Blog

Dec 9, 2025

Every financial professional knows that wealth management begins with understanding the fundamentals. Yet among the most frequently misunderstood metrics in both personal and corporate finance remains gross income—a foundational concept that shapes everything from tax liabilities to investment strategies.

For Registered Investment Advisors, a nuanced understanding of gross income isn't just academic. It's the lens through which client financial health is assessed, tax efficiency is optimized, and holistic planning becomes possible. As 47% of high-net-worth investors now seek tax planning services from their wealth advisors, the ability to articulate and apply gross income concepts has become table stakes for differentiation.

What Gross Income Actually Means

At its core, gross income represents total earnings before deductions—but the definition bifurcates significantly between individuals and businesses.

For individuals, gross income under IRC Section 61 encompasses "all income from whatever source derived," including wages, tips, interest, dividends, capital gains, business income, and retirement distributions. This expansive definition means that everything from W-2 wages to rental property income to that freelance consulting check contributes to an individual's gross income calculation.

For businesses, gross income—often termed gross profit—tells a different story. It's calculated as total revenue minus cost of goods sold (COGS), capturing the profitability of core operations before operating expenses, interest, and taxes enter the equation. A manufacturing company with $10 million in revenue and $4 million in COGS has a gross income of $6 million, representing a 60% gross margin.

The distinction matters profoundly. While an individual's gross income determines tax bracket thresholds and eligibility for deductions, a company's gross income reveals operational efficiency and pricing power—metrics that sophisticated advisors use to evaluate investment opportunities and business health.

Individual Gross Income: The Starting Point for Tax Planning

Understanding individual gross income is foundational to effective wealth management, particularly as tax laws grow increasingly complex.

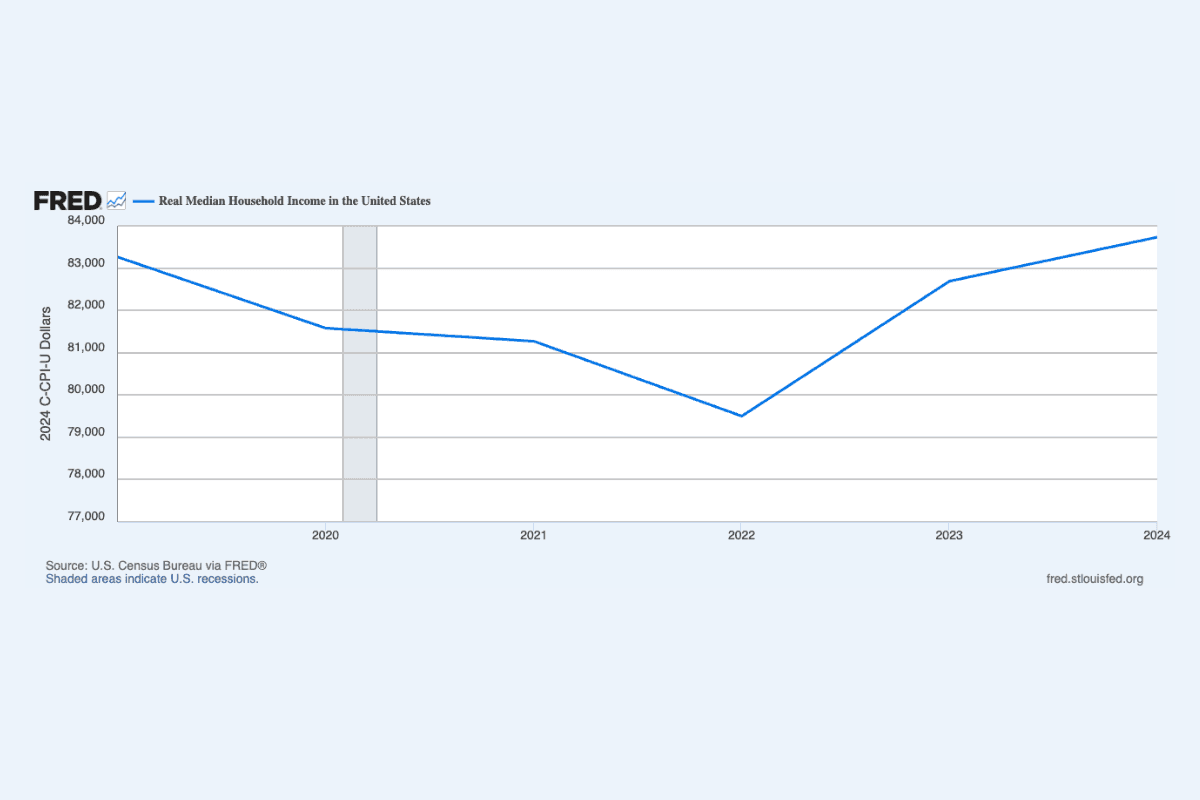

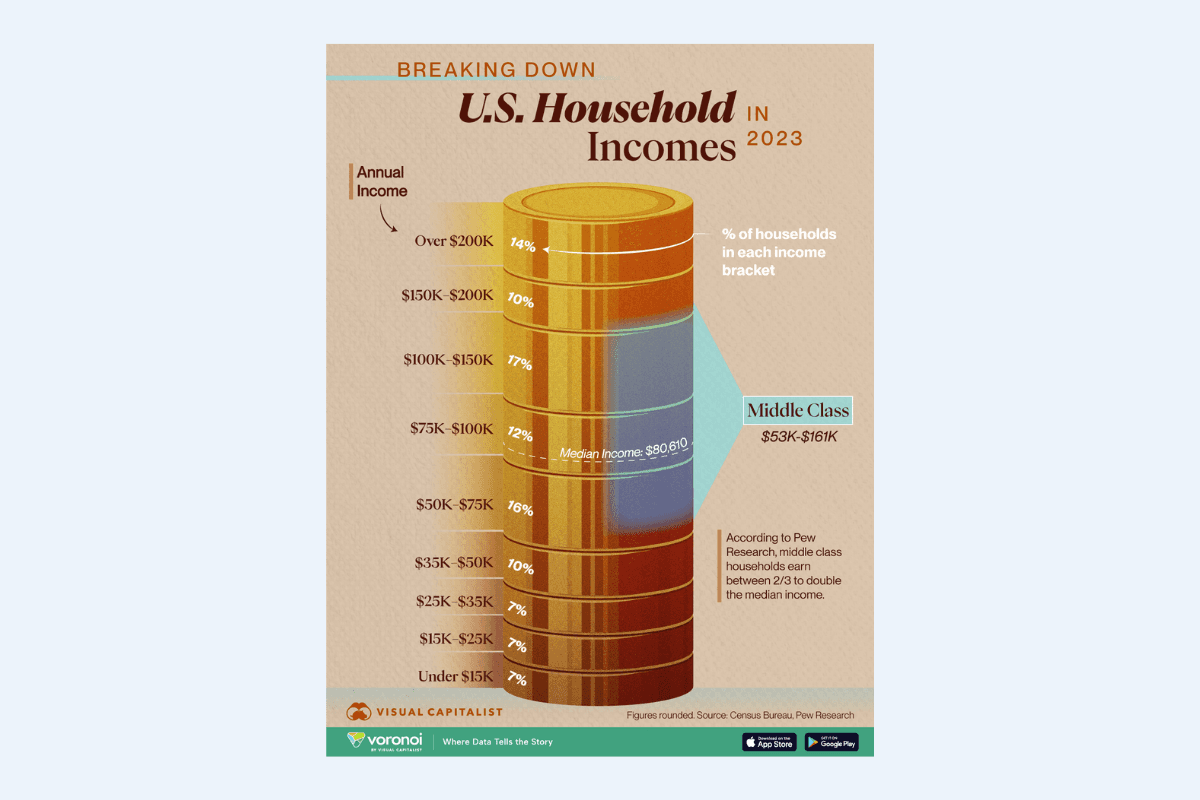

The IRS uses gross income as the starting point for calculating Adjusted Gross Income (AGI), which then determines eligibility for various deductions and credits. For 2024, the median U.S. household income stood at $83,730, relatively unchanged from 2023—yet the tax implications for households at this income level vary dramatically based on how gross income is structured.

Consider a household earning that median income entirely through W-2 wages versus one with $60,000 in wages plus $23,730 in qualified dividends. The gross income figure is identical, but the tax treatment differs substantially due to capital gains rates. This is where advisor value crystallizes.

The calculation is straightforward but comprehensive. An individual's gross income includes:

Employment compensation (wages, salaries, bonuses, commissions)

Self-employment and business income

Investment income (interest, dividends, capital gains)

Retirement distributions (pensions, 401(k) withdrawals, IRA distributions)

Rental and royalty income

Alimony received (for pre-2019 divorce agreements)

Unemployment compensation

Social Security benefits (potentially taxable portion)

What's critical for advisors is recognizing that gross income precedes—and therefore shapes—every subsequent tax calculation. The 2024 contribution limits for 401(k) plans increased to $23,000 for those under 50, with catch-up contributions of $7,500 for those 50 and older. These contributions reduce AGI, not gross income—a distinction that sophisticated tax planning exploits.

Business Gross Income: Measuring Operational Efficiency

For business owners and corporate finance, gross income serves as the primary indicator of core business health, stripped of the noise that operating expenses and financing decisions introduce.

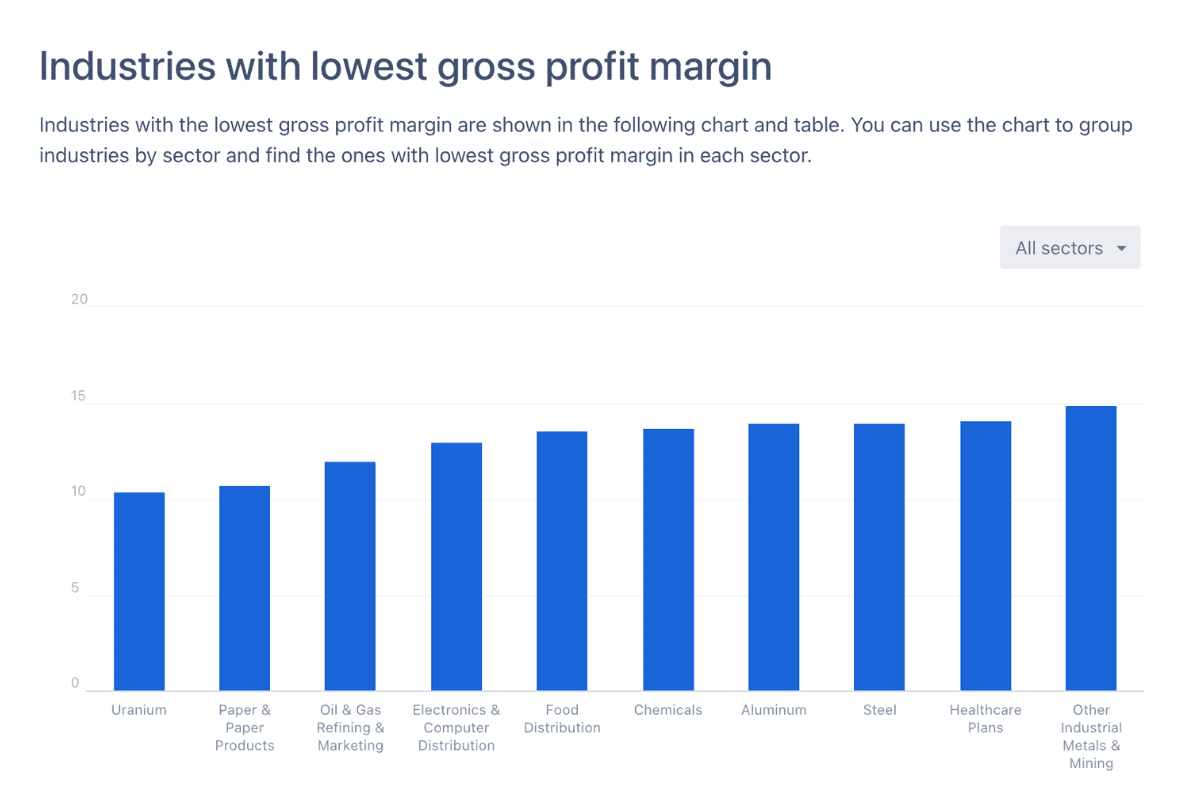

The formula is elegantly simple: Gross Income = Total Revenue - Cost of Goods Sold. Yet its implications are profound. According to industry analysis, gross profit margins vary dramatically by sector. Regional banking averages nearly 100% gross margins (since their "COGS" is minimal), while paper and paper products companies typically operate around 10-11% gross margins due to high raw material costs.

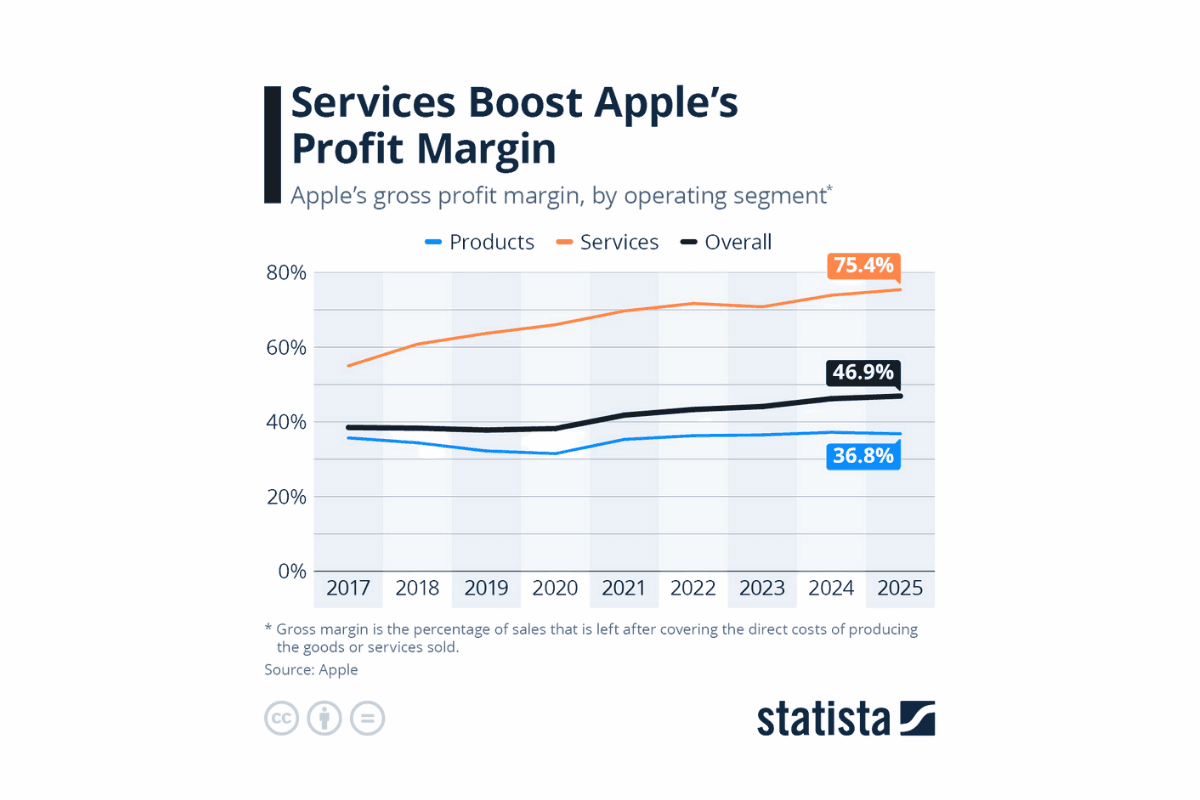

These variations aren't arbitrary—they reflect business model fundamentals. Apple's gross margin reached 43.88% in Q4 2024, driven substantially by its high-margin services business, which alone generates approximately 75% gross margins. In contrast, Walmart's gross margin has remained remarkably stable around 23-24% since 2006, reflecting the razor-thin margins inherent to high-volume retail.

For RIAs evaluating business owner clients or assessing investment opportunities, gross income trends reveal more than profitability—they expose pricing power, cost control, and competitive positioning. A deteriorating gross margin often signals pricing pressure or rising input costs before it impacts bottom-line earnings. An expanding gross margin can indicate successful operational improvements or market power that allows for price increases.

Consider a business owner client generating $2 million in annual revenue. If their COGS is $800,000, their $1.2 million gross income (60% margin) provides the capacity to support operating expenses, debt service, owner compensation, and reinvestment. When that same business sees revenue grow to $2.5 million but COGS increases to $1.25 million, gross income rises nominally to $1.25 million—but the margin compression to 50% signals potential trouble ahead.

Where Gross Income Shapes Advisory Value

The real advisory opportunity emerges at the intersection of gross income understanding and strategic tax planning—an area where RIAs are increasingly differentiating their practices.

Tax planning integrated with comprehensive financial planning can enhance outcomes significantly. As wealth management professor Michael Finke notes, "Tax efficiency is a way for investors to achieve alpha reliably and consistently." Yet only a fraction of investment advisor representatives currently offer small business owner tax planning, despite consistent client demand.

For individual clients, understanding gross income enables proactive strategies like:

Strategic income timing: For clients with variable income streams—business owners, executives with bonus structures, retirees with flexible withdrawal timing—shifting income between tax years can reduce lifetime tax burdens. Someone expecting a $200,000 gross income year followed by a $100,000 year might defer year-end consulting income or accelerate retirement distributions to smooth tax brackets.

Roth conversion opportunities: Clients with temporarily reduced gross income—perhaps due to early retirement before Social Security begins—present ideal Roth conversion candidates. Converting traditional IRA assets during low-income years locks in lower tax rates on that income.

Investment location optimization: While gross income includes investment returns, the type and location of investments determines tax efficiency. Tax-inefficient assets like REITs and taxable bonds belong in tax-deferred accounts, while tax-efficient equity index funds work well in taxable accounts.

For business owner clients, gross income analysis enables:

Structural optimization: Understanding how different business structures affect gross income reporting can significantly impact tax outcomes. S-Corporation election, for instance, allows business owners to reduce self-employment taxes by taking reasonable salary (subject to payroll taxes) plus distributions (not subject to payroll taxes).

Pricing strategy validation: Gross margin trends inform whether a business has pricing power or faces commoditization pressures. This directly impacts business valuation and exit planning conversations.

Growth capital decisions: A healthy gross margin provides the capacity for reinvestment. Businesses with deteriorating gross margins may need operational turnarounds before they can support growth initiatives.

The Surmount Wealth Advantage

Modern advisory demands more than retrospective tax return analysis. It requires real-time visibility into client financial positions and the computational power to model various scenarios instantly.

This is where infrastructure matters. Traditional advisory models, built on quarterly reviews and annual tax return retrospectives, struggle to deliver the proactive, integrated planning that today's sophisticated clients expect. The advisors winning new business are those who can demonstrate immediate value—showing clients how different gross income scenarios affect their tax liabilities, retirement projections, and legacy goals in real-time.

The most efficient RIAs have moved beyond treating tax planning as a separate service line. Instead, they've woven it into their core investment and planning processes through purpose-built technology. When gross income data flows seamlessly from client records into scenario modeling tools, advisors can shift from reactive compliance to proactive optimization.

Consider the difference in client experience: One advisor reviews last year's tax return in April and suggests generic tax-loss harvesting. Another advisor continuously monitors client positions, models the gross income implications of potential stock option exercises, and presents three scenarios showing how timing decisions could save $50,000 in taxes over two years.

Both advisors are competent. Only one is indispensable.

Why This Matters Now

The confluence of rising tax complexity, increasing client sophistication, and persistent fee pressure has made gross income literacy more valuable than ever for RIAs.

With median household income growth stagnating while cost of living continues rising, clients are acutely sensitive to tax efficiency. The difference between smart and unsmart tax planning on a $250,000 gross income could easily exceed the advisor's fee multiple times over.

Meanwhile, as the great wealth transfer accelerates, younger beneficiaries bring different expectations. They're digitally native, they expect real-time insights, and they're less loyal to legacy advisory relationships. These clients evaluate advisors on value delivered, not credentials held.

For RIAs, the imperative is clear: master the fundamentals like gross income calculation and application, then layer on modern infrastructure that lets you deliver insights at scale. The firms thriving in today's market aren't those with the most sophisticated investment strategies—they're those combining financial planning depth with technological leverage.

Understanding gross income isn't glamorous. But it's the foundation upon which sophisticated planning is built. For advisors serious about differentiation, it's where the real work begins.

Related

Get Started

Experience the full power of our SaaS platform with a risk-free trial. Join countless businesses who have already transformed their operations. No credit card required.

FAQs