Blog

Dec 17, 2025

Real estate has always occupied an awkward position in wealth management—simultaneously too important to ignore and too illiquid to manage cleanly.

The challenge isn't whether real estate belongs in a diversified portfolio. The data is clear: real estate has historically delivered 9-10% annualized returns with low correlation to equities. The problem is that most clients don't experience real estate as a diversified asset class—they experience it as a concentrated, leveraged, illiquid bet on a single property or market.

The typical high-net-worth household holds 25-40% of their net worth in real estate, according to data from the Federal Reserve's Survey of Consumer Finances. Add in vacation properties or rental units, and you're often looking at portfolios where real estate concentration exceeds equity concentration—except with far less liquidity.

The Real Risks That Actually Matter

Real estate risk management isn't about timing cap rate compression or predicting rental demand. The risks that damage client outcomes are structural and compounding:

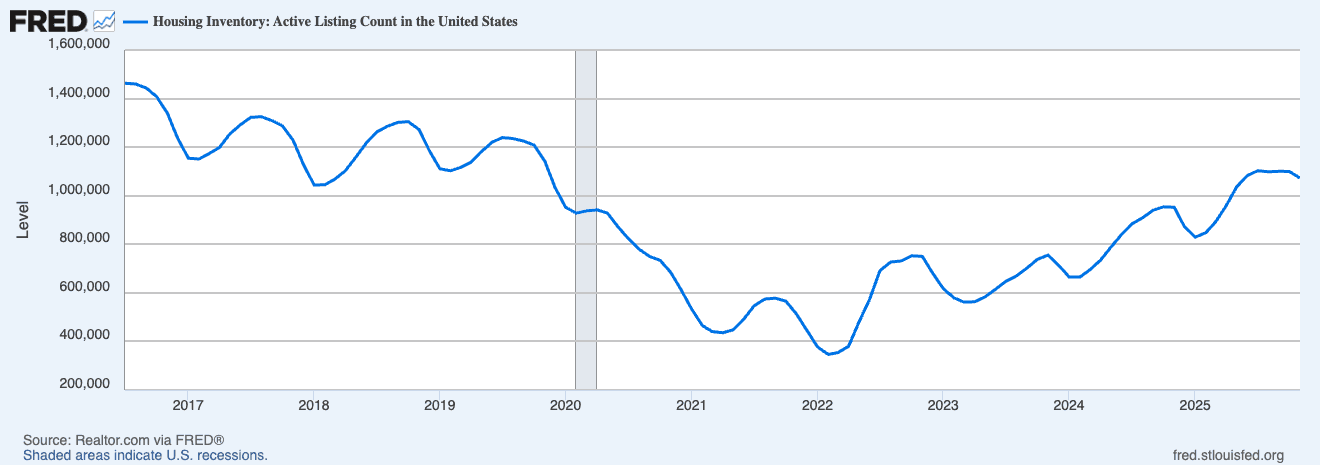

Concentration risk is the silent killer. When a client has $800,000 in real estate and $1.2 million in liquid investments, they don't have a 60/40 portfolio—they have 40% tied to residential real estate in potentially correlated markets. Metro-level real estate returns can show 0.7+ correlation during market stress, meaning a home in Austin and rental in San Antonio aren't actually diversified.

Leverage amplifies everything. Most clients wouldn't buy stocks on 80% margin, but they don't hesitate at 20% down payments. When prices decline 10%, leveraged properties lose 50% of equity. During 2008-2009, U.S. home prices fell 27% nationally, but leveraged homeowners in bubble markets experienced total equity wipeouts.

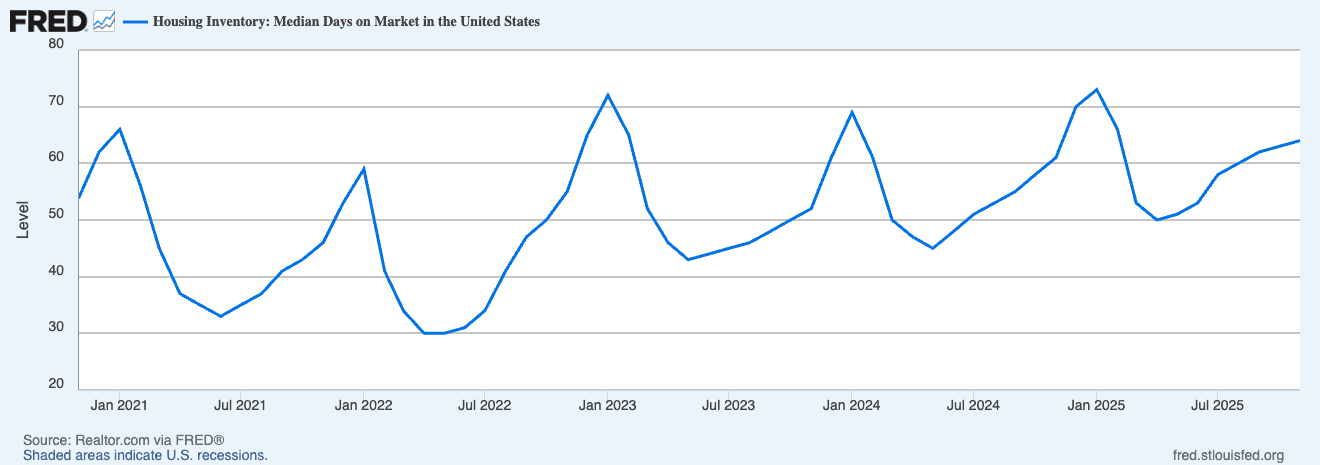

Liquidity risk forces selling at the worst time. Real estate takes 60-180 days to liquidate in normal markets—longer during stress. This creates binary choices: sell at distressed prices or find emergency liquidity by dumping stocks after they've already declined.

How Most Advisors Get This Wrong

The traditional RIA approach is to either ignore client-owned real estate ("that's not part of your investment portfolio") or add REITs to the 60/40 allocation and call it diversified. Both miss the actual risk.

Ignoring real estate means building portfolios on incomplete information. An advisor constructing a "conservative" 50/50 portfolio for a client with $2M in real estate and $1M liquid has actually built an aggressive portfolio with massive concentration.

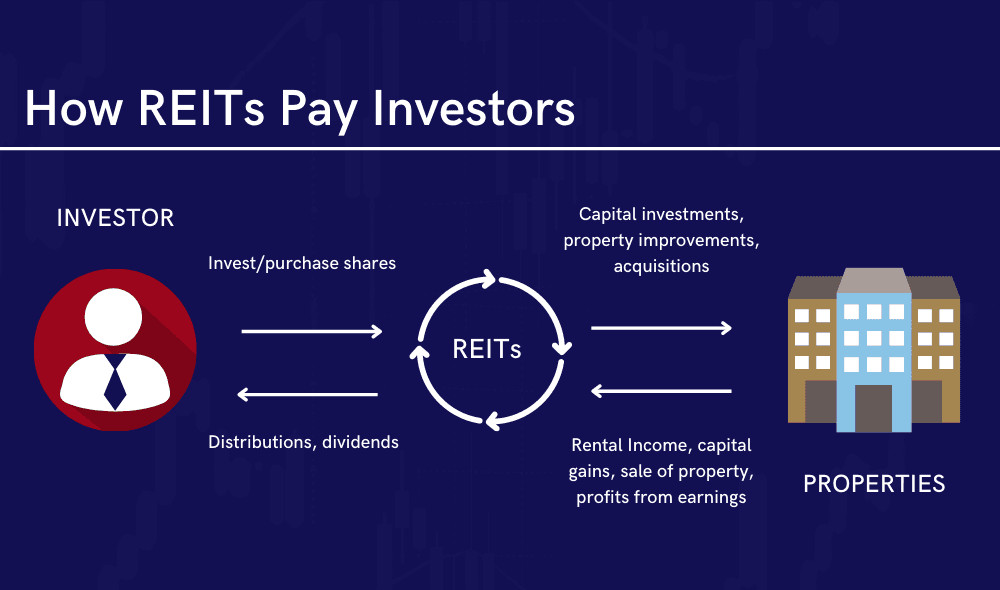

Adding REITs helps less than most think. While private real estate shows 0.3-0.5 correlation with stocks, publicly traded REITs typically show 0.6-0.8 correlation—especially during market stress. Owning REITs alongside rental properties doesn't reduce real estate concentration—it increases it.

A Framework That Actually Works

Step 1: Map total exposure

Calculate real estate across everything:

Market value of all properties (primary, vacation, rental, commercial)

Outstanding mortgages and leverage ratios

REIT and real estate fund exposure

Geographic concentration by metro and state

For many HNW clients, this reveals 30-50% of net worth in real estate—far beyond what they'd consciously choose.

Step 2: Quantify leverage and liquidity mismatch

Compare total real estate leverage against liquid reserves. Morgan Stanley recommends maintaining liquid reserves equal to 18-24 months of real estate carrying costs to avoid forced liquidations.

Step 3: Reduce correlation, not real estate

The goal isn't selling homes—it's reducing correlation:

Reduce REIT exposure in portfolios with heavy direct ownership

Increase truly non-correlated assets like managed futures or commodities

Add international equity that doesn't track U.S. housing

Step 4: Build tiered liquidity

Structure liquidity specifically for real estate risk:

Tier 1: 6-12 months carrying costs in money markets

Tier 2: 12-24 months in short-term bonds

Tier 3: Credit facilities accessible without selling holdings

Advanced Strategies for Concentrated Positions

For clients with $5M+ in properties against $3M liquid:

1031 exchanges and DSTs allow contributing appreciated real estate into diversified structures while deferring gains. JPMorgan analysis shows properly structured exchanges can reduce single-property concentration from 100% to under 20%.

Derivatives hedging through REIT put options provides downside protection without triggering capital gains. Research from Green Street suggests metro-level REIT exposure captures 60-70% of single-property downside risk.

Securities-backed credit lines spread leverage across uncorrelated assets rather than piling it onto real estate, preserving the option to delever without selling property.

The Role of Liquid Alternatives

Modern real estate platforms offer middle-ground solutions:

Private funds with quarterly liquidity like Blackstone's BREIT ($60B+ in assets) provide institutional exposure with semi-liquid structures

Interval funds offer diversified portfolios with 5% quarterly redemptions

Tokenized platforms are demonstrating that technology can solve liquidity challenges

Trade-offs include 1-2% management fees and redemption gates during stress—but still far more liquid than direct ownership.

Managing Client Psychology

The hardest part isn't math—it's the conversation. Clients have emotional attachments to real estate that don't exist with stocks.

Frame discussions around concepts they already accept:

"When we include real estate, you're 55% real estate, 30% stocks, 15% bonds—is that your intended risk profile?"

"If Austin prices declined 20%, how would that affect retirement funding?"

"Could that $200K vacation home equity generate better returns elsewhere?"

What Modern Infrastructure Enables

Managing real estate risk requires seeing beyond traditional portfolios to include all client assets. Legacy platforms weren't built for this—they handle stocks and bonds, with real estate tracked manually or ignored.

Modern infrastructure aggregates everything—property valuations, mortgages, rental income—alongside portfolio holdings. This enables:

Stress scenarios including real estate

Rebalancing based on total net worth

Automated alerts when concentration exceeds guidelines

Reports showing true diversification across all assets

The Bottom Line

Real estate risk management is where wealth management diverges from investment management. Advisors winning HNW relationships today solve the concentration, leverage, and liquidity challenges that keep clients awake.

Most clients with $2M+ in net worth have meaningful real estate risk that no one is managing. The firms that solve this problem own those relationships for decades.

Related

Get Started

Experience the full power of our SaaS platform with a risk-free trial. Join countless businesses who have already transformed their operations. No credit card required.

FAQs