Blog

Dec 12, 2025

For many households, an IRA is the most accessible and tax-efficient path to retirement security. With 44% of U.S. households holding IRA assets, the vehicle has become a core pillar of long-term wealth management. The real complexity isn’t in opening an account — it’s choosing between the Roth and Traditional structures, each with different implications for taxes, liquidity, compounding, and estate planning. For RIAs, the objective is less about picking a winner and more about matching a client’s evolving income, goals, and distribution preferences with the right tax structure over time.

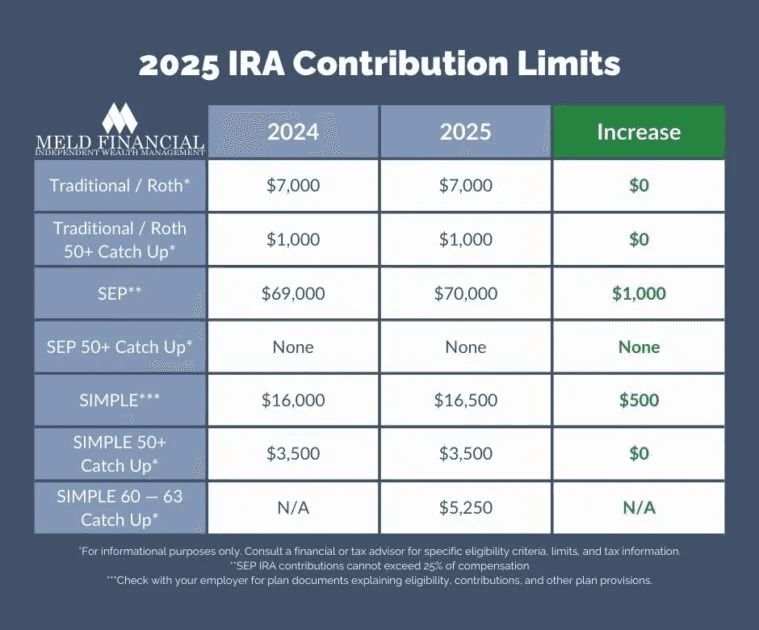

Annual Contribution Limits

Both Roth and Traditional IRAs share a $7,000 annual contribution limit in 2025 (or $8,000 if age 50+).

Tax Treatment

Traditional IRA contributions may be deductible and can reduce current taxable income depending on income and workplace plan participation.

Roth contributions are always after-tax and provide no current deduction.

Withdrawals from a Traditional IRA are taxed as ordinary income at retirement.

Qualified Roth withdrawals are tax-free—including earnings once age and the holding-period rules are met.

Income Eligibility

Roth contribution eligibility phases out as income increases:

Single filers begin Roth phase-out around $150,000 MAGI

Married joint filers begin phase-out around $236,000 MAGI

(Both based on IRS Roth contribution rules verified for 2025)

Traditional IRAs impose no income limits for contributions, though deductibility may be limited for clients covered by an employer plan.

Required Minimum Distributions (RMDs)

Traditional IRAs must begin RMDs at age 73 under current law.

Roth IRAs have no RMD obligation during the original owner’s lifetime.

Both requirements are consistent with IRS retirement distribution guidelines.

When a Traditional IRA Is a Stronger Fit

Traditional IRAs become more attractive in scenarios where:

The client benefits from an immediate tax deduction — especially during peak-income years.

The client expects to fall into a lower tax bracket in retirement, making deferred taxation more efficient.

The client exceeds Roth income thresholds and still wants IRA participation.

The structure of RMDs helps enforce disciplined drawdowns later in retirement.

A notable behavioral pattern: many IRA balances are large not because of consistent annual contributions, but because of plan rollovers throughout a career. Traditional IRAs still dominate this channel, reflecting workplace retirement transitions, long job tenures, and consolidation across accounts.

When a Roth IRA Is the Better Strategic Asset

Roth IRAs meaningfully benefit savers who:

Expect higher marginal tax rates in retirement, either due to increased income or potential legislative change.

Are younger or early in their compounding journey, maximizing decades of tax-free growth.

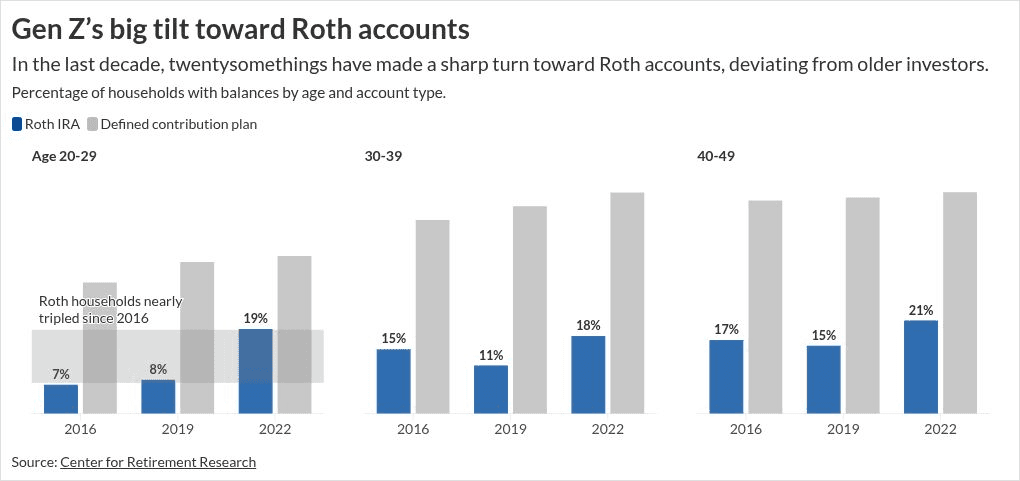

(This aligns with Roth adoption among households in their 20s nearly tripling between 2016 and 2022)Value liquidity — Roth contributions (not earnings) can often be withdrawn without penalty.

Want estate-planning flexibility — Roth assets do not force RMD drawdowns, allowing longer compounding and cleaner legacy transfer.

Advisors increasingly emphasize Roth diversification because it provides more control over retirement income, Medicare surcharge thresholds, and tax-driven sequencing decisions.

Observable Client Behavior

Several patterns matter for RIAs:

Traditional IRAs remain widely held, while Roth penetration is expanding fastest among younger earners and long-horizon savers.

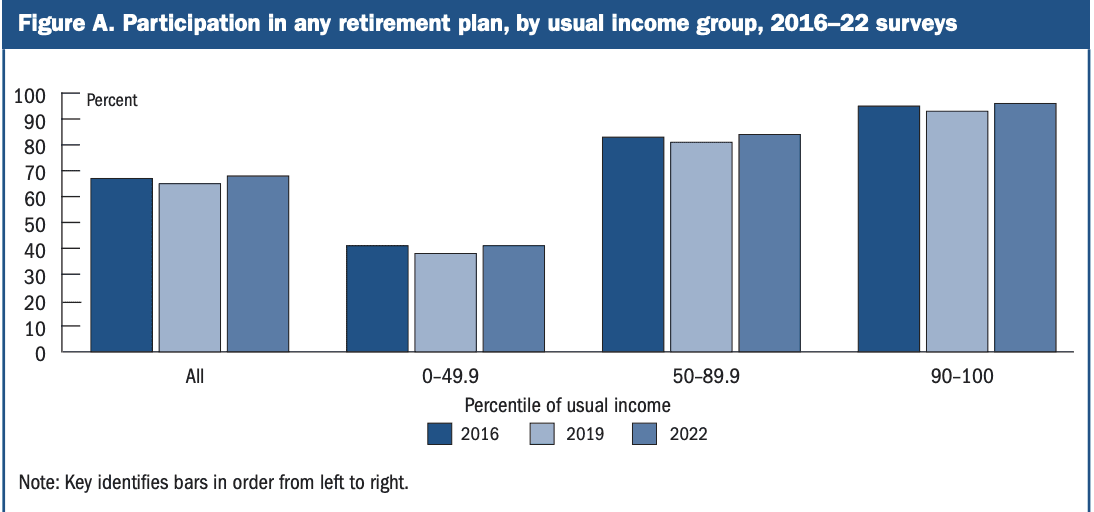

Despite widespread ownership, a minority of households contribute in any given year — many IRAs are built through employer-plan rollovers rather than active annual saving.

(Participation findings supported by retirement industry contribution studies)

This reinforces an important advisory insight: IRA structure decisions should not be treated as singular events. They should be revisited as careers, incomes, and tax laws evolve.

A Practical RIA Framework

A structured framework helps RIAs evaluate IRA selection:

Current vs future tax bracket

Does the client earn more now than they will in retirement, or vice versa?Time horizon

Longer compounding periods increase Roth value.Liquidity needs

Clients with uncertain income, early retirement plans, or intermittent sabbaticals benefit from Roth’s contribution flexibility.Estate and gifting goals

No RMDs and long compounding horizons improve Roth legacy transfer.Eligibility & deductibility

MAGI limits may restrict Roth participation, while Traditional deductibility rules depend on workplace plan coverage.

For many clients, the right answer isn’t exclusive. A hybrid allocation across Roth and Traditional structures offers optionality and smoother income control during decumulation.

Why Better RIA Infrastructure Matters

IRA design has real impact over multiple decades. Advisors benefit from technology that:

Checks contribution limits and eligibility automatically

Models lifetime tax and withdrawal scenarios under different structures

Supports multi-account coordination and income sequencing

Scales beyond manual work and spreadsheets as advisory practices grow

The value lies less in automated selection and more in consistent recalibration — allowing RIAs to pair structure with evolving client realities.

Related

Get Started

Experience the full power of our SaaS platform with a risk-free trial. Join countless businesses who have already transformed their operations. No credit card required.

FAQs