Blog

Dec 22, 2025

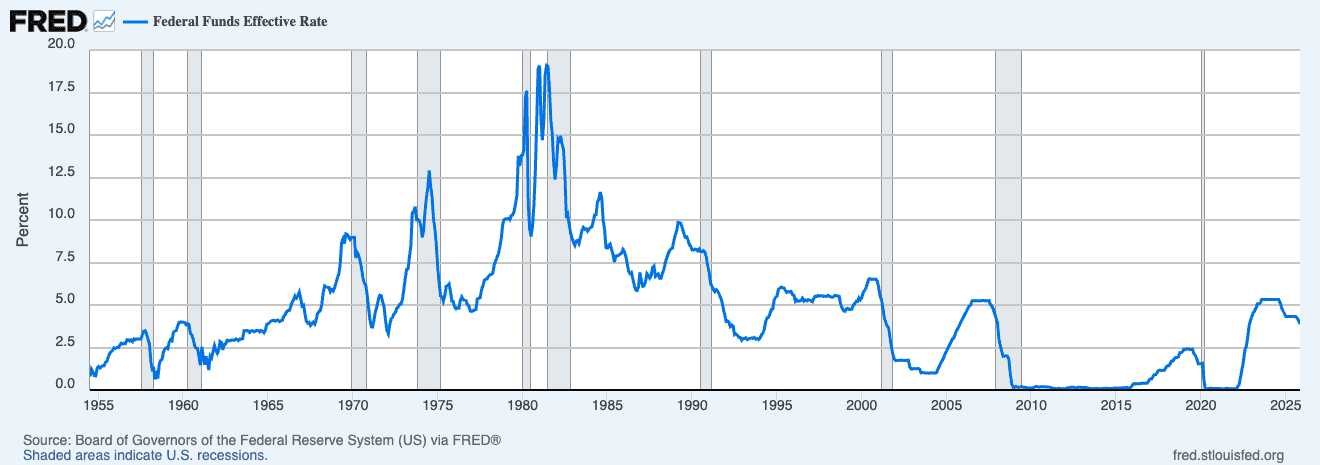

The Federal Reserve's pivot from aggressive tightening to measured easing has reshaped the investment landscape in ways that demand strategic recalibration. After raising rates 525 basis points between March 2022 and July 2023, the central bank cut rates by 50 basis points in September 2024 and another 25 basis points in November, signaling a definitive shift in monetary policy.

For advisors managing client portfolios through 2026, understanding the mechanics and market implications of this transition isn't academic—it's essential.

Why Central Banks Shifted Gears

The pivot wasn't arbitrary. Inflation, which peaked at 9.1% in June 2022, had cooled to approximately 2.7% by November 2024. This deceleration, combined with moderating labor market pressures and mounting evidence of economic resilience, gave the Fed room to recalibrate without abandoning its inflation mandate.

The European Central Bank followed suit, cutting rates by 25 basis points in October 2024, while the Bank of England made its first cut since 2020 in August. The synchronized easing reflects a global recognition that restrictive policy had achieved its purpose—cooling inflation without triggering severe recession.

How Easing Reshapes Valuations

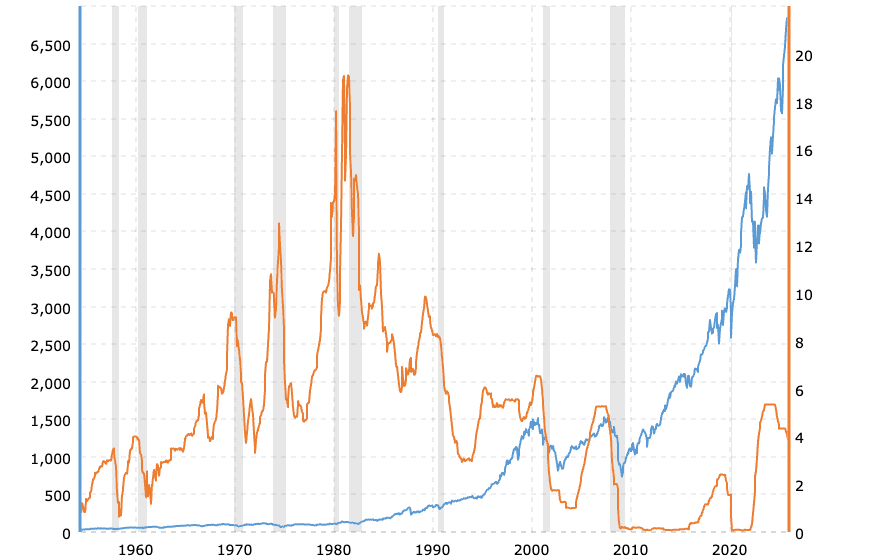

Lower rates fundamentally alter the mathematics of asset pricing. When discount rates decline, the present value of future cash flows increases—particularly for growth equities with earnings weighted toward outer years.

The equity risk premium compressed throughout 2024, with the S&P 500 climbing over 23% despite persistent geopolitical uncertainty. This wasn't irrational exuberance—it was the market repricing assets as the cost of capital declined and recession probabilities faded.

For fixed income, the dynamic proved more nuanced. While falling rates typically boost bond prices, the term premium—the extra yield investors demand for duration risk—remained stubbornly low. According to data from the New York Fed, the 10-year term premium hovered near zero through late 2024, suggesting investors anticipated contained inflation and steady policy normalization.

The Yield Curve's Messages

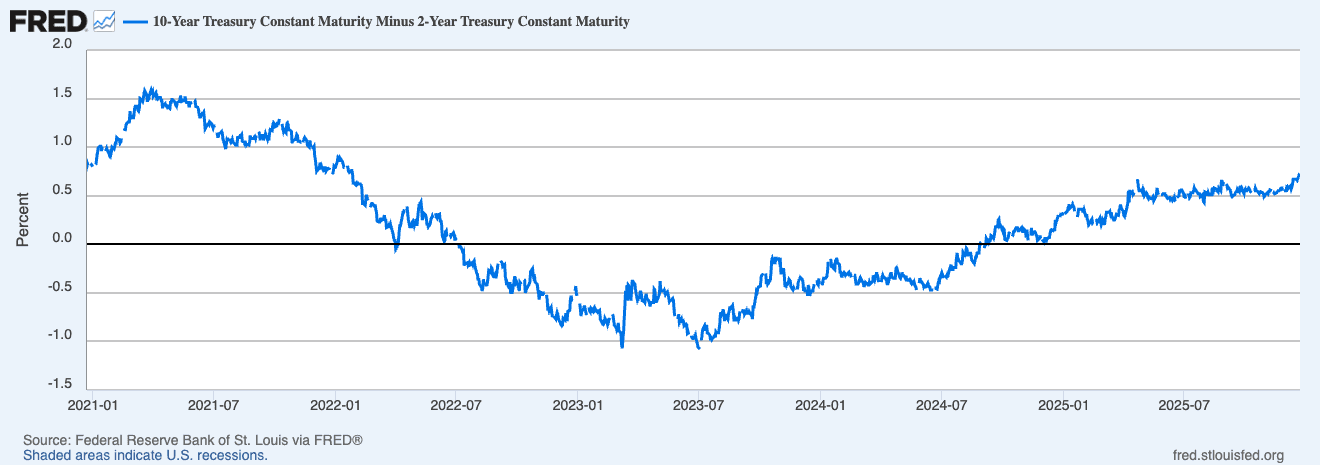

The Treasury yield curve, which inverted severely in 2023 as short rates spiked above long rates, began normalizing as the Fed eased. By December 2024, the 2-year/10-year spread had steepened to approximately 35 basis points, ending one of the longest inversions on record.

This steepening carries implications beyond recession signaling. A positively sloped curve benefits banks through improved net interest margins, supports longer-duration bonds, and typically correlates with improving economic expectations. For advisors, it suggests reduced urgency around ultra-short duration positioning that dominated 2023.

Shifting Asset Preferences

As monetary conditions ease, historical patterns suggest specific asset class rotations:

Fixed Income: With policy rates declining but still elevated relative to the 2010s, investment-grade corporate bonds and municipal bonds offer compelling tax-adjusted yields. Vanguard's 2025 outlook projects 10-year annualized returns of 4.2%-5.2% for U.S. aggregate bonds—materially higher than the prior decade.

Equities: Large-cap growth stocks, which suffered disproportionately during rate hikes due to duration sensitivity, have regained favor. However, earnings growth expectations for 2025 remain concentrated in technology and communication services, warranting diversification beyond the "Magnificent Seven."

Real Assets: With inflation stabilizing but not eliminated, real estate investment trusts and infrastructure assets offer inflation-hedging characteristics without the volatility of commodities. Commercial real estate transaction volumes began recovering in Q4 2024 as financing costs improved.

International Considerations

The Fed's pivot occurs against divergent global monetary trajectories. While developed markets ease in tandem, timing differences create currency volatility and relative value opportunities.

Japan's central bank ended negative interest rates in March 2024, marking a historic policy shift after years of ultra-accommodation. This divergence contributed to significant yen appreciation, with implications for U.S. investors' unhedged international equity exposure.

For advisors with globally diversified portfolios, currency hedging strategies warrant renewed attention as monetary policy differentials widen.

Adjusting Client Expectations for 2026

The transition from tightening to easing creates both opportunity and risk that require explicit communication:

Temper Return Expectations: While 2024 delivered exceptional equity returns, forward P/E ratios for the S&P 500 remained elevated at approximately 21x by year-end. Mean reversion suggests more modest forward returns absent sustained earnings growth.

Duration as Defense: With recession risks diminished but not eliminated, extending duration in fixed income provides portfolio ballast that was absent when short-term yields exceeded 5%.

Volatility Isn't Risk: Lower rates reduce the opportunity cost of holding equities, but political uncertainty, geopolitical tensions, and elevated valuations ensure volatility will persist. Advisors should distinguish between short-term price fluctuations and permanent capital impairment.

Tax Efficiency Matters More: In a lower-return environment, tax-loss harvesting, asset location optimization, and municipal bond utilization become more consequential to after-tax outcomes.

The Infrastructure Imperative

Managing these complexities demands more than tactical adjustments—it requires infrastructure that enables responsive, personalized portfolio management at scale.

Modern RIA platforms that integrate real-time data, flexible automation, and customizable rebalancing logic allow advisors to implement nuanced strategies without manual intervention. As monetary conditions shift and client circumstances evolve, the ability to execute sophisticated strategies efficiently separates leading practices from lagging ones.

The 2025 monetary pivot represents neither crisis nor panacea. It's a transition that rewards preparation, demands clarity, and punishes complacency. For advisors equipped with both intellectual frameworks and operational infrastructure, it's an opportunity to demonstrate value when clients need guidance most.

Related

Get Started

Experience the full power of our SaaS platform with a risk-free trial. Join countless businesses who have already transformed their operations. No credit card required.

FAQs