Blog

Jan 7, 2026

After two consecutive years of 25%+ gains in the S&P 500, every advisor faces the same client question: should we rebalance away from winning positions, or let momentum continue? The answer requires stepping back from short-term narratives and reconnecting with fundamental portfolio principles.

The Behavioral Trap Undermining Rational Decisions

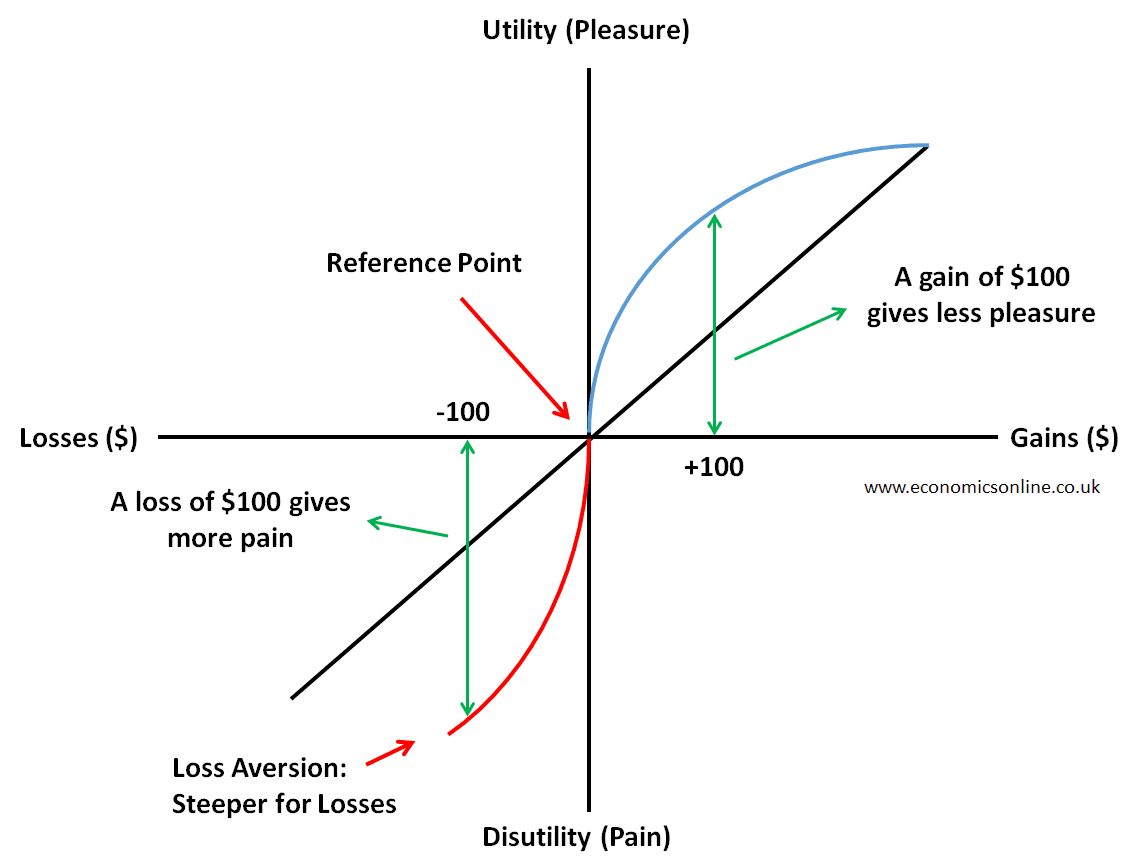

Human psychology systematically works against sound portfolio management. Behavioral finance research demonstrates that investors experience losses roughly twice as intensely as equivalent gains—a phenomenon known as loss aversion. This asymmetry drives predictable irrationality:

Selling winners prematurely while clinging to losing positions

Delaying rebalancing during rallies due to recency bias

Making emotionally-driven timing decisions that destroy value

The cost isn't trivial. In 2022, the average equity investor underperformed the S&P 500 by 3.06 percentage points—losses attributable largely to behavioral mistakes. For a $2 million portfolio, these seemingly minor errors compound into six-figure wealth destruction over a career.

Rebalancing provides mechanical discipline that emotion cannot sustain. By establishing predetermined allocation targets and tolerance bands, advisors remove emotion from implementation entirely.

What Research Actually Reveals About Rebalancing

The performance benefits of rebalancing depend critically on portfolio composition. Comprehensive analysis over 29 years examined quarterly, annual, and threshold-based approaches across bull and bear markets:

Key findings:

Rebalancing delivers strongest risk-adjusted returns when portfolio components exhibit low correlation and comparable long-term expected returns

Research Affiliates tracked portfolios across multiple countries and found disciplined rebalancing reduced volatility by 15-30% while maintaining or improving absolute returns

However, predictable calendar-based rebalancing creates exploitable price patterns costing investors approximately $16 billion annually

Structuring Rebalancing Policies That Actually Work

Implementation strategy matters as much as the decision to rebalance:

Trigger methodology:

Threshold-based approaches (20-25% relative deviations) generally outperform calendar schedules

Vanguard research found 200 basis point triggers substantially reduced transaction costs versus monthly rebalancing

Wider bands allow winners to run while preventing catastrophic drift

Tax considerations:

Rebalance aggressively in tax-deferred accounts

In taxable accounts, prioritize new contributions and use tax-loss harvesting

Recent research shows threshold strategies with systematic tax-loss harvesting can generate 1.5% annual tax alpha

Why Current Market Concentration Demands Action

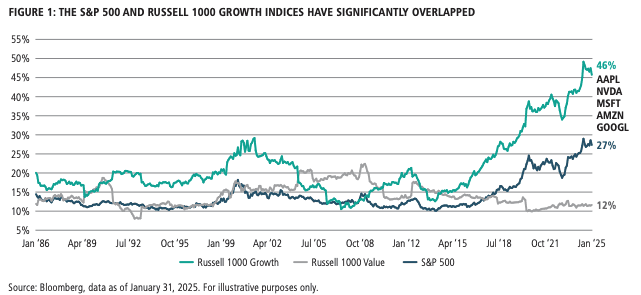

As of early 2025, five technology companies represent more than 25% of the S&P 500 and nearly half of the Russell 1000 Growth Index. This concentration creates asymmetric risks—passive index exposure has become de facto overweight growth.

Following strong equity performance in 2024, many portfolios drifted from 60/40 allocations toward 70/30 or more aggressive positions. The natural human impulse—delay rebalancing to let winners run—contradicts fiduciary responsibility to maintain risk alignment with client objectives.

The Fiduciary Dimension Advisors Cannot Ignore

Rebalancing isn't merely best practice—it's fundamental to fiduciary duty. SEC guidance emphasizes that duty of care requires advisers to monitor accounts and ensure continued alignment with investment objectives throughout the relationship.

Allowing significant portfolio drift creates regulatory and liability exposure:

If a client's 60/40 portfolio drifts to 75/25, then suffers disproportionate losses in a correction, advisers face difficult questions

Was the client aware of increased risk?

Did allocation still match stated objectives?

Was rebalancing policy documented?

Clear investment policy statements should specify target allocations, rebalancing triggers, and rationale relative to client goals. Regular documentation of drift and rebalancing decisions provides both better outcomes and regulatory compliance.

Technology Transforms Operational Feasibility

Modern portfolio management technology eliminates operational friction that historically limited rebalancing effectiveness:

Automation capabilities:

Automatic portfolio monitoring against target allocations

Flagging accounts exceeding tolerance bands

Optimized trade lists minimizing transaction costs

Tax-loss harvesting algorithms coordinating with rebalancing

Sequenced trades minimizing market impact

For practices managing $500 million+ across 200+ client relationships, automation transforms rebalancing from quarterly burden into continuous background optimization. Advisors spend less time on mechanics and more time on strategic portfolio decisions and client communication.

The most advanced solutions integrate custodial data, performance attribution, risk analytics, and investment policy statements into comprehensive workflows—enabling client-specific trigger bands, cash flow coordination, and optimized execution timing that would be operationally impossible manually.

The Infrastructure Advantage

For many practices, rebalancing effectiveness is constrained not by strategy but by infrastructure. Legacy systems require manual uploads, spreadsheet reconciliation, and disconnected workflows that introduce errors and delays.

Modern infrastructure transforms capabilities through integration and automation. Platforms that connect custodial data, portfolio analytics, client policies, and execution into unified workflows enable advisors to:

Monitor larger client bases more effectively

Implement sophisticated strategies impossible manually

Generate superior client reporting demonstrating value added

Deliver truly personalized portfolios responding dynamically to changing conditions

As RIA market research indicates, investment authority increasingly concentrates in CIO-led offices using model portfolios precisely because this infrastructure enables consistent, scalable implementation. For firms seeking sustainable growth amid increasing competition, infrastructure isn't operational—it's strategic.

The persistent appeal of market timing reflects our desire to believe superior insight can consistently outmaneuver random market movements. But financial history suggests otherwise. Investors who build sustainable wealth over decades aren't those who called every turn correctly—they maintained disciplined risk management, stayed invested through volatility, and systematically harvested diversification benefits through rebalancing.

For advisors, this distinction clarifies value proposition. Clients don't need someone claiming superior forecasting ability—they need someone helping them stick to sound principles when emotion pulls in destructive directions. Systematic rebalancing provides exactly this service, translating abstract commitment to risk management into concrete portfolio actions that protect wealth over complete market cycles.

Related

Get Started

Experience the full power of our SaaS platform with a risk-free trial. Join countless businesses who have already transformed their operations. No credit card required.

FAQs