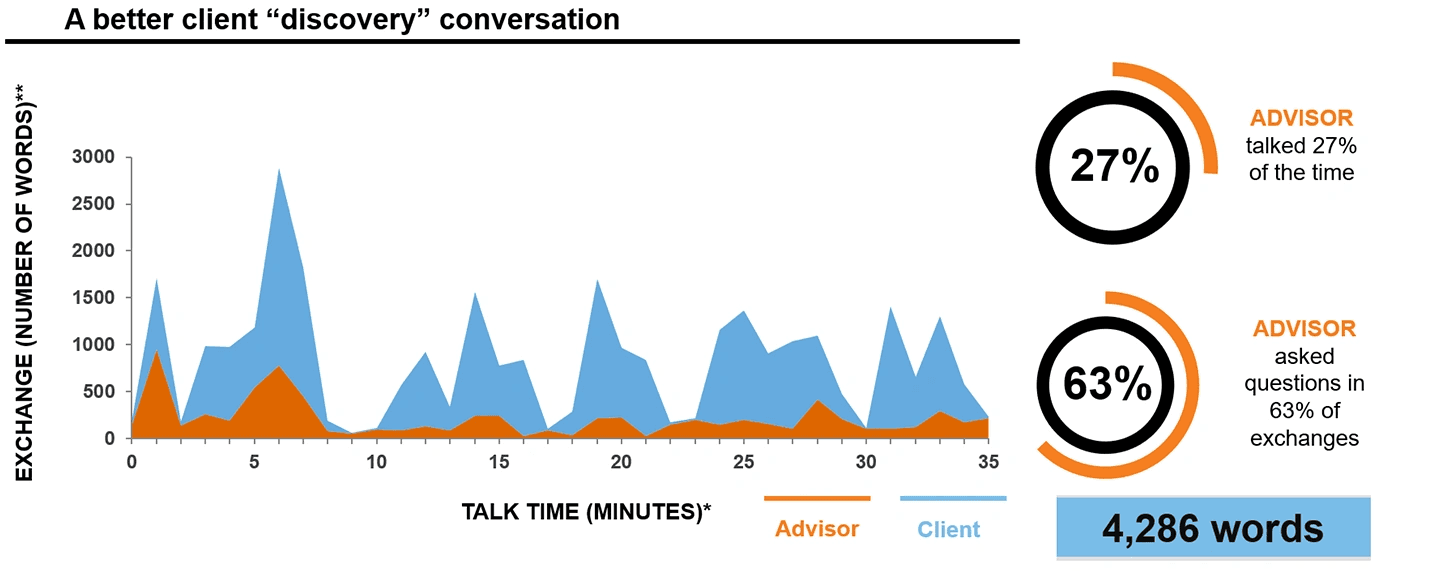

Russell Investments' research on client retention studied actual advisor-client conversations and found concerning patterns:

What the data revealed:

Advisors spoke 54% of meeting time

Advisors asked questions just 26% of the time

Clients spoke approximately 1,200 words total

After training advisors in better communication techniques, the dynamics shifted dramatically—more listening, better questions, deeper understanding.

High-impact communication strategies:

Personalization over standardization: 60% of clients say more personalized contact would increase confidence in their financial plan

Frequency matters more than length: Quarterly substantive touchpoints outperform annual lengthy reviews

Multiple channels serve different purposes: Email for market perspectives (61% prefer), calls for strategic discussions (43% of high-value clients prefer)

Proactive over reactive: Address concerns before clients raise them

The 2024 YCharts survey found specific content clients want more of: investment opportunities (52%), market trends and news (48%), and interest rates and economic insights (43%).

Technology Enables Personalization at Scale

As client expectations evolve, technology becomes essential for delivering the personalized, real-time experiences that build trust. Modern platforms can't replace human judgment, but they enable advisors to maintain meaningful relationships with larger client bases.

Infrastructure advantages:

Automated portfolio monitoring flags drift before it becomes material

AI-powered tools synthesize client meeting notes into actionable insights

Integrated communication systems ensure no client falls through cracks

Performance reporting that contextualizes results against stated objectives

Northwestern Mutual's 2025 study found Americans trust human advisors far more than AI alone—but younger generations prefer advisors who understand how to leverage AI as a planning tool. The winning formula combines human empathy with technological efficiency.

For practices managing 200+ client relationships, technology transforms what's operationally feasible. Advisors using integrated platforms can deliver consistent behavioral coaching, proactive communication, and personalized guidance that would be impossible manually. The clients who receive this level of attention develop trust that survives market volatility.

Building Trust That Compounds Like Returns

Trust erodes gradually, then suddenly. A few missed communications during strong markets create small doubts. Clients start managing portions of their portfolio independently (74% already do, rising to 85% among those desiring frequent contact). Before long, they're evaluating whether your value justifies your fee.

The advisors who build lasting practices understand that trust compounds like investment returns—small, consistent actions accumulate into unshakeable relationships. This requires viewing communication not as client service overhead but as the core value delivery mechanism.

During strong markets:

Increase communication frequency rather than decrease it

Emphasize behavioral coaching and risk management

Proactively address concentration and rebalancing

Document and celebrate disciplined decision-making

Infrastructure matters because it enables advisors to deliver personalized, proactive guidance consistently across hundreds of client relationships. Platforms that integrate portfolio monitoring, client communication, and behavioral coaching tools allow advisors to maintain the human connection that builds trust while serving larger client bases effectively.

The data tells a clear story: clients switching advisors during strong market years aren't chasing better performance—they're seeking advisors who make them feel understood, prepared, and confident about their financial future regardless of market conditions. That's not a performance problem. It's a relationship problem with a relationship solution.

Related

Get Started

Experience the full power of our SaaS platform with a risk-free trial. Join countless businesses who have already transformed their operations. No credit card required.

FAQs