Blog

Dec 31, 2025

The Hidden Cost of Advisor Optionality

The average RIA offers clients between seven and twelve portfolio models. Each model permits tactical overrides. Most platforms allow fund substitutions across hundreds of options. Advisors can rebalance manually or automate with customizable thresholds. Every decision point represents optionality—and optionality sounds like sophistication until you measure its actual cost.

The uncomfortable truth: more choice doesn't always correlate with better client outcomes. It often correlates with slower execution, inconsistent implementation, and decision fatigue that compounds across your practice. The advisors achieving the highest risk-adjusted returns and the most scalable operations share a counterintuitive trait—they've systematically reduced optionality rather than expanded it.

The Decision Fatigue Problem

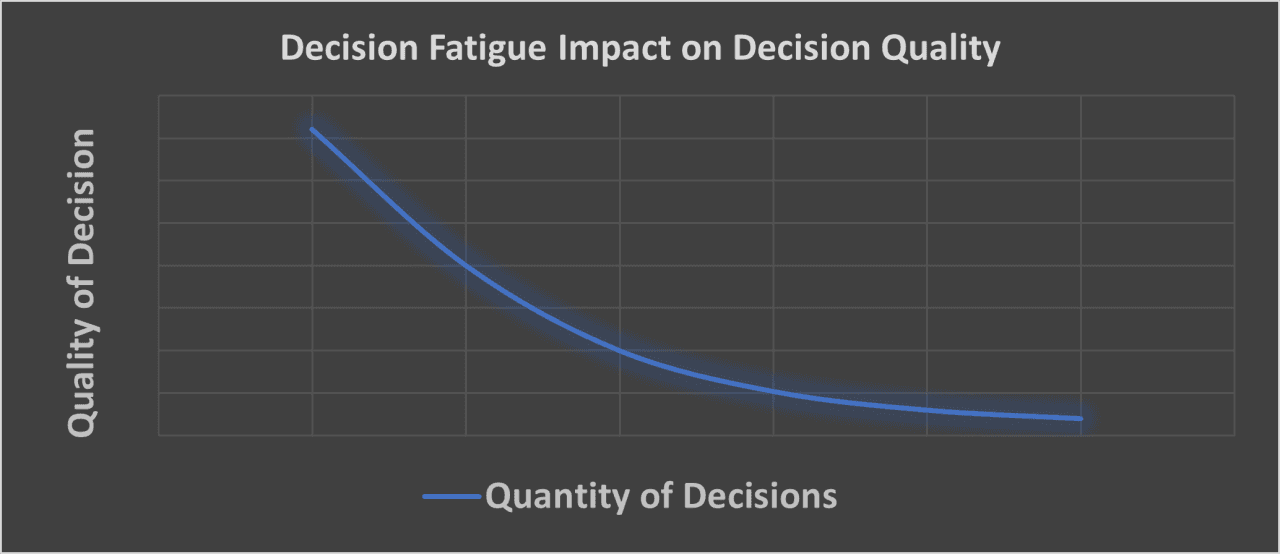

Research published in the Journal of Accounting and Economics examining financial analyst forecasting found that decision quality degrades significantly as professionals make sequential decisions throughout the workday. Analysts who issued more forecasts earlier in the day showed measurably lower accuracy on later forecasts—not because of changed market conditions, but because of cognitive depletion.

The mechanism is straightforward: each decision carries cognitive load, and that load is cumulative. Financial professionals making dozens of portfolio decisions daily operate in a state of chronic decision fatigue, particularly during rebalancing season and market volatility.

For advisors, this translates into real operational costs. A solo advisor managing 80 households with four portfolio models makes approximately 320 quarterly rebalancing decisions alone—before accounting for tactical adjustments, model assignments, or exception handling. A three-advisor team managing 200 households? The decision count scales multiplicatively, not linearly.

The quality of decision #180 in a week is measurably worse than decision #12, yet most practice management systems treat all decisions as equally considered. The platform flexibility that seems like a feature—unlimited model customization, household-level overrides, discretionary timing—creates the exact conditions that undermine decision quality at scale.

The Model Proliferation Trap

Advisory practices accumulate models over time like sedimentary layers. Conservative Growth (2018 vintage). Moderate Growth ESG (added 2020). Tax-Aware Balanced (2021). Income Focus with Inflation Protection (2023). Each seemed justified when created. Collectively, they create operational complexity that scales exponentially.

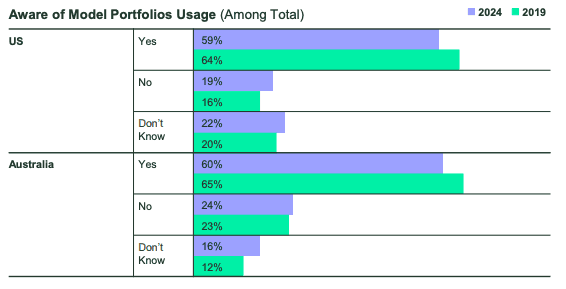

According to Morningstar's 2025 research on model portfolios, the model portfolio industry has grown to $646 billion in assets under advisement as of March 2025. This growth reflects advisors' recognition that outsourcing portfolio construction creates operational efficiency—yet many practices maintain their own proliferated internal model lineups that undermine these efficiency gains.

The mathematics of model count aren't linear—they're multiplicative. Four models require four sets of documentation, four performance reports, four compliance reviews, four sets of rebalancing rules. Eight models? The complexity doubles but the client outcome differentiation approaches zero.

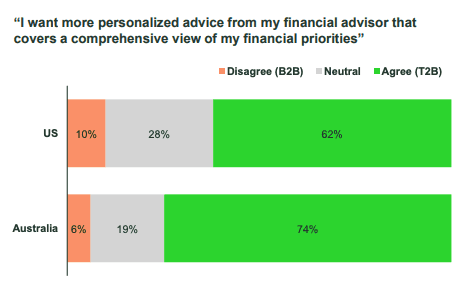

Research from State Street Global Advisors found that investors who know their assets are in model portfolios report significantly higher satisfaction with their advisors' transparency and portfolio optimization—suggesting clients value consistency and clarity over theoretical model granularity.

The highest-performing practices run three to five core models: conservative, moderate, growth, and perhaps tax-aware and income-focused variations. They achieve this not through oversimplification but through recognition that client risk tolerance exists on a spectrum that doesn't require twelve discrete implementation options.

Tactical Override Culture

The most expensive form of optionality is the tactical override—the ability to deviate from model allocations at the household or account level based on advisor discretion.

Override culture starts innocuously. A client expresses concern about tech exposure. You trim 2% from their growth model. Another client has concentrated single-stock risk. You adjust their equity allocation to compensate. Within two years, you're managing de facto custom portfolios disguised as model-based accounts.

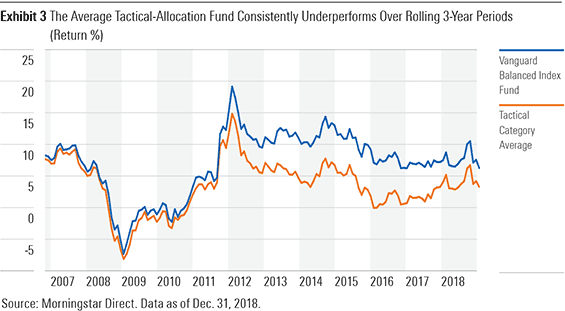

Research on tactical asset allocation published by CFA Institute analyzing 57 tactical allocation funds found that over three- and five-year periods, not a single fund outperformed a simple static balanced index. The average underperformance was 5-6% annually—not from poor security selection, but from tactical timing decisions.

The underperformance isn't random—it's behavioral. Tactical adjustments cluster during periods of market stress (when advisors feel pressure to "do something") and disproportionately involve selling recent losers and buying recent winners. The classic timing error, executed at the household level with the best intentions.

Why Constraints Improve Outcomes

The world's most successful institutional investors operate under strict constraints—defined mandates, explicit style boxes, systematic rebalancing triggers. These constraints don't limit performance; they enable it by eliminating the cognitive overhead of perpetual decision-making.

Vanguard's Advisor's Alpha research estimates that behavioral coaching—specifically helping clients avoid reactive decisions during market distortion—adds approximately 150 basis points of annual value. That value emerges precisely because systematic constraints prevent timing errors during volatility.

The constraints that matter:

Limited model count: Three to five core models that span the risk spectrum without artificial granularity.

Systematic rebalancing triggers: Predefined tolerance bands that execute automatically rather than discretionary timing calls.

Restricted override capability: Client-specific adjustments require documentation, approval, and annual review to justify continuation.

Curated fund universe: A focused list of 15-25 holdings across asset classes rather than access to thousands of options.

Practices implementing these constraints report lower operational complexity while maintaining or improving client satisfaction scores—suggesting clients value consistency and clarity over theoretical flexibility.

The Cognitive Liberation of Less

Reducing optionality isn't about dumbing down your practice—it's about redirecting cognitive resources from low-value portfolio decisions to high-value client relationships.

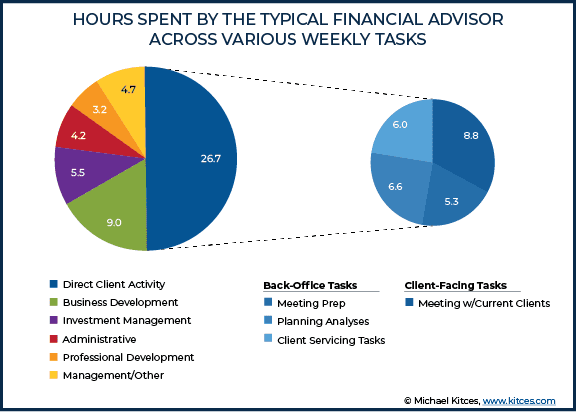

The advisor spending six hours weekly on tactical model adjustments and override management has six fewer hours for financial planning depth, tax strategy collaboration, estate planning coordination, or simply being present during client conversations without mental background noise.

Research from Fidelity's 2024 RIA Benchmarking Study found that high-performing RIA firms demonstrate clear client segmentation and align service models to household value and complexity. The implication: successful practices systematically reduce non-differentiated complexity to focus resources on activities that clients actually value.

When Fidelity surveyed advisory clients, "investment customization" ranked well behind communication quality, planning comprehensiveness, and responsiveness. Yet advisors often build practices optimized for a feature clients don't particularly prioritize.

The Infrastructure Advantage

Reducing optionality requires infrastructure that makes constraints feel like liberation rather than limitation. You need portfolio management systems that enforce systematic rebalancing, model governance workflows that prevent casual proliferation, and reporting that demonstrates consistency across your book.

According to Cerulli Associates' research on model portfolio adoption, asset allocation model portfolio assets are projected to reach $2.9 trillion by 2026, with 34% of outsourcer advisors expecting to increase their use of model portfolios. This growth reflects advisors' recognition that disciplined infrastructure enables better outcomes.

The technology itself isn't the differentiator—it's the willingness to use technology to impose discipline that most advisors theoretically support but practically avoid.

What Modern Advisors Actually Control

The highest-performing advisory practices have redefined what "control" means. It's not the ability to make unlimited tactical adjustments. It's the discipline to establish intelligent defaults, systematic processes, and clear constraints—then trust them during periods when your instincts scream to override.

Research from analysts' decision-making patterns demonstrates that professionals who strategically manage their decision fatigue—by prioritizing high-impact decisions and systematizing routine ones—achieve better career outcomes. The same principle applies to advisory practices.

Fewer decisions. Better outcomes. Lower stress. Higher capacity.

That's not a reduction in advisor value—it's a clarification of where value actually lives. It lives in planning sophistication, behavioral coaching, client communication, and long-term strategic positioning. It doesn't live in the 83rd portfolio model or the discretionary override on a moderate-growth allocation.

The hidden cost of optionality isn't just the hours spent managing complexity. It's the opportunity cost of not building a practice optimized for the activities that actually matter—activities that require cognitive clarity, not cognitive exhaustion from decision overload you created for yourself.

Related

Get Started

Experience the full power of our SaaS platform with a risk-free trial. Join countless businesses who have already transformed their operations. No credit card required.

FAQs