Blog

Nov 10, 2025

Introduction

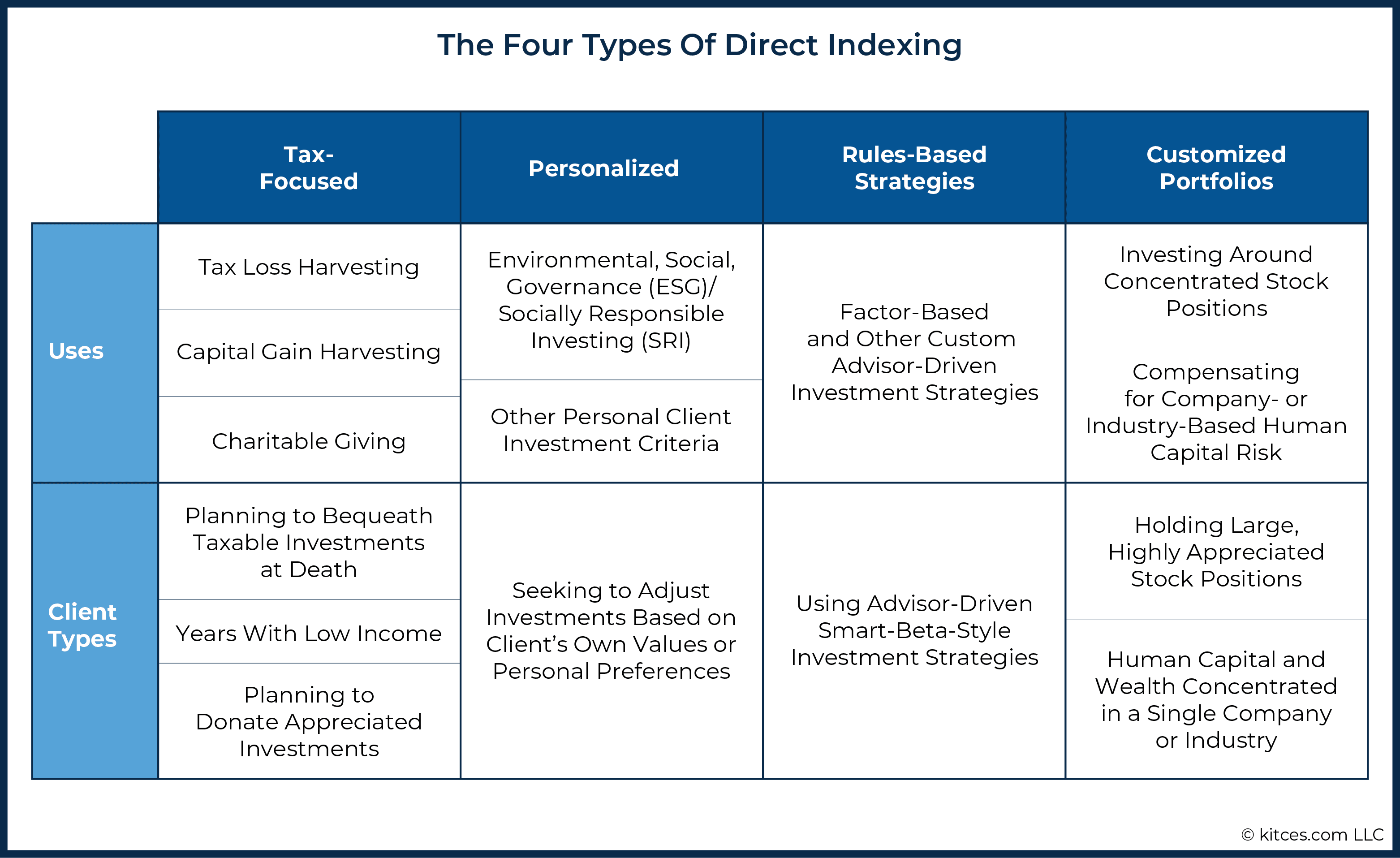

Independent RIAs are facing mounting pressure: falling fees, rising client expectations, and a race to deliver more personalization with fewer resources. One solution gaining rapid momentum is direct indexing — a strategy that gives clients greater control, transparency, and potential tax advantages compared to ETFs or mutual funds.

Yet, despite its growing popularity, many advisors still misunderstand what direct indexing actually is, when it makes sense, and how to implement it profitably.

This guide breaks down direct indexing for RIAs in 2025 — what it is and isn’t, who it’s for, how to explain it to clients, and what technology infrastructure makes it work.

What Direct Indexing Actually Is (and Isn’t)

At its core, direct indexing means clients own the individual stocks of an index rather than a pooled ETF. Instead of buying a fund that tracks the S&P 500, the investor directly holds each security (or a representative subset).

According to Morgan Stanley, this structure allows investors to personalize their portfolios, exclude specific companies or sectors, and take advantage of tax-loss harvesting opportunities that ETFs can’t replicate.

Charles Schwab notes that investors can sell underperforming individual positions to offset capital gains elsewhere — even when the overall index is up. This flexibility gives advisors a powerful lever to enhance after-tax performance.

It’s not, however, a magic formula. As Investopedia explains, the approach carries trade-offs — higher costs, minimums, and operational complexity.

And it’s not simply “an ETF by another name.” With ETFs, you own shares in a pooled fund. With direct indexing, you control the actual tax lots of each holding.

So, while the philosophy of passive exposure remains, the mechanics — and the control — are very different.

Why It’s Growing Now

Three forces are driving the 2025 surge in direct indexing adoption among RIAs:

Fractional-share trading: Enables accurate replication of large indices in smaller accounts, reducing previous barriers. (FINRA)

Tax awareness: Advisors and clients increasingly value personalized tax efficiency. (Russell Investments)

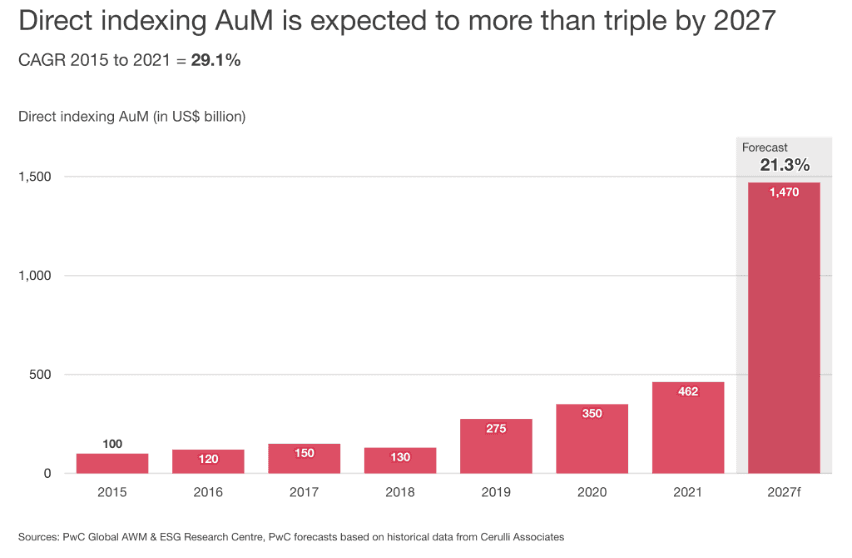

Asset growth: Direct indexing assets hit $864.3 billion at year-end 2024, up nearly 87% from 2021. (Cerulli Associates)

Minimum Account Sizes That Make Sense

While platforms have lowered barriers, not every client is an ideal candidate for direct indexing.

Historically, this strategy was reserved for ultra-high-net-worth investors. But technology and automation have shifted that. Charles Schwab now offers Personalized Indexing accounts starting at $100,000, while Fidelity and Vanguard are experimenting with even lower thresholds.

However, minimums aren’t just about platform requirements — they’re about where tax benefits exceed costs.

Under $100K: Tracking error and transaction costs often outweigh benefits

$250K–$1M: Sweet spot for meaningful tax alpha

$1M+ taxable portfolios: Best suited for personalized exclusion, transition, and charitable strategies

For context, Smartleaf found that direct indexing becomes efficient around $50K–$100K when using fractional shares — but below that, tracking error rises sharply.

Advisors can explain this simply:

“Below $100K, ETFs are still the most efficient tool. But once we reach a size where tax management and personalization create real after-tax benefits, direct indexing becomes the smarter choice.”

Quantifying the Tax Benefits (vs. ETFs)

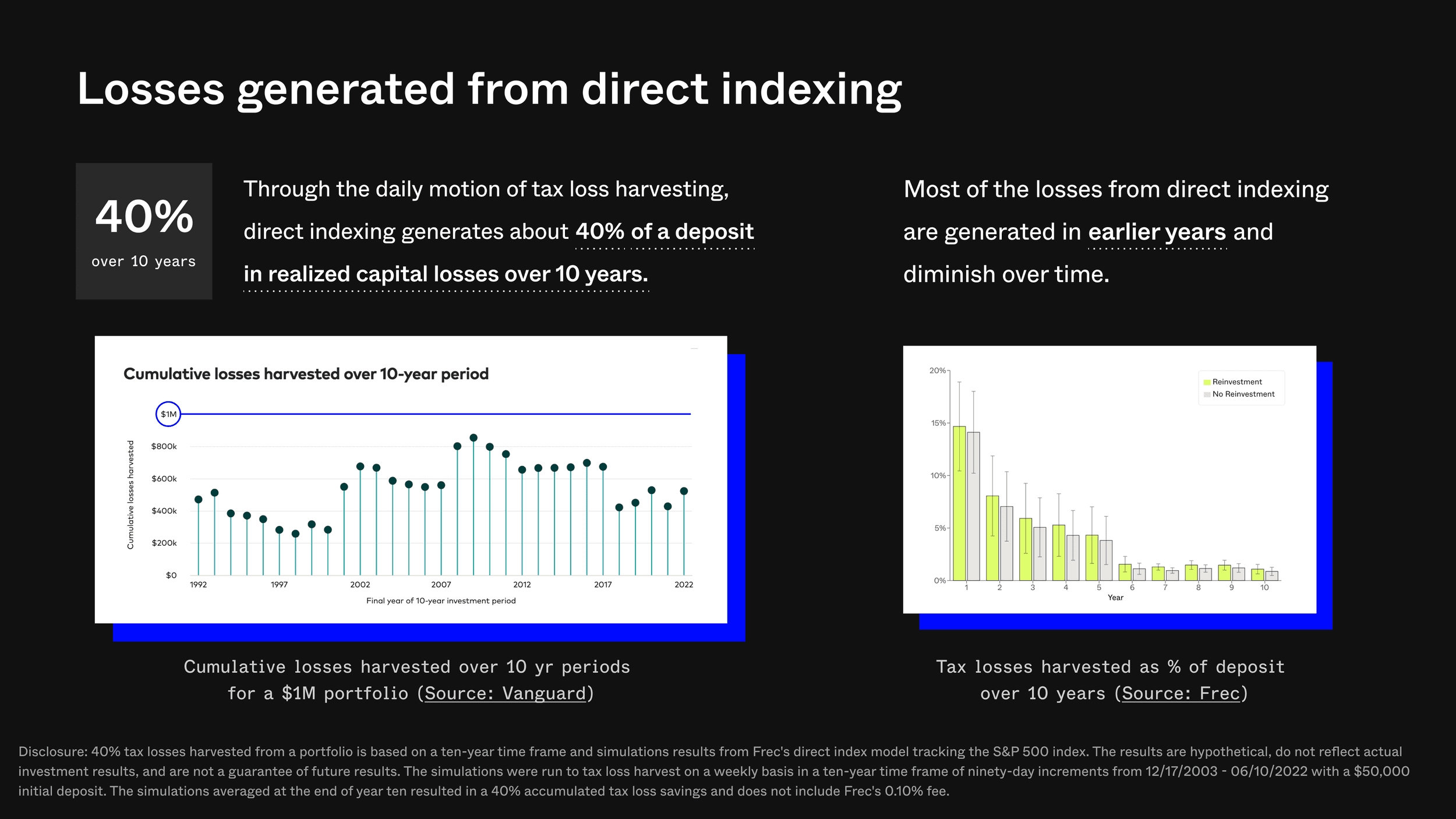

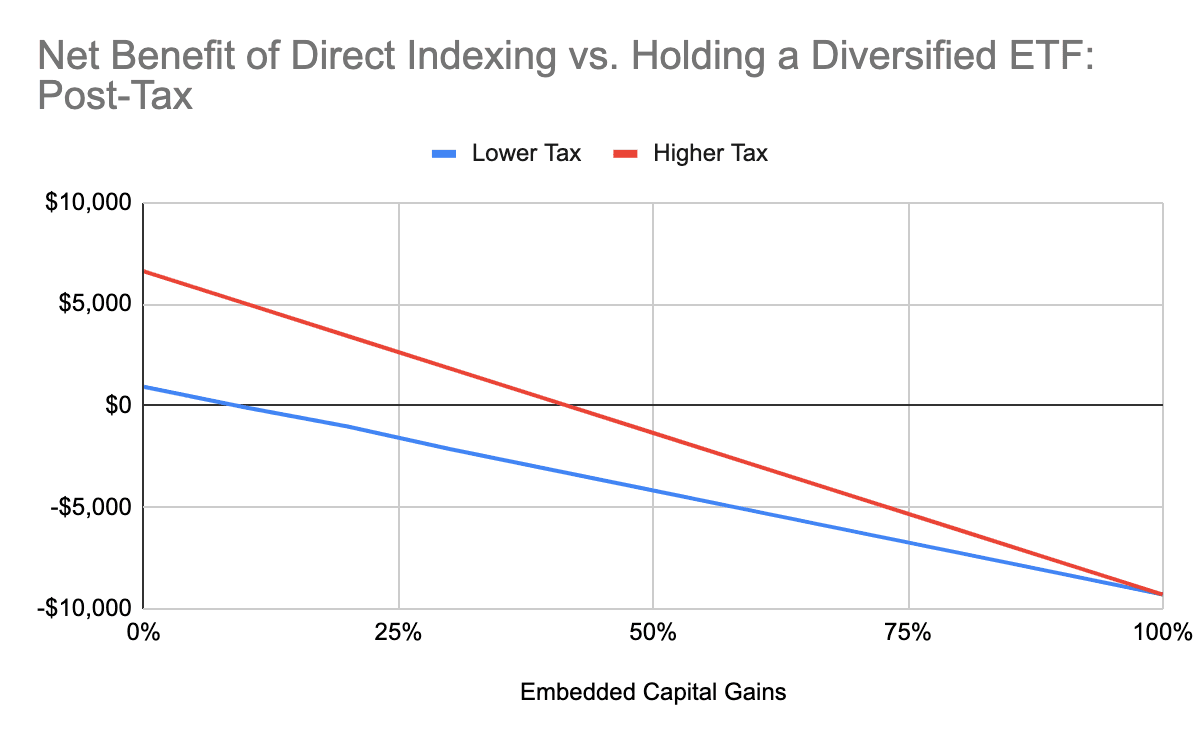

Direct indexing’s strongest case is its tax alpha — the incremental after-tax return it can generate.

AQR Capital Management found that for suitable investors, the potential annual benefit ranges from 0.20% to 1.40% depending on tax rate and harvesting frequency. Eaton Vance estimates that disciplined tax management can add up to 2% per year in after-tax returns compared to an unmanaged index fund.

Here’s how that plays out:

Investor Profile | Marginal Tax Rate | Estimated Tax Alpha |

|---|---|---|

$250K income, moderate trading | 32% | 0.50% – 0.70% |

$500K income, active rebalancing | 37% | 0.80% – 1.20% |

$1M+ taxable account, ongoing TLH | 45% | 1.00% – 2.00% |

That “free lunch” has caveats. If markets rise consistently and few stocks trade at a loss, harvestable opportunities shrink. The tax benefit also declines once prior losses have been fully realized or offset.

Alpha Architect cautions that transitioning from ETFs to direct indexing can create capital gains events that negate much of the advantage — a reminder that implementation timing matters.

How to Explain Direct Indexing to Clients

Most clients will initially ask: “Isn’t this just indexing with more steps?”

Here’s how to simplify your explanation:

Frame it around control:

“Instead of buying one fund that owns 500 stocks, we own the actual stocks — which means we can make changes that fit you.”

Highlight the tax story:

“If some of your holdings fall, we can sell those and harvest losses to offset other gains. That’s not possible inside an ETF.”

Show the personalization:

“We can remove any company or sector you don’t want — energy, tobacco, tech concentration — and rebalance automatically to keep risk in line.”

Address the cost directly:

“This isn’t about chasing performance. It’s about improving after-tax efficiency. The gains usually more than cover the slight fee difference once your portfolio reaches a certain size.”

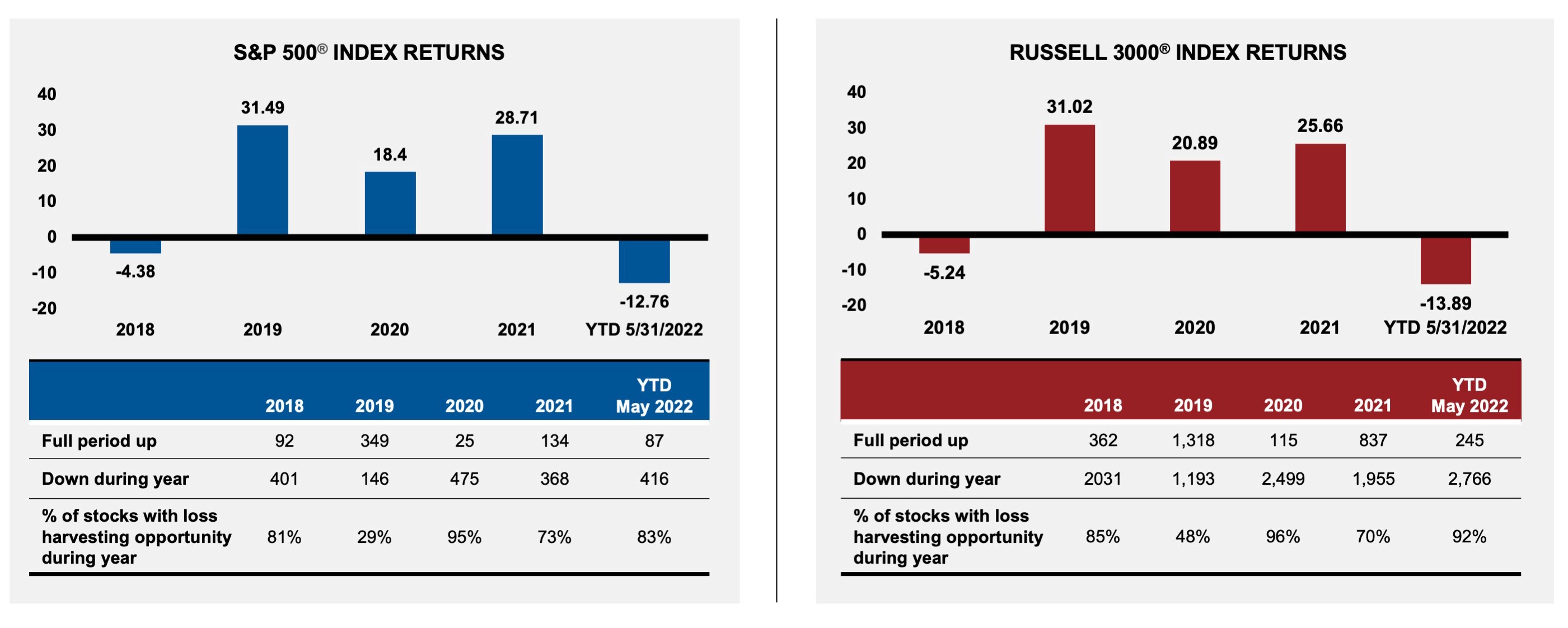

Allspring Global Investments showed that even in up markets, nearly 40% of S&P 500 stocks experience declines each year — creating continuous harvesting opportunities.

That statistic alone helps clients see why direct indexing’s tax benefits are not just theoretical.

Technology and Workflow Requirements

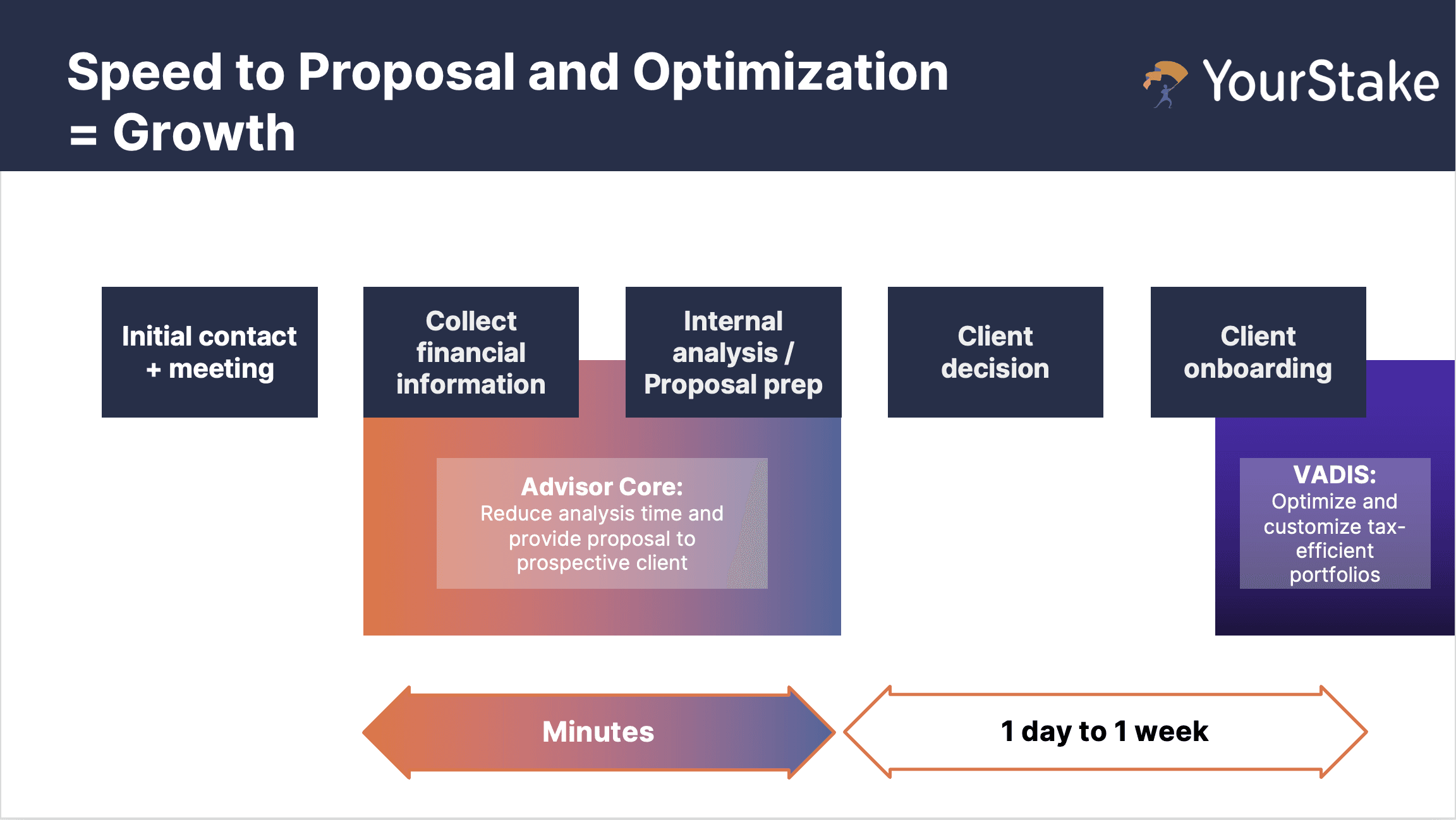

Direct indexing is operationally demanding. It requires automation, data management, and compliance workflows that many small firms lack.

A 2024 FTSE Russell survey found that while 76% of advisors plan to adopt direct indexing, only 13% consider implementation “very easy.”

Here’s what RIAs need to deliver it efficiently:

Custodial integration: Must support fractional shares, real-time lot tracking, and automated rebalancing.

Portfolio-construction engine: Aligns with benchmarks (e.g., S&P 500) while enabling custom tilts or exclusions. (BNY Mellon Pershing)

Tax-optimization module: Scans accounts daily for harvesting opportunities and triggers trades without wash-sale violations. (Broadridge)

Client reporting: Illustrates harvested losses, tracking error, and after-tax impact.

Compliance workflows: Monitors deviation from models and documents rationale for exclusions.

Platforms like Vanguard Personalized Indexing and Schwab Personalized Indexing now package these tools for RIAs, lowering barriers that once required institutional infrastructure.

Positioning Direct Indexing in Your Practice

For independent RIAs, direct indexing isn’t just a feature — it’s a strategic differentiator.

According to WealthManagement.com, wirehouse advisors have been faster to adopt it, leaving independents behind. But that’s an opportunity.

Here’s how to position it effectively:

Differentiate through tax efficiency: Compete not on fees, but on after-tax outcomes.

Automate the heavy lifting: Use infrastructure that handles construction, rebalancing, and compliance so your team can focus on relationships.

Educate selectively: Not every client qualifies — use screening criteria to identify where it truly adds value.

Embrace transparency: Clients like seeing what they own and why. Direct indexing offers that visibility.

Cerulli Associates projects that direct indexing assets will surpass $1 trillion by 2026, driven largely by RIAs expanding access to mass-affluent clients via fractional trading.

That trajectory mirrors the early rise of ETFs in the 2000s — and suggests we’re at the start of a structural shift.

Final Thoughts

Direct indexing isn’t right for every investor — or every RIA. But for clients with sizable taxable portfolios, high marginal rates, or ESG/personalization goals, it represents one of the clearest paths to differentiation and real after-tax value.

For advisors, the challenge is execution. You’ll need automation, compliance-ready workflows, and scalable infrastructure to make it profitable.

But the reward? A modern, data-driven offering that delivers what clients increasingly expect: personalized portfolios built intelligently, not manually.

With the right platform and process, direct indexing can move from a niche solution to a cornerstone of your RIA’s value proposition.

Related

Get Started

Experience the full power of our SaaS platform with a risk-free trial. Join countless businesses who have already transformed their operations. No credit card required.

FAQs