Blog

Dec 19, 2025

Starting an investment fund used to require Goldman Sachs pedigree, $50 million in committed capital, and a Rolodex of family office contacts. That world still exists—but it's no longer the only path.

The investment management industry has fractured over the past decade. While mega-funds raise billion-dollar vehicles, a parallel ecosystem has emerged where credible managers can launch with $5-25 million, operate virtually, and build track records that attract institutional capital within 3-5 years.

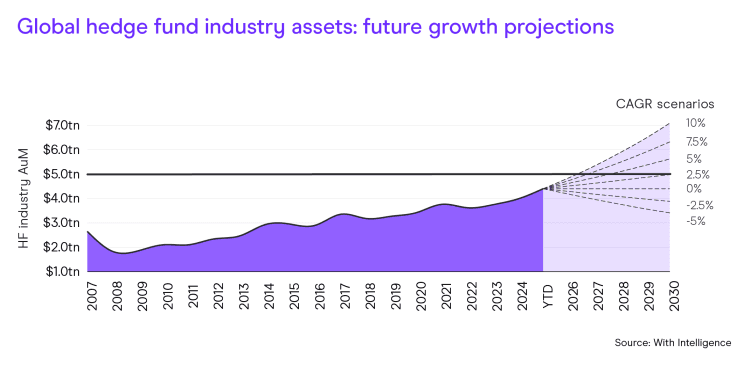

The democratization isn't about lowered standards—it's about infrastructure. New hedge fund launches surged to 375 in the first three quarters of 2024, with liquidations dropping to the lowest levels since 2006. But 2024 also saw mega launches like Taula Capital and Jain Global each raising over $5 billion, proving that emerging managers face fiercer competition than ever.

The managers winning today aren't just great investors—they're the ones who've figured out how to access institutional-grade infrastructure without building it themselves. Here's what actually matters if you're serious about launching in 2025.

The Strategic Decision: Fund Structure

Your fund structure determines everything—legal liability, tax treatment, investor eligibility, operational complexity, and fundraising feasibility.

The 3(c)(1) exemption allows up to 100 beneficial owners without SEC registration. This works for friends-and-family launches or managers planning to stay small. The constraint: once you hit 100 investors, you either close to new capital or restructure—an expensive, disruptive process.

The 3(c)(7) exemption requires all investors to be "qualified purchasers" ($5M+ in investments), but allows unlimited investors. This is the standard structure for managers with institutional ambitions. The challenge: your addressable market shrinks significantly, making early fundraising harder.

The hedge fund LP structure (Delaware LP or offshore Cayman feeder) is standard for liquid strategies:

Delaware LP for U.S. taxable investors

Cayman feeder for tax-exempt and international investors

Master fund that aggregates capital and executes strategy

Expected legal costs: $50,000-150,000 for proper multi-entity structure, with organizational expense caps typically set at $50K-$150K depending on complexity.

The private equity fund structure uses committed capital with capital calls rather than continuous liquidity. This works for strategies requiring 3-7 year hold periods—but means you start with $0 deployed despite raising millions.

The right structure depends on your strategy, target investors, and growth plans. Working with experienced fund infrastructure providers who understand these nuances can save months of back-and-forth with legal counsel.

The Economics That Determine Viability

Fund economics aren't just about getting rich—they're about whether your fund can survive long enough to prove its strategy works.

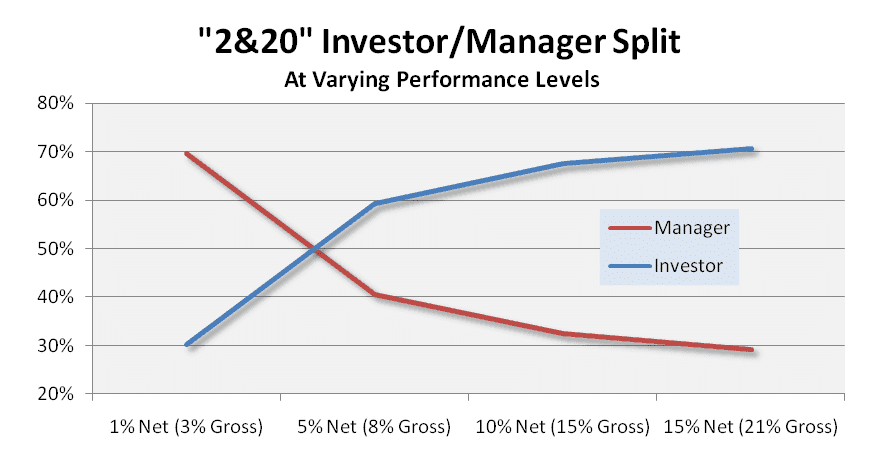

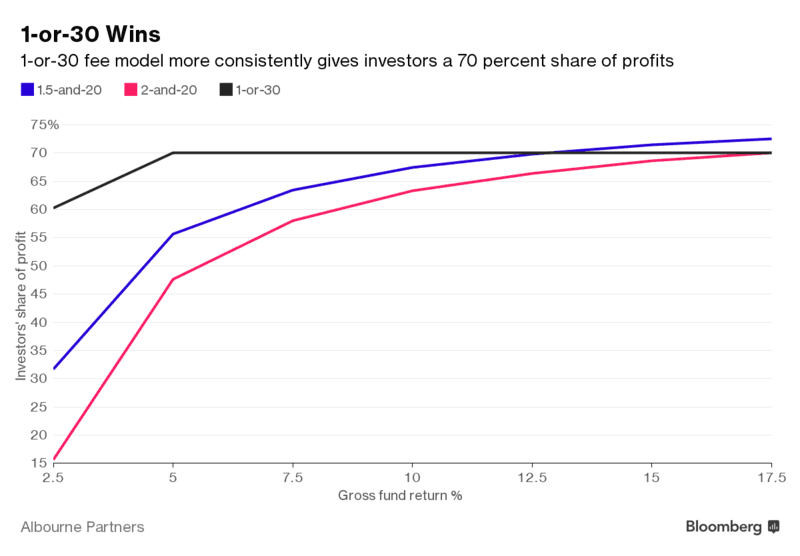

The traditional "2 and 20" structure now applies to only about 35% of single-manager hedge funds. Industry averages for 2024-2025:

Management fees: 1.35% average industry-wide, down to 1.17% for new launches

Performance fees: 16.17% average, with new funds averaging 18.5%

Year 1 on $10M AUM:

Management fee revenue (1.5%): $150,000

Less: Legal/compliance ($40K), audit ($25K), admin ($30K), tech ($30K), insurance ($15K)

Operating margin before salary: $10,000

This is why most emerging managers need $15-25M minimum to avoid running out of cash. According to Gen II's 2024 Emerging Manager Report, total commitments to first-time funds dropped to $26.7 billion in the first three quarters of 2024—the lowest in years—meaning LPs are more selective than ever.

Reality check on fee structures:

Management fees below 1.5% make funds operationally unviable under $25M AUM

Performance fees below 15% signal lack of confidence to institutional allocators

High-water marks are non-negotiable

Hurdle rates (5-8%) are increasingly expected

The difference between success and failure often comes down to cost structure. Managers who can access shared infrastructure—compliance systems, trading technology, portfolio accounting—at a fraction of the cost of building in-house extend their runway by 12-24 months.

Regulatory Requirements You Can't Skip

Form ADV filing is required if you have $100M+ in regulatory AUM. Most emerging managers file voluntarily because institutional investors won't allocate to unregistered advisors. Filing timeline: 45 days for initial registration, annual updates within 90 days of fiscal year end.

Custody Rule compliance requires:

Using a qualified custodian

Annual surprise audits by independent accountants

Client account statements from custodian, not from you

Marketing Rule changes (effective 2021) now allow testimonials and past performance in marketing materials, but all marketing must be substantiated and records maintained for seven years.

Form PF reporting is required for advisors with $150M+ in hedge fund assets. Below that threshold, you're exempt—but expect to hit it within 2-3 years if successful.

The regulatory landscape has become increasingly complex, and violations—even inadvertent ones—can derail a launch. Having compliance infrastructure that automatically tracks requirements and flags potential issues is no longer optional for serious fund managers.

Operational Infrastructure: The Make-or-Break Decision

This is where most emerging managers either waste six months building from scratch or get trapped in expensive legacy systems designed for $500M+ funds.

Fund administration handles NAV calculations, investor reporting, regulatory filings. Traditional costs for emerging managers: $750-$1,500 monthly plus $500-$1,500 setup fees—but these are often stripped-down services that can't scale. Large administrators charge $5,000+ monthly but aren't economical under $250M AUM.

Brokerage and custody: You need reliable trade execution, portfolio tracking, and investor reporting—all integrated so you're not manually reconciling positions across systems.

Technology stack traditionally costs $50,000-100,000 annually:

Portfolio management and analytics

Risk monitoring and compliance tracking

Trading execution infrastructure

Investor portal and reporting systems

The smart play in 2025? Modern fund platforms that provide turnkey infrastructure—from regulatory compliance and portfolio accounting to investor reporting and API-connected trading—without the six-figure annual price tag or multi-month implementation timeline.

The Fundraising Reality

According to With Intelligence's emerging manager analysis, the top 10 emerging private equity managers launching in 2024 were targeting a combined $7.5 billion—but despite headwinds where buyout fundraising fell 23% year-over-year in H1 2025, several have already closed or exceeded targets.

The friends-and-family launch remains most common:

✓ Flexible terms and fee structures

✓ Patient capital that won't redeem during drawdowns

✗ Typically insufficient capital for sustainable operations

✗ Relationship risk if performance disappoints

Institutional seeding from pension funds and seed platforms offers capital plus credibility. Typical seed deals provide $25-100M with 20-30% revenue participation over 3-5 years.

Trade-offs:

✓ Instant credibility and capital

✓ Removes fundraising distraction

✗ Dilutes long-term economics substantially

✗ Often includes restrictive covenants

The capital introduction reality: Conversion rates typically under 5% for managers with less than $100M AUM. Most emerging managers spend 12-18 months building their initial LP base before institutional interest materializes.

The credibility gap is real: LPs want to see institutional-quality operations, audited track records, and proper compliance infrastructure before writing checks. But you can't afford to build that infrastructure until you raise capital. This catch-22 kills more fund launches than poor investment performance.

What Success Actually Requires

NYC Retirement Systems increased exposure to emerging managers by almost $3 billion in FY 2024-2025, bringing total emerging manager exposure to $13.02 billion. But these programs define emerging managers as firms with under $10 billion AUM—proving institutional capital flows to proven performers with proper infrastructure, not garage-band operations.

Critical success factors:

Sufficient runway capital. You need 24-36 months of operating expenses covered. Industry rule of thumb: $500K-1M in personal capital to bridge the gap before break-even.

Differentiated strategy with institutional demand. According to Barclays' 2025 Hedge Fund Outlook, statistical arbitrage and multi-manager funds are seeing the largest allocation increases, while credit strategies are seeing decreased interest.

Operational excellence from day one. LPs are requiring more meetings and stronger proof of strategy before committing. Third-party administration, audited financials, and documented compliance programs aren't optional—they're table stakes.

Technology that scales without breaking the bank. The days of choosing between expensive legacy systems and building everything in-house are over. Modern infrastructure platforms let you launch with institutional-grade technology at emerging manager economics.

How Modern RIA Infrastructure Changes Everything

The traditional path to launching a fund meant either:

Building everything in-house (12+ months, $200K+ in costs)

Outsourcing to legacy providers (expensive, inflexible, opaque)

Cobbling together point solutions that don't integrate

None of these work for managers launching with $5-25M who need to be operational within 90 days.

This is where platforms built specifically for RIAs and emerging fund managers make the difference. Instead of spending six months negotiating with multiple vendors—one for compliance, one for portfolio accounting, one for investor reporting, one for trading infrastructure—you get integrated technology that handles:

Regulatory compliance with automated Form ADV filing, audit trails, and marketing rule compliance

Portfolio management with real-time position tracking, performance attribution, and risk analytics

Investor operations including capital calls, distributions, and quarterly reporting

Trading infrastructure with API connectivity to custodians and automated reconciliation

Back-office automation that eliminates manual data entry and reduces operational risk

The economic impact is substantial. Instead of $75K-100K in annual technology costs plus $40K+ for compliance consulting, you're looking at a fraction of that—with faster deployment and better functionality.

More importantly, you get infrastructure that institutional LPs actually recognize and trust. When a pension fund conducts operational due diligence, they're not evaluating your homegrown Excel models—they're seeing institutional-grade systems that handle billions in assets across hundreds of managers.

The Bottom Line for Fund Managers

Starting an investment fund in 2025 is more accessible than ever—but success rates haven't improved despite record industry assets of $4.74 trillion in H1 2025. The managers who succeed aren't necessarily the best investors—they're the ones who figured out how to access institutional-grade infrastructure without the institutional price tag.

If you can't commit $75K-150K in setup costs, 24+ months without meaningful income, and the discipline to build proper operations from day one, you're not ready. But if you have a differentiated strategy, sufficient runway capital, and the operational maturity to treat this as a business—not just a trading account with fancy letterhead—the infrastructure exists to get you from zero to institutional-quality fund in 90 days instead of 12 months.

At Surmount Wealth, we've built our platform specifically to solve the infrastructure problem that kills most fund launches. We provide RIAs and emerging managers with everything they need—compliance systems, portfolio management, trading infrastructure, investor reporting, and regulatory support—in a single integrated platform designed for the realities of launching and scaling a fund in 2025.

The opportunity is real. The question isn't whether you can launch a fund—it's whether you have the right infrastructure partner to get you there.

Related

Get Started

Experience the full power of our SaaS platform with a risk-free trial. Join countless businesses who have already transformed their operations. No credit card required.

FAQs