Blog

Jan 9, 2026

The $100 million AUM threshold represents more than a milestone—it's where most advisory firms' technology infrastructure reveals its fundamental limitations. Recent industry data shows RIA firms under $1 billion in AUM hit historic lows in operating margins as expenses consumed 82% of revenue, leaving just 18% in profitability. The culprit isn't compensation or compliance costs. It's technology decisions made when firms were one-tenth their current size.

What worked brilliantly for managing 50 clients across two advisors becomes actively destructive at 200 clients with eight team members. Yet most firms continue patching their existing tech stack rather than confronting the uncomfortable reality: their infrastructure can't support the firm they're trying to become.

The Hidden Cost of Point Solution Accumulation

Most RIAs don't set out to build fragile tech stacks. Ezra Group's analysis of hundreds of firms from $200 million startups to multi-billion-dollar aggregators reveals a consistent pattern: firms start with good intentions, adding software to meet immediate client or compliance needs. Over time, one-off decisions accumulate into tangled ecosystems of loosely connected tools with poorly documented workflows and fragile integrations that fail without warning.

The typical evolution:

Under $50M AUM: CRM, portfolio management, and financial planning software selected independently based on individual advisor preferences

$50-100M AUM: Added compliance tracking, document management, proposal generation, and client portal solutions to address specific pain points

$100M+ AUM: System becomes counterproductive—more time spent managing technology than serving clients

Industry research shows that 67% of advisors now use integrated technology stacks versus standalone tools, up from 48% in 2022. Yet many firms claiming integration simply mean their systems can export CSVs to import elsewhere—a far cry from true data unification.

The Data Reconciliation Death Spiral

The breaking point usually arrives quietly. An operations manager spends three hours reconciling portfolio values across systems before a client review. An advisor discovers their CRM shows different holdings than portfolio management software. Billing calculations require manual verification because automated systems produce inconsistent results.

Research on operational efficiency found that top-performing firms spend an average of 13 fewer annual hours acquiring new clients compared to other firms—purely through process optimization. For firms acquiring ten clients annually, that's 130 hours saved. Conversely, firms with fragmented tech stacks spend exponentially more time on basic operations as they scale.

Common breaking points at $100M+:

Staff spending 15-20 hours monthly reconciling data across systems

Inability to generate firm-wide performance reports without manual intervention

Client onboarding taking 4-6 weeks due to disconnected processes

Critical information existing in one system but unavailable where decisions happen

Advisors maintaining personal spreadsheets because "the system doesn't do that"

The insidious reality: each workaround seems minor individually, but collectively they represent thousands of hours annually—hours that can't be allocated to client service or business development. Fidelity's research found that 39% of advisors' time goes to investment management and administrative activities rather than client-facing work.

When Hiring Can't Solve Infrastructure Problems

Many firms attempt to scale through headcount, assuming operational personnel can manage technology limitations. Kitces Research reveals dramatic shifts in hiring patterns: in 2022, firms typically made their first hire at $200,000-$300,000 in revenue; by 2024, that threshold rose to $250,000-$400,000.

More revealing: productivity improvements enabled 1+1 teams to manage 111 clients in 2024 versus 86 clients in 2022—a 29% increase in client capacity driven primarily by technology and process optimization, not just additional staff.

The capacity equation breakdown:

Below $100M: Additional staff can compensate for technology limitations

$100M-250M: Hiring accelerates but productivity gains diminish as infrastructure constraints emerge

$250M+: Infrastructure becomes primary growth constraint regardless of headcount

Industry benchmarking shows that even RIAs with over $1 billion in AUM face capacity strains as they serve more clients with smaller accounts, underscoring that headcount alone can't solve systemic infrastructure problems.

The Infrastructure Versus Software Distinction

The fundamental problem: most firms buy software when they need infrastructure. Software solves specific problems—portfolio reporting, financial planning calculations, CRM functionality. Infrastructure provides the foundation for operations to scale—unified data models, automated workflows, integrated analytics, and seamless information flow across all business functions.

Software characteristics:

Purchased to solve specific point problems

Requires manual bridges between systems

Data exists in silos requiring reconciliation

Scales linearly with users (more users = proportionally more work)

Infrastructure characteristics:

Built to support entire operational model

Native integration across all business functions

Single source of truth for all data

Scales sub-linearly (more users create marginal additional overhead)

Research on RIA technology adoption found that data aggregation and integration capabilities rank as the #1 factor in advisors' technology selection. Yet 65% of advisors feel they could get greater leverage from existing tech tools, rising to 69% among independent RIAs—suggesting the problem isn't lack of features but fundamental architectural limitations.

What Actually Changes at Scale

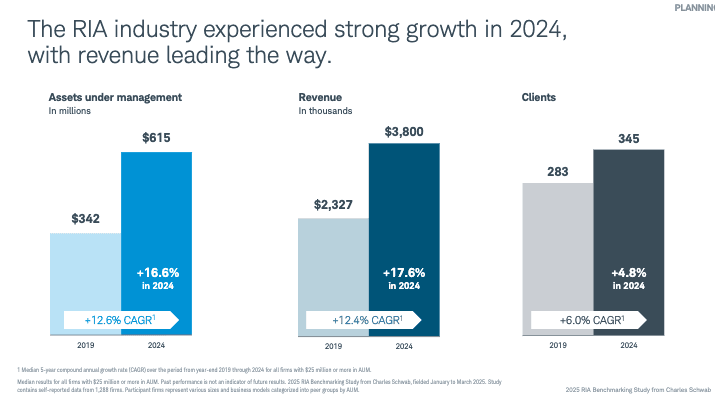

The requirements at $250 million AUM differ fundamentally from $50 million, yet many firms attempt to serve both with the same operational model. Schwab's 2025 RIA Benchmarking Study found that while firms experienced strong growth—16.6% AUM increase and 4.8% client growth in 2024—success also created capacity and service strains.

Operating complexity inflection points:

Multiple advisor teams: Coordination, standardization, and knowledge sharing become critical

Specialized roles: Operations, compliance, and client service require dedicated staff with unified workflows

Institutional expectations: Larger clients demand enterprise-grade reporting, security, and responsiveness

Regulatory scrutiny: Documentation, audit trails, and compliance monitoring intensify

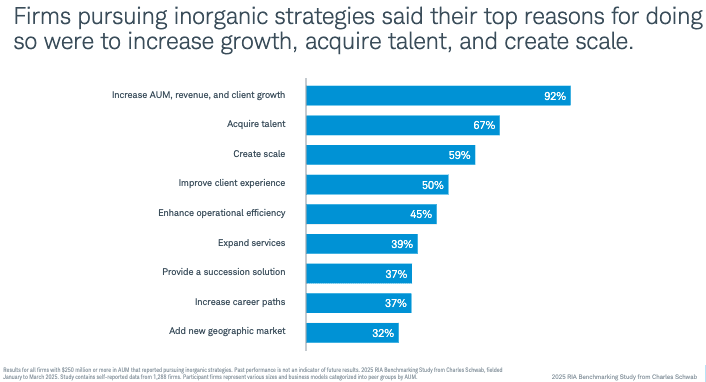

M&A activity: 44% of firms over $1 billion actively pursue acquisitions, requiring integration capabilities

Industry consolidation continues accelerating—366 deals announced in 2024, up 14% from 2023. Q1 2025 alone saw 88 transactions, the highest first quarter on record. Firms with robust infrastructure command premium valuations because acquirers recognize the operational leverage they provide.

The Service Expansion Trap

As firms grow, they naturally expand service offerings. Schwab's research shows RIAs working in financial planning, charitable planning, tax planning and strategy, estate planning, and bill payment all increased since 2021. This expansion creates value—but also operational complexity that fragmented tech stacks can't support efficiently.

The service-technology mismatch:

Estate planning data in one system

Tax information in another

Investment holdings in a third

Financial planning assumptions in a fourth

Client communications scattered across email, portal, and CRM

Lisa Salvi, Schwab's vice president of advisor services, warned: "When you keep adding services and strategies, it manifests in margin compression. You are adding more for the same fee, and that can be a real challenge when you want to give clients the highest-quality, gold-standard service."

Without infrastructure enabling seamless information flow, each additional service multiplies operational burden exponentially rather than adding leverage. Cerulli's research found that advisors increasingly recognize scaling requires operational efficiency, yet challenges like ineffective delegation and lack of process documentation hinder productivity.

Building for the Firm You're Becoming

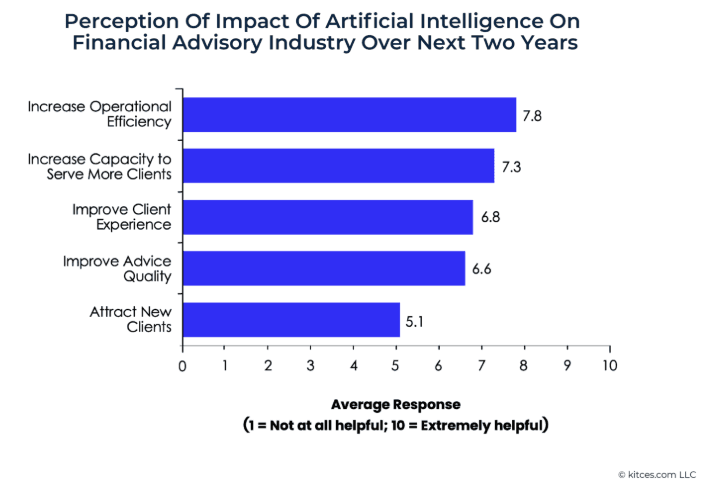

The solution isn't purchasing more software—it's reconceptualizing technology as infrastructure that enables operations rather than applications that perform specific tasks. Envestnet's analysis emphasizes that the most successful advisors leverage integrated platforms to deliver holistic support across their entire book of business while maintaining capacity for growth.

Infrastructure investment priorities:

Unified data architecture: Single source of truth accessible across all systems and functions

Automated workflows: Business logic embedded in systems rather than staff knowledge

Real-time reporting: Performance, billing, and operations visible without manual compilation

Client experience layer: Portal, communications, and service delivery integrated with operations

API ecosystem: Ability to add capabilities without architectural disruption

Technology spending averages 3.8% of firm revenue according to 2024 industry benchmarks—but where that spending goes determines whether it creates leverage or compounds complexity. Firms that view technology as infrastructure investment rather than software expense position themselves to scale past $100 million, $250 million, and beyond without proportional increases in operational overhead.

The firms commanding premium valuations in today's M&A market aren't those with the most software licenses—they're those with infrastructure enabling efficient operations at scale. That's not a technology problem. It's a strategic architecture problem with strategic architecture solutions.

Related

Get Started

Experience the full power of our SaaS platform with a risk-free trial. Join countless businesses who have already transformed their operations. No credit card required.

FAQs