Blog

Dec 10, 2025

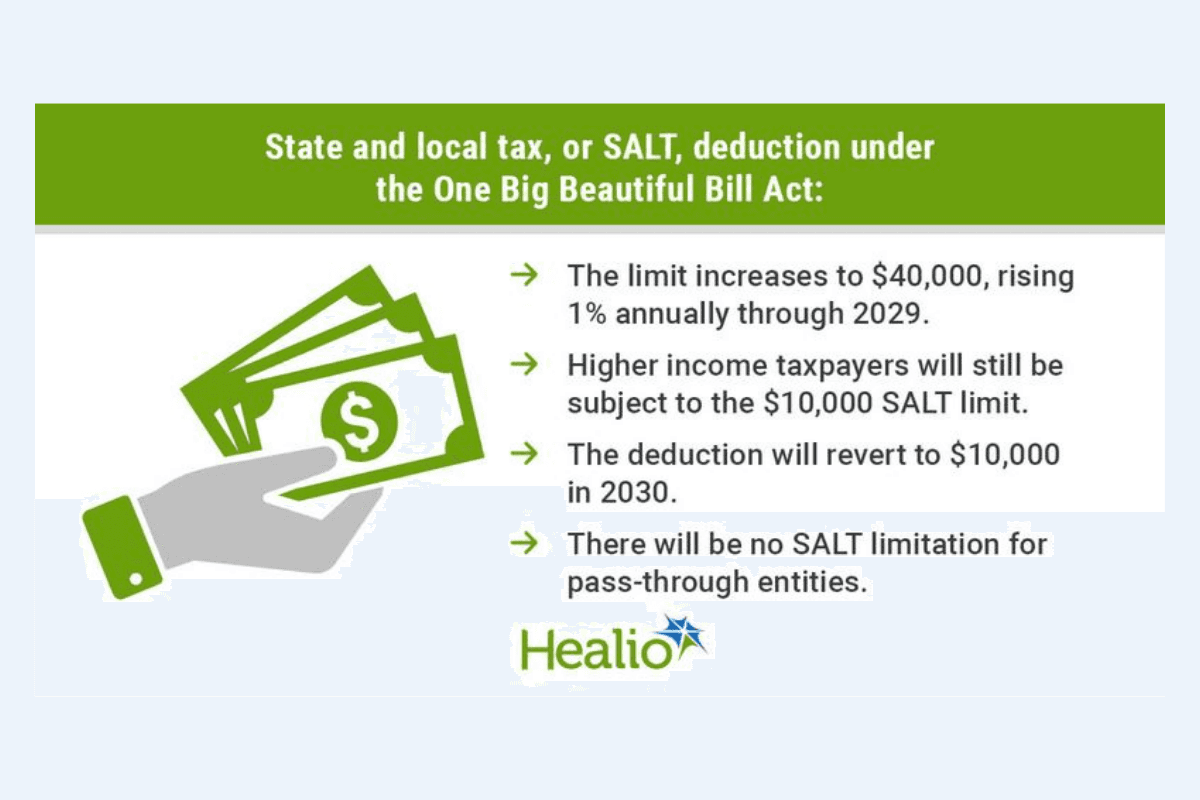

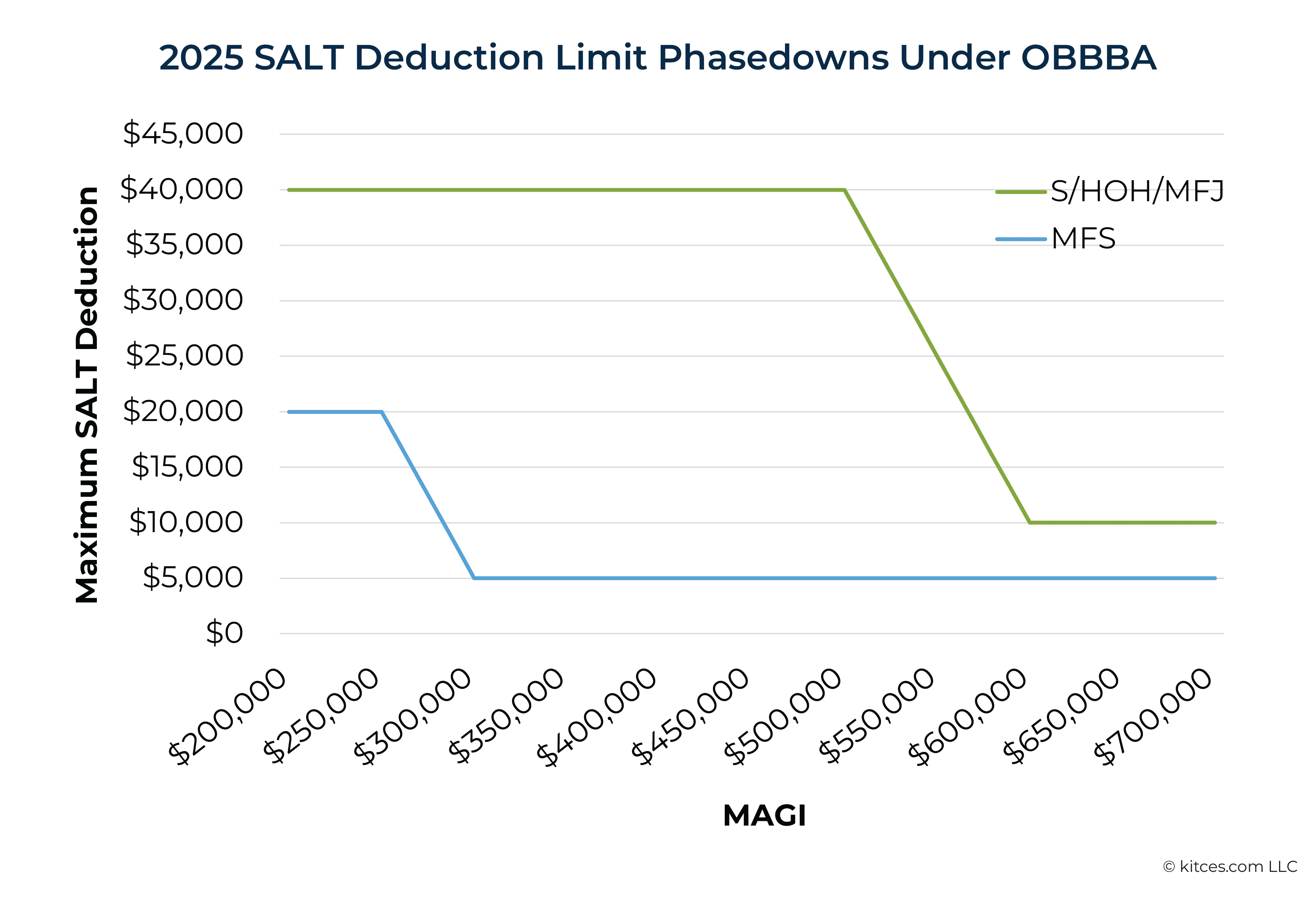

The final weeks of December separate advisors who plan from advisors who react. For 2025, the stakes are particularly high. The One Big Beautiful Bill Act (OBBBA) signed in July introduced sweeping tax changes creating a narrow window between now and January 1. With the SALT deduction jumping from $10,000 to $40,000 and charitable rules shifting dramatically in 2026, waiting costs clients thousands of dollars.

Yet most RIAs lack the operational capacity to execute comprehensive year-end strategies across their entire client base. The bottleneck isn't knowledge—it's executing dozens of client-specific scenarios in 20 business days.

The OBBBA Window Closes December 31

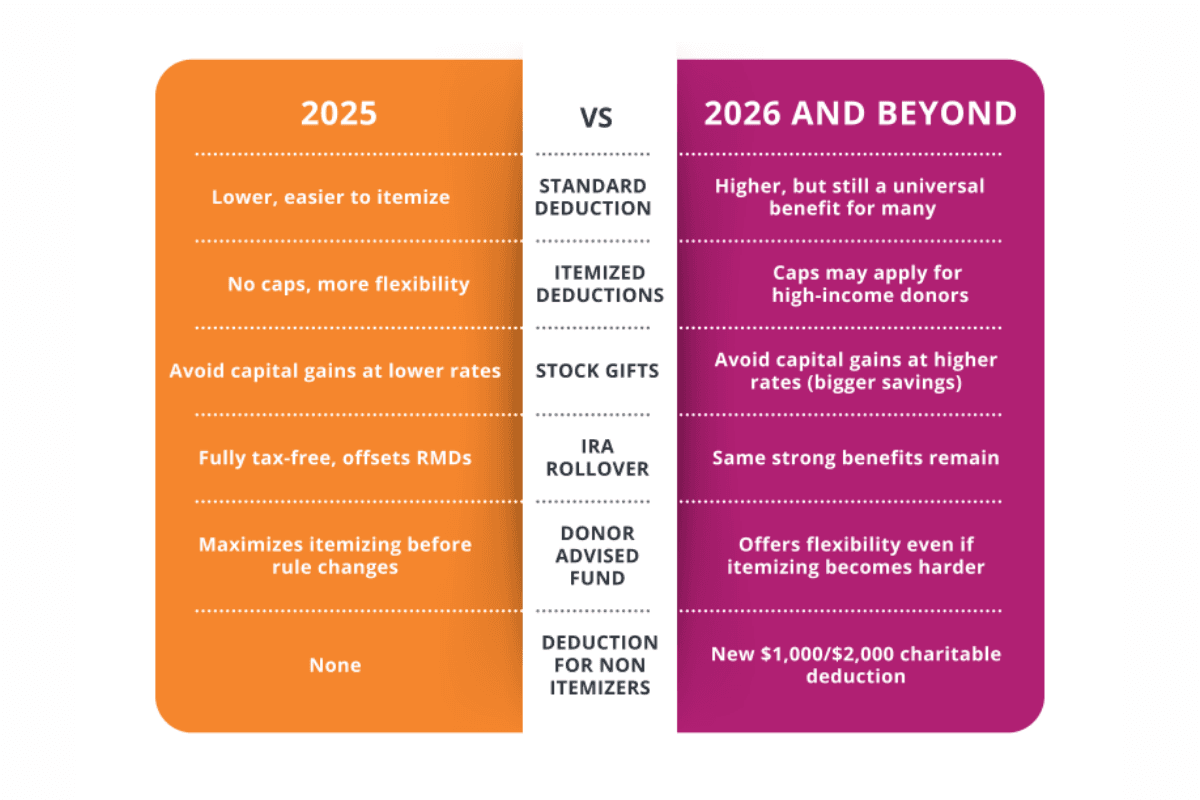

Starting in 2026, taxpayers in the 37% bracket will see charitable deductions capped at 35% instead of receiving full marginal benefit. For a client donating $100,000, that's $2,000 lost. A $500,000 gift loses $10,000 in value if delayed to 2026.

The complexity deepens. Also starting in 2026, itemized charitable deductions only apply to donations exceeding 0.5% of AGI. For a household with $500,000 in income, the first $2,500 in donations generates zero tax benefit. Should clients bunch multiple years into 2025 or wait for 2026's new $2,000 above-the-line deduction?

The optimal strategy depends on each client's giving patterns, tax bracket, and multi-year projections. Advisors need to model multiple scenarios per client—now.

Meanwhile, the SALT expansion to $40,000 helps high-tax state residents through 2029, then reverts to $10,000. For clients in New York, California, or New Jersey, should they prepay 2026 property taxes in December? Only if formally assessed and due in 2025—get it wrong, and the IRS disallows everything.

Tax-Loss Harvesting Demands Surgical Precision

The Morningstar US Market Index gained nearly 17% through November, yet April's 20% drawdown created widespread harvesting opportunities. Advisors who captured losses in April generated value that disappeared by December when positions recovered. This distinguishes systematic tax management from year-end scrambling.

Long-term Treasury ETFs posted 8% annualized losses over five years through November 2025. Small-cap quality funds generated meaningful losses despite broader market strength. But harvesting requires navigating wash-sale rules without disrupting allocation—selling Vanguard 500 and immediately repurchasing violates the 30-day window. Replace with Vanguard Total Market instead.

For clients in the 0% long-term capital gains bracket—under $94,050 for married filing jointly—the inverse applies: realize gains to step up basis while paying zero federal tax.

Executing this across 100+ client accounts in December? Infrastructure determines outcomes.

RMDs and the Inherited IRA Complexity

The December 31 RMD deadline creates execution challenges, especially given July 2024 inherited IRA regulations. Beneficiaries who inherited IRAs after 2019 face annual distributions over 10 years. Miss it, and the penalty is 25% of under-distributed amounts. For a $100,000 RMD, that's $25,000—devastating and avoidable.

Clients with temporarily suppressed income present optimal Roth conversion candidates. Someone who retired in 2025 but hasn't begun Social Security may have their lowest tax year ever. Converting $100,000 at 22% today avoids future conversions at 32% when RMDs and Social Security stack.

The decision requires multi-year tax projections. What's the interaction between Roth conversions, IRMAA surcharges, and SALT benefits? These are quantitative analyses requiring precise modeling—for every applicable client before December 31.

QCDs: The Underutilized RMD Strategy

For clients 70½ or older, qualified charitable distributions elegantly satisfy RMDs while supporting philanthropy. QCDs allow direct IRA-to-charity transfers up to $108,000 per individual in 2025, rising to $115,000 in 2026. The distribution counts toward RMDs but isn't included in taxable income.

For a client in the 32% bracket with a $50,000 RMD who planned to donate $30,000 anyway, a QCD saves approximately $9,600 versus taking the distribution and donating separately. It keeps $30,000 out of AGI entirely—avoiding IRMAA surcharges, reducing taxable Social Security, and preserving income-tested benefits.

Yet QCDs remain underutilized partly because execution requires IRA custodian-charity coordination before year-end. The charity must receive funds by December 31. Systematic tracking beats heroic last-minute efforts.

Infrastructure Is the Differentiator

Year-end tax planning isn't a knowledge gap—it's an execution gap.

An advisor with 80 clients needs to pull realized gains/losses for every account, identify specific tax lots, model wash-sale replacements, project 2025 and 2026 brackets, calculate SALT benefits, determine charitable timing, verify RMD completion for clients 73+, evaluate Roth conversions, assess QCD eligibility, and model multi-year scenarios.

At 30 minutes per client—aggressive for thorough analysis—that's 40 hours of work. In December. While markets are open and clients are calling.

The advisors executing this successfully aren't working harder. They're working differently.

Purpose-built technology automatically identifies harvesting opportunities daily, generates client-specific tax projections that update dynamically, models multiple scenarios in minutes rather than hours, tracks RMD compliance with deadline alerts, and systematically reviews every client for opportunities without manual management.

The difference compounds. Advisors capturing losses in April when opportunities emerge generate better after-tax returns than those finding recovered markets in December. Clients receiving proactive October recommendations make thoughtful decisions rather than rushed December ones.

What Separates December from Differentiation

Many advisors will realize mid-December that comprehensive planning for their entire client base is operationally impossible. They'll triage—largest accounts, vocal clients, obvious opportunities—while knowing systematic optimization would generate significantly more value.

This isn't an indictment. It's physics. There are only so many hours between now and December 31.

The firms solving this have prioritized infrastructure over incremental product sophistication. When tax workflows are automated, client data flows seamlessly into scenario tools, and exception reports flag opportunities before emergencies, the advisor shifts from data gatherer to strategic decision-maker.

The clients experience better service. The advisors experience sustainable scale. The economics work because the same infrastructure enabling year-end tax planning makes ongoing management, rebalancing, and reporting dramatically more efficient.

Twenty business days remain. For some, that's enough to execute comprehensive strategies across their entire base. For others, it's a reminder that next year must be different.

December 31 will arrive whether you're ready or not. The question isn't whether year-end tax planning matters—everyone agrees it does. The question is whether your practice is structured to actually execute it.

Related

Get Started

Experience the full power of our SaaS platform with a risk-free trial. Join countless businesses who have already transformed their operations. No credit card required.

FAQs