Blog

Dec 15, 2025

The wealth management industry has spent the last decade watching direct indexing evolve from a niche offering for ultra-high-net-worth families into a democratized, scalable strategy that's reshaping how advisors compete for clients with $100,000+ portfolios.

What started as a manual, labor-intensive customization tool has become one of the most compelling value propositions in modern portfolio management—not because it's revolutionary in concept, but because technology finally made it economically viable at scale.

For RIAs navigating an increasingly competitive landscape where fee compression and robo-advisors have commoditized traditional portfolio construction, direct indexing represents something increasingly rare: a tangible, quantifiable way to demonstrate alpha through tax efficiency rather than market timing.

What Direct Indexing Actually Is

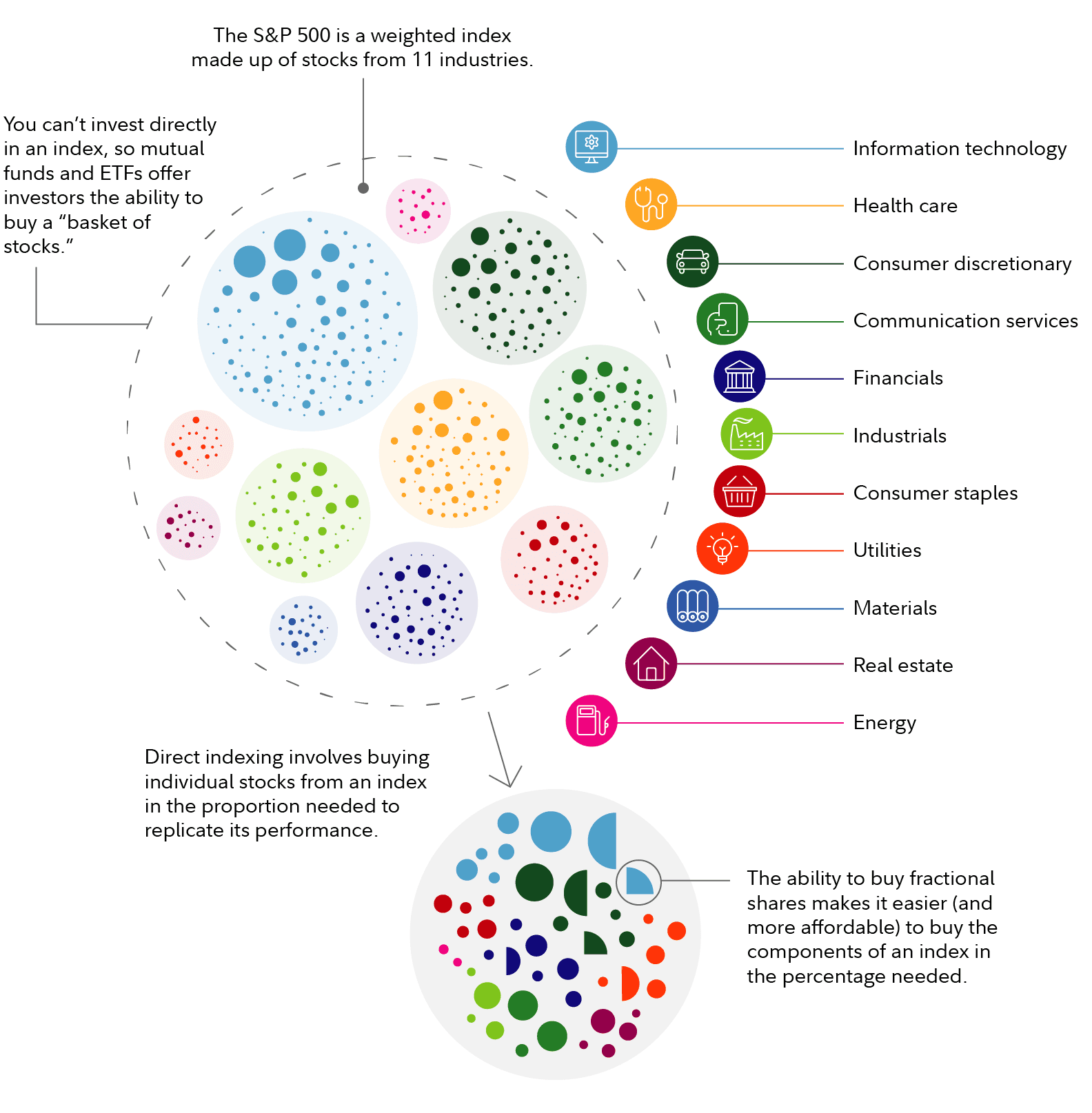

Direct indexing is the practice of replicating an index—typically the S&P 500 or Russell 1000—by purchasing the individual securities that comprise it, rather than buying an ETF or mutual fund wrapper.

The mechanical difference is straightforward: instead of owning one share of an S&P 500 ETF, a client owns fractional positions in 500 individual stocks weighted to mirror the index. But the strategic implications are profound.

This approach transforms a passive index exposure into an actively managed tax vehicle. Because the client owns individual securities rather than fund shares, each position can be sold independently to harvest tax losses without disrupting overall index exposure—a strategy that Morningstar estimates can add 1-2% in annual after-tax returns for high-net-worth investors in top tax brackets.

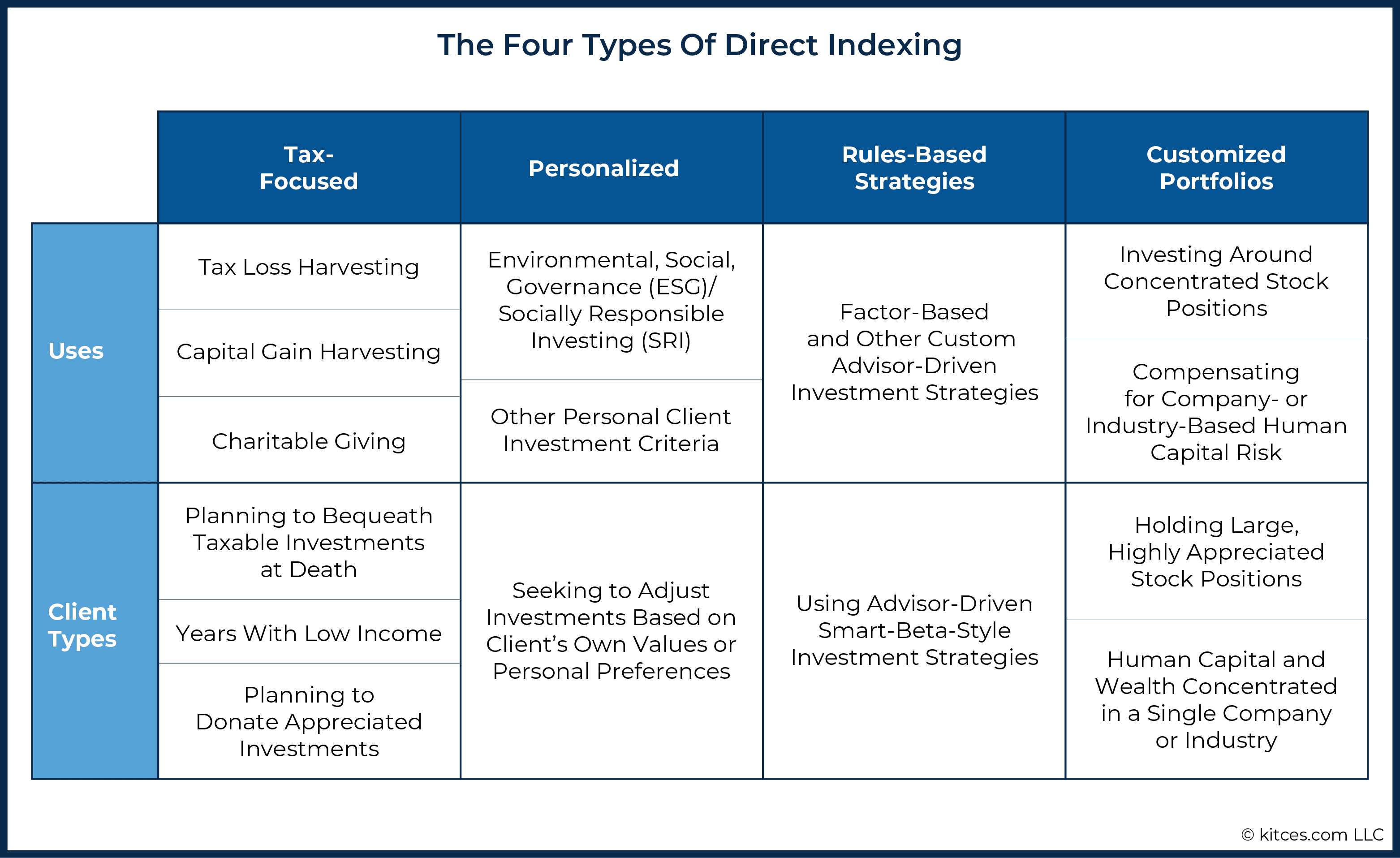

The appeal extends beyond tax-loss harvesting. Direct indexing enables values-based customization (excluding fossil fuels or tobacco), concentration management for executives with single-stock risk, and transition strategies for clients with embedded capital gains—all while maintaining broad market exposure.

Why Direct Indexing Is Having Its Moment Now

The direct indexing market has exploded from $100 billion in assets in 2019 to over $350 billion by mid-2023, according to Cerulli Associates. This isn't gradual adoption—it's a structural shift driven by three converging forces.

Technology infrastructure has collapsed the cost barrier. Ten years ago, managing 500 individual positions with daily tax-loss harvesting required expensive separately managed account platforms and minimum investments of $500,000 or more. Today's API-driven rebalancing engines and fractional share trading have pushed minimums below $100,000 at many providers.

Vanguard launched its direct indexing platform in 2023 with a $100,000 minimum—a signal that the strategy has moved from boutique to mainstream. When the world's largest index fund provider enters a market segment, it's no longer experimental.

Regulatory tailwinds have accelerated adoption. The Tax Cuts and Jobs Act of 2017 raised the standard deduction significantly, meaning fewer investors itemize—but it simultaneously increased the value of tax-loss harvesting for those in top brackets by maintaining higher marginal rates. The result: tax alpha matters more than ever for high earners, even as traditional deductions have diminished.

Client expectations have evolved. A 2023 PwC study found that 73% of high-net-worth investors now expect personalization in their portfolios—not as a luxury feature, but as a baseline requirement. Direct indexing delivers customization at scale in a way that picking individual stocks or building thematic sleeves simply cannot.

The Tax Alpha Math That Makes Direct Indexing Work

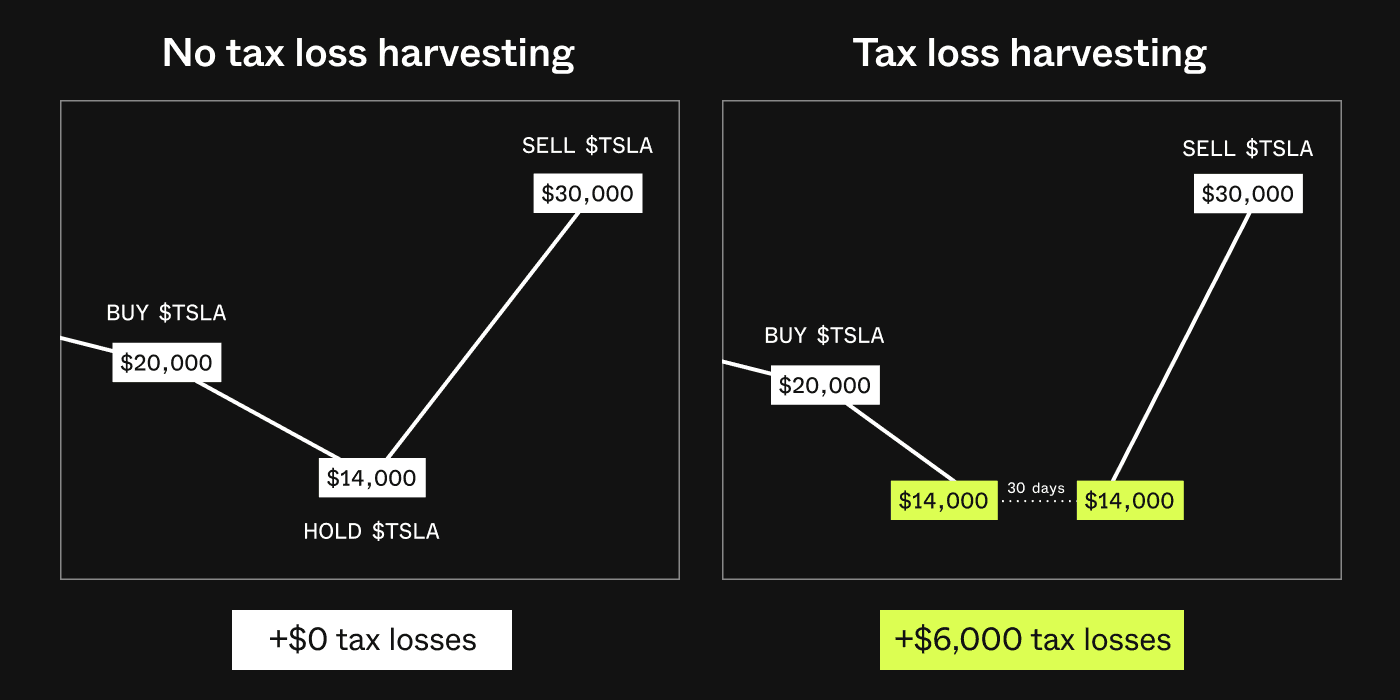

The core value proposition of direct indexing lives in systematic tax-loss harvesting—the ability to realize losses on individual securities that decline while maintaining overall index exposure through other holdings.

Here's how the math works: In a typical year, even when the S&P 500 is up 10%, roughly 30-40% of individual stocks will be down at some point. Direct indexing platforms can automatically sell these declining positions, harvest the loss for tax purposes, and immediately reinvest in similar (but not identical) securities to maintain market exposure—all without triggering wash sale rules.

A 2022 analysis by Parametric Portfolio Associates found that direct indexing strategies averaged 1.0-1.5% in annual tax alpha for investors in the highest federal tax bracket—a benefit that compounds significantly over time. For a client with a $1 million portfolio, that's $10,000-$15,000 in additional after-tax value annually.

The alpha comes from three mechanisms:

Immediate loss harvesting during market volatility (often generating 5-7% in losses during drawdowns)

Ongoing opportunistic harvesting as individual stocks fluctuate throughout the year

Long-term capital gains optimization by systematically holding winners past the one-year mark

It's worth noting that tax-loss harvesting isn't magic—it's tax deferral, not elimination. But deferral has real present value, especially when losses can offset ordinary income (up to $3,000 annually) or shelter future gains. For clients with concentrated stock positions or carried interest income, that flexibility is exceptionally valuable.

Where Direct Indexing Adds the Most Value

Direct indexing isn't a universal solution—it's a targeted strategy that delivers outsize benefits in specific client situations.

The high-income professional in accumulation mode. A tech executive earning $500,000+ annually with RSU vesting schedules and W-2 income faces a 37% federal marginal rate plus state taxes. For this client, systematic loss harvesting can generate thousands in tax savings each year, while ESG customization might address values-based concerns about defense contractors or fossil fuel exposure in their portfolio.

The liquidity event client with concentrated stock. When an entrepreneur sells their business or an executive exercises options, they face an immediate capital gains liability. Direct indexing can create a transition strategy that diversifies gradually while harvesting losses to offset gains—essentially amortizing the tax bill over multiple years rather than taking the full hit upfront.

The family office managing intergenerational wealth. Ultra-high-net-worth families benefit from multi-account tax optimization across generations, using losses in one account to offset gains in another, while maintaining customization for different family members' values preferences.

A 2023 report from Cerulli noted that 68% of RIAs now view direct indexing as essential for serving clients with $500,000+ in investable assets—not as an optional enhancement, but as table stakes for competitive positioning.

The Implementation Challenge RIAs Actually Face

Despite the compelling value proposition, direct indexing adoption has been uneven—not because advisors don't understand the benefits, but because implementation has historically required infrastructure that most RIAs don't have.

Running direct indexing in-house means building or integrating:

Real-time rebalancing engines that can process 500+ positions daily

Tax optimization algorithms that respect wash sale rules across accounts

Fractional share trading connectivity to multiple custodians

Performance reporting that accurately attributes tax alpha

Compliance monitoring for customization requests

Deloitte's 2023 RIA Benchmarking Study found that 64% of firms cited technology integration as the primary barrier to direct indexing adoption—not client demand or fee economics.

The traditional solution has been outsourcing to turnkey providers like Parametric, Aperio (now part of BlackRock), or Canvas. But outsourcing creates its own challenges: limited customization flexibility, opacity in the loss harvesting logic, and margin compression as providers take 10-25 basis points off the top.

How Modern Infrastructure Changes the Equation

The next generation of RIA technology is solving the direct indexing implementation problem through composable infrastructure rather than outsourced solutions.

Instead of choosing between building everything in-house or outsourcing to a black-box provider, forward-thinking platforms are offering advisors programmatic access to the core components—fractional trading APIs, tax optimization engines, and rebalancing logic—that can be configured and controlled directly.

This approach gives RIAs the economic benefits of direct indexing (keeping the full 50-100 bps advisory fee) while maintaining control over client experience, customization rules, and data ownership. It's the difference between renting a turnkey solution and owning the infrastructure.

For firms managing $100M+ in AUM, this infrastructure model can add $500,000-$1M in annual revenue compared to outsourcing—simply by eliminating the middleman fee layer while maintaining the tax alpha client benefit.

What This Means for Your Practice

Direct indexing has moved from "interesting strategy" to "competitive necessity" for RIAs serving high-net-worth clients who care about after-tax returns. The firms winning new business today aren't selling generic asset allocation—they're demonstrating quantifiable tax alpha through sophisticated implementation.

The question isn't whether direct indexing belongs in your value proposition—it's whether you have the infrastructure to deliver it profitably, at scale, without outsourcing control or economics to a third party.

For RIAs who've watched robo-advisors and fee compression erode traditional portfolio management margins, direct indexing represents a genuine opportunity to differentiate through execution quality rather than just philosophy. But that opportunity requires technology infrastructure that most legacy platforms simply weren't built to support.

The wealth management industry has reached an inflection point where the advisors who own their technology stack will capture economics and client relationships that those dependent on outsourced solutions will steadily lose.

Related

Get Started

Experience the full power of our SaaS platform with a risk-free trial. Join countless businesses who have already transformed their operations. No credit card required.

FAQs