Blog

Dec 30, 2025

December arrives with its usual ritual: portfolio reviews, year-end performance chasing, and clients asking whether recent gains signal continued momentum. For advisors, it's also the season of explaining why the answer is almost always "not really."

Year-end market behavior operates under a fundamentally different set of rules than the other eleven months. Thin liquidity, institutional window dressing, and tax-motivated trading create distortions that systematically mislead both amateur and professional investors. Understanding these mechanics isn't just academic—it's essential for managing client expectations and avoiding reactive portfolio decisions that undermine long-term strategy.

The Liquidity Illusion

December trading volumes tell a consistent story: fewer participants, smaller trades, amplified price swings. Average daily trading volume drops approximately 30-40% during the final two weeks of December as institutional desks wind down and traders take holiday leave.

This liquidity vacuum creates what market microstructure specialists call "price discovery failure." Small order flows that would barely register in September can move markets noticeably in late December. A modest pension fund rebalancing or a single large redemption request can push sector indices up or down by magnitudes that suggest fundamental shifts—when the reality is simply fewer buyers and sellers willing to absorb the flow.

The statistical evidence is unambiguous. Research from Vanguard examining 40 years of market data found that December price movements show 60% higher volatility relative to the same percentage moves in other months—not because of changed fundamentals, but because of changed market structure.

For advisors, this means December's best-performing sectors rarely stay best-performing in January. The correlation between December sector leadership and subsequent January performance sits near zero, according to analysis by J.P. Morgan Asset Management.

Window Dressing: The Year-End Performance Theater

Institutional portfolio managers face a simple career incentive: year-end holdings reports that look smart. This creates "window dressing"—the practice of buying recent winners and dumping losers just before year-end reporting deadlines.

Academic research published in the Journal of Finance documented that mutual fund managers systematically increase their holdings of stocks with strong recent performance in the final weeks of December. This isn't portfolio repositioning based on conviction—it's optics management.

The mechanical impact is predictable: stocks that performed well in October and November get additional buying pressure in December, often pushing them to unsustainable valuations. Come January, when actual portfolio decisions resume based on fundamental analysis rather than reporting aesthetics, these positions often reverse.

Analysis by Morningstar Direct found that stocks in the top decile of December performance underperformed their sector averages by 140 basis points on average in the following quarter—a pattern that has held for eighteen of the past twenty-five years.

For client conversations, the implication is clear: December winners often become January laggards not because the thesis changed, but because the buying pressure was never fundamental to begin with.

Tax-Loss Harvesting: The December Distortion

December is tax-loss harvesting season, creating systematic selling pressure on underperforming positions. Fidelity reported that tax-loss harvesting activity surged 340% in December 2024 compared to monthly averages, as investors scrambled to realize losses before year-end.

This creates predictable patterns: underperforming small-cap stocks, emerging markets, and sector-specific names with negative year-to-date returns experience concentrated selling pressure completely divorced from their fundamental outlook or valuation.

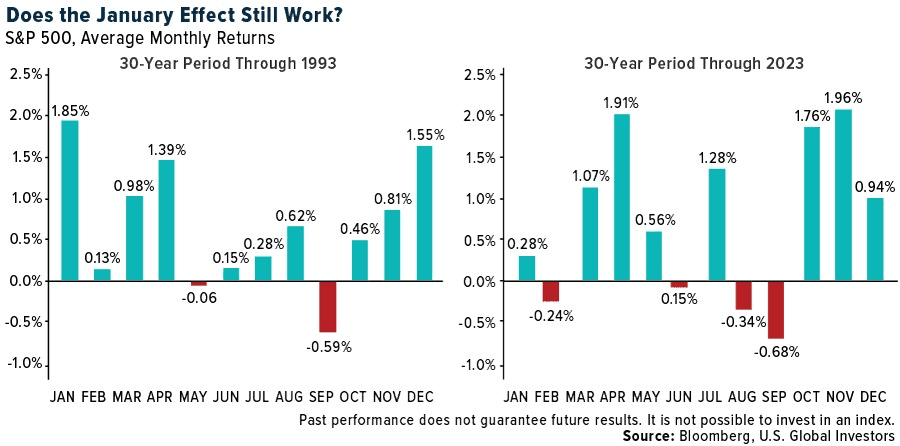

The reversal pattern is equally predictable. Research from Charles Schwab examining the "January Effect"—the tendency for beaten-down December sellers to outperform in January—found that stocks with the heaviest December tax-loss selling bounced back an average of 4.2% in January, well above market averages.

Yet retail clients often interpret December selling as a negative signal about a position's prospects. Advisors who understand the tax-driven mechanics can reframe the conversation: December weakness in fundamentally sound positions often represents opportunity, not deterioration.

The Santa Claus Rally: Signal or Noise?

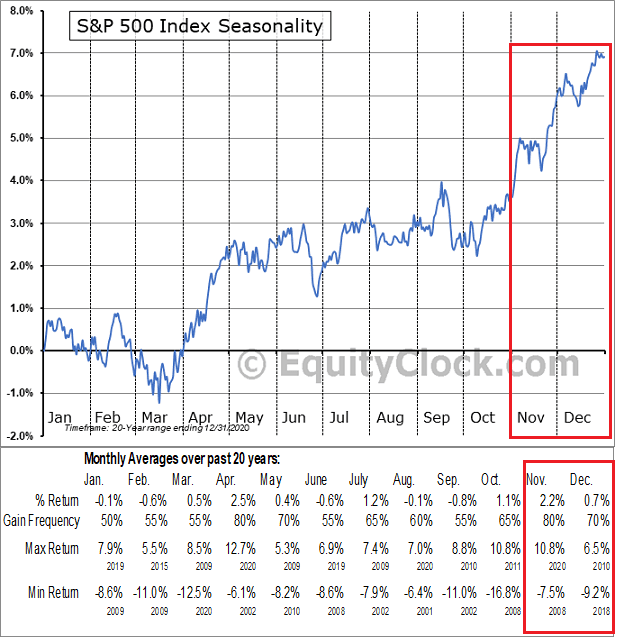

Market commentators reliably discuss the "Santa Claus Rally"—the tendency for markets to rise in the final trading days of December. Stock Trader's Almanac data shows positive returns in this period roughly 75% of the time since 1950, creating media narratives about year-end optimism and positioning for the new year.

The statistical reality is less compelling. The average magnitude of these rallies is approximately 1.3%—economically modest and well within normal variance. More importantly, research published in Financial Analysts Journal found zero predictive relationship between Santa Claus Rally magnitude and subsequent January or Q1 performance.

The rally exists, but it's primarily a function of institutional rebalancing, reduced short interest, and the same liquidity dynamics that distort all December price action. Treating it as a forward indicator compounds the same error as extrapolating from any other December signal.

Framing Year-End Results in Client Conversations

The advisory conversation challenge is straightforward: clients see December performance and naturally project it forward. Your role is to contextualize without appearing dismissive.

The framework that works:

Acknowledge the data: "Yes, the portfolio was up 2.1% in December—that's accurate."

Explain the mechanics: "December trading typically involves 30-40% lower volume and significantly more technical flows than fundamental repositioning. What we're seeing is partly year-end institutional activity rather than changed market conditions."

Redirect to what matters: "Our positioning for 2025 is based on [specific fundamental thesis], not December price action. Let's review those drivers."

Cerulli Associates research on advisor-client communication found that clients who received explicit explanations of year-end market mechanics were 60% less likely to request reactive portfolio changes in January—suggesting that education genuinely mitigates behavioral errors.

The Discipline Advantage

Markets reward advisors who resist December noise. Vanguard's analysis of advisor alpha estimates that behavioral coaching—specifically preventing reactive decisions during periods of market distortion—adds approximately 150 basis points of annual value.

December represents one of the clearest tests of this discipline. The advisors who treat year-end signals with appropriate skepticism, educate clients on the mechanical drivers of December distortions, and maintain strategic positioning regardless of seasonal noise consistently produce better client outcomes.

The infrastructure to support this discipline matters. Advisors need systems that surface the right data at the right time—fundamental indicators, not seasonal noise—and automate the mechanical work that makes thoughtful client communication possible rather than rushed.

Related

Get Started

Experience the full power of our SaaS platform with a risk-free trial. Join countless businesses who have already transformed their operations. No credit card required.

FAQs