Blog

Dec 1, 2025

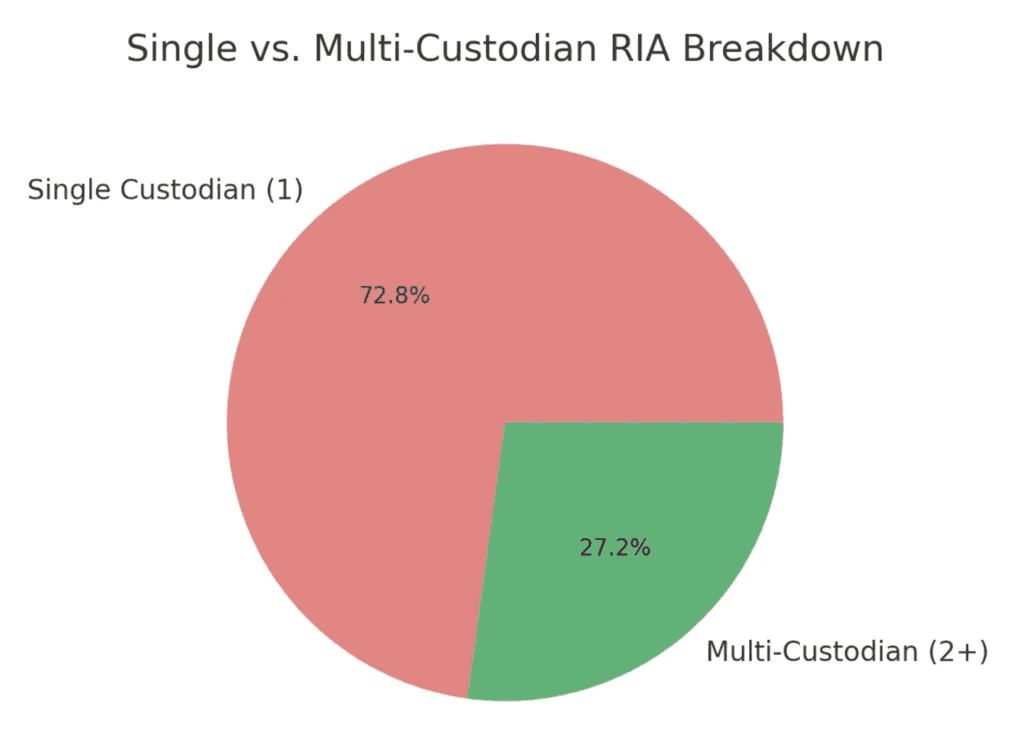

The custodial landscape is shifting beneath advisors' feet. Nearly 30% of RIAs now use two or more custodians—a defensive posture that wasn't necessary five years ago. What changed? Tech outages, service bottlenecks, and consolidation have transformed custodial diversification from a luxury into a risk management imperative.

If you're still running your practice on a single custodian, you're not alone. Most RIAs still operate this way. But the question worth asking is: how much operational risk are you carrying that you don't need to?

Why the Single-Custodian Model Is Showing Cracks

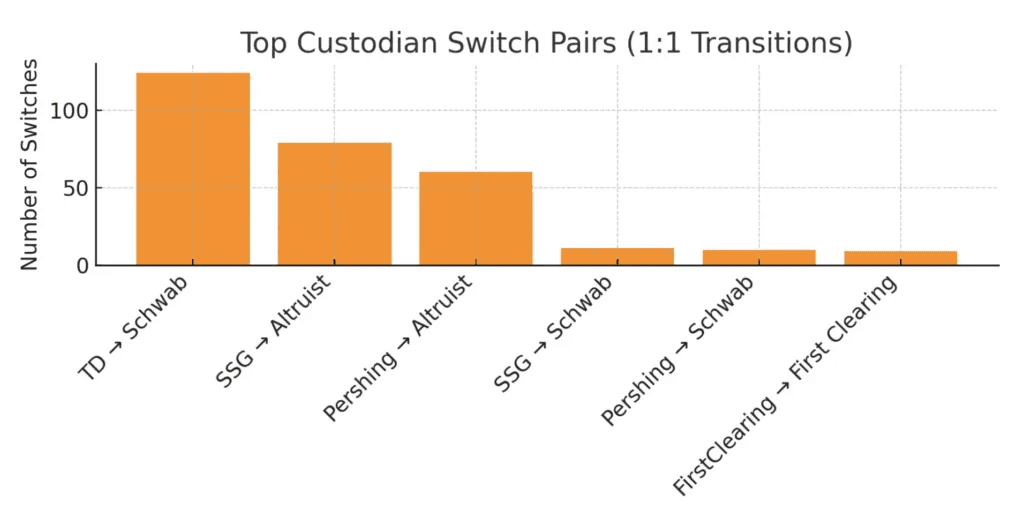

For years, the calculus was simple: stick with one of the big players, accept their service model, and focus on clients. That worked when custodians competed on service quality and technology innovation. But consolidation has changed the equation. When Schwab acquired TD Ameritrade, thousands of advisors found themselves managing forced migrations, repapering accounts, and navigating service degradation during the transition.

The vulnerability isn't just M&A activity. Technology failures have become more frequent and consequential. When a custodian's platform goes down for hours during market volatility, you can't execute trades, can't access client data, and can't service accounts. Your clients don't care that it's the custodian's problem—they see it as your problem.

Service quality has become another pressure point. As custodians scale to support tens of thousands of advisors, many firms struggle to maintain service levels, funneling advisors into call centers where hold times stretch and personalized support disappears. The 64% of advisors using at least two custodians aren't hedging against catastrophic failure—they're hedging against incremental erosion of their ability to serve clients effectively.

The Strategic Case for Adding a Second Custodian

The decision to add a second custodian isn't about paranoia. It's about building operational resilience into your infrastructure. Think of it as portfolio diversification for your business itself.

Risk mitigation through redundancy

When you custody with two platforms, you create optionality. If one custodian experiences a service disruption, you can route new accounts to the other. If pricing structures change unfavorably, you have negotiating leverage. If technology integrations fail, you're not entirely dependent on a single vendor's roadmap.

The math is straightforward: RIAs using multiple custodians rose to 6,253 in 2025, up from 5,938 the prior year. That 5% annual growth rate reflects advisors recognizing that single points of failure create unacceptable business risk.

Client optionality and specialized capabilities

Different custodians excel at different things. Some make cross-border trading seamless; others create friction. If you work with offshore clients, international equities access matters. If you serve younger, tech-forward clients, digital onboarding speed matters. A multi-custodian setup lets you match client segments to the custodian that serves them best.

Schwab and Fidelity remain the most common pairing, leveraging the institutional strength of both while avoiding overconcentration. But newer platforms like Altruist—which grew 111.7% year-over-year—are gaining traction among advisors seeking digital-first solutions alongside legacy relationships.

Negotiating leverage and fee compression

When you custody $200 million with one provider, you're a valued client. When you custody $100 million with two providers, you're a client with options. That changes the dynamic. Custodians know that advisors with diversified relationships can shift assets. It creates competitive pressure that often translates into better pricing, better service, or both.

The Framework: When Should You Add a Second Custodian?

Not every practice needs two custodians immediately. The decision should be driven by specific business realities, not abstract risk aversion. Here's how to evaluate whether the complexity is worth the benefit.

Trigger 1: You crossed $100M in AUM

At this scale, you have enough assets to justify the operational overhead of managing two custodial relationships. Most mid-tier custodians become accessible at this threshold, and your practice likely has enough staff to handle the incremental complexity.

Trigger 2: You experienced a service failure that cost you business

If you've lost a client opportunity because your custodian couldn't open an account quickly enough, or if you've fielded client complaints about platform downtime, you've crossed the threshold where single-custodian risk is material. These aren't hypothetical scenarios—they're revenue events.

Trigger 3: You serve distinct client segments with different needs

If you work with both domestic mass-affluent clients and international high-net-worth clients, a single custodian probably can't serve both segments optimally. Different custodians have varying strengths in cross-border trading, alternative investments, and specialized asset custody.

Trigger 4: Your primary custodian announced a merger or acquisition

The Schwab-TD Ameritrade integration was relatively smooth, but it still created uncertainty and forced thousands of advisors to manage transitions. If your custodian is acquired, having a second relationship in place gives you flexibility to manage the transition on your terms.

The Operational Playbook: How to Split Accounts

Adding a second custodian without a clear operational strategy is worse than staying with one. Here's the framework that works.

New client allocation strategy

The cleanest approach: all new clients go to Custodian B starting on a specific date. This avoids cherry-picking decisions and creates a natural bifurcation over time. Legacy clients stay on their existing custodian, minimizing repapering friction while building your book at the new relationship.

Client segmentation approach

Alternatively, segment by client type. High-net-worth clients with complex needs go to one custodian; mass-affluent clients with straightforward portfolios go to another. This works particularly well if one custodian offers superior service for ultra-high-net-worth clients while the other excels at digital efficiency for smaller accounts.

Service specialization split

Some advisors use different custodians for different account types. Brokerage accounts at one, IRA accounts at another. Taxable accounts at one, qualified plans at another. This approach requires strong operational discipline but can work if each custodian has clear specialization advantages.

The 60/40 rule

Whatever allocation strategy you choose, avoid going below a 60/40 split long-term. If one custodian holds less than 40% of your assets, you lose negotiating leverage and don't really achieve diversification benefits. You're just carrying operational complexity without strategic advantage.

The Traps to Avoid

Multi-custodian strategies fail when advisors underestimate the operational lift. Here are the mistakes that turn diversification into chaos.

Trap 1: Ignoring data integration challenges

Managing data from multiple custodians creates messy, inconsistent flows that threaten accuracy, compliance, and efficiency. Each custodian has unique file formats, naming conventions, and reporting quirks. Without proper data aggregation and normalization platforms, you'll drown in manual reconciliation.

Solution: Invest in middleware that harmonizes custodial feeds before they hit your portfolio management system. Platforms designed for multi-custodial integration become essential infrastructure, not optional technology.

Trap 2: Underestimating compliance complexity

Two custodians means two sets of compliance protocols, two trade error procedures, two fee billing systems, and two reporting workflows. Your compliance officer needs documented Standard Operating Procedures for each relationship, including who processes custodial files, what accuracy checks are required, and escalation paths when issues arise.

Solution: Create a Custodian Data SOP before you add the second relationship. Document everything: data reconciliation steps, file processing responsibilities, exception handling procedures. Governance matters more than technology when managing multiple relationships.

Trap 3: Creating a client experience nightmare

If Client A logs into one portal and Client B logs into a different portal, and your team can't remember who's where, you've added friction without adding value. Client confusion about where their accounts live, inconsistent statement formats, and varying access to custodian services create dissatisfaction.

Solution: Invest in client-facing technology that abstracts away custodial complexity. Your clients should experience one unified view of their holdings, regardless of which custodian holds the assets. This typically requires portfolio aggregation tools or a robust CRM with strong reporting capabilities.

Trap 4: Failing to leverage automation

Sixty-four percent of advisors cite automation as critical to managing multi-custodian complexity. Manual processes that work fine with one custodian become bottlenecks with two. Account opening, rebalancing, trade execution, performance reporting—every workflow needs to function seamlessly across both platforms.

Solution: Evaluate your tech stack before adding a second custodian. Can your rebalancing software handle multiple custodians? Does your CRM integrate with both? If not, the technology gap becomes a service quality gap.

The Infrastructure Advantage

The advisors succeeding with multi-custodian strategies share one characteristic: they treat infrastructure as a strategic asset, not a cost center. They recognize that modern practice management requires technology that provides flexibility, not rigidity.

This is where Surmount Wealth's approach becomes relevant. The platform was built specifically to support multi-custodian operations without forcing advisors to manage the complexity themselves. Data aggregation, automated rebalancing, and unified client reporting work identically whether you custody with one provider or five. The infrastructure adapts to your custodial choices; you don't adapt to the infrastructure's limitations.

That matters because the decision to add a second custodian should be driven by business strategy, not technology constraints. If your systems can't handle multiple relationships, you're constrained by your tools, not your judgment.

The Long View: Where This Is Heading

The growth in multi-custodian adoption isn't a temporary trend—it reflects a permanent shift in how sophisticated advisors manage operational risk. As consolidation continues and technology platforms become more modular, expect this number to continue climbing.

The advisors building two-custodian strategies today are positioning themselves for flexibility tomorrow. When the next merger happens, when the next platform outage occurs, when the next pricing change arrives, they'll have options. That's worth the operational complexity.

The question isn't whether multi-custodian strategies make sense in theory. The data already answered that: nearly 30% of your peers decided the answer is yes. The question is whether your practice has reached the inflection point where single-custodian risk outweighs multi-custodian complexity.

If you're asking the question, you're probably there.

Related

Get Started

Experience the full power of our SaaS platform with a risk-free trial. Join countless businesses who have already transformed their operations. No credit card required.

FAQs