Blog

Jan 27, 2026

Your client calls after the market drops 2% on geopolitical headlines. Another emails demanding to "go to cash" after reading about recession risks. A third wants to shift their entire portfolio based on a policy announcement they saw trending on social media. The news cycle has accelerated to the point where every day brings multiple narratives that feel urgent, consequential, and action-demanding.

Yet the data tells a different story. The average equity investor has consistently underperformed the S&P 500 by substantial margins over the past two decades—not because they picked the wrong stocks, but because they traded at the wrong times in response to news and emotions. The gap between market returns and investor returns represents the cost of reacting to noise rather than adhering to disciplined strategy.

For advisors, the challenge isn't predicting which news will actually matter—it's building decision frameworks that help clients distinguish signal from noise, and maintaining the behavioral discipline that compounds into superior long-term outcomes.

Why News Cycles Destroy Portfolio Returns

Financial media operates on an incentive structure fundamentally misaligned with long-term investing. News organizations maximize engagement through urgency, novelty, and emotional intensity. Markets, meanwhile, reward patience, consistency, and emotional detachment. This mismatch creates predictable patterns of wealth destruction.

The behavioral mechanisms are well-documented:

Recency bias: Recent events feel more important than historical patterns, causing investors to overweight new information

Loss aversion: Losses hurt approximately twice as much as equivalent gains feel good, triggering panic selling during downturns

Confirmation bias: Investors seek information that confirms existing beliefs, creating echo chambers that reinforce poor decisions

Action bias: The psychological need to "do something" during uncertainty, even when inaction would produce better outcomes

Research from Morningstar's behavioral finance studies analyzing investor flows shows that money consistently enters equity funds near market peaks and exits near market troughs. This behavior—buying high and selling low—is precisely backward, yet it persists because news cycles amplify the emotional drivers that cause it.

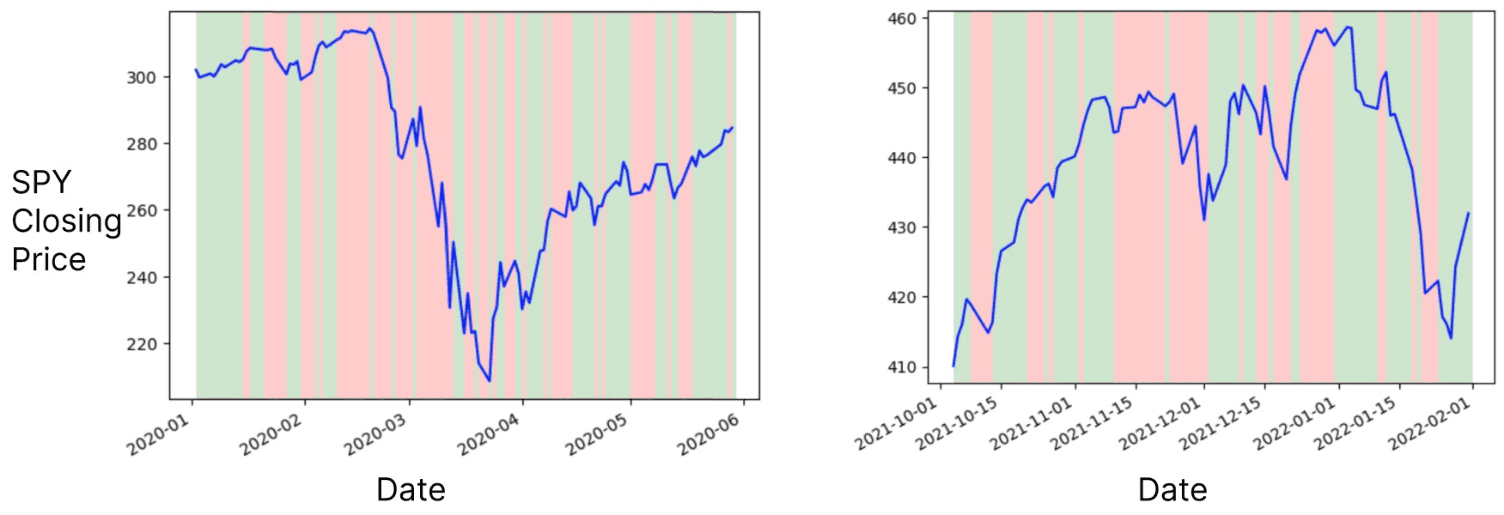

The 2020 pandemic crash provides a perfect case study:

Markets fell 34% in March 2020, with headlines screaming about economic collapse

Investors who sold in panic missed the subsequent recovery that reached new highs by August

Those who maintained discipline—or rebalanced into equities—captured the full rebound

The news was accurate about short-term disruption but completely misleading about investment implications

The pattern repeats across every crisis: September 11th, the 2008 financial crisis, the 2011 debt ceiling debate, Brexit, and countless smaller panics. Each time, staying invested outperformed reacting to headlines.

The Half-Life of Financial News Is Measured in Hours

A useful mental model for evaluating financial news is to ask: how long will this information remain relevant? Most headlines have a half-life measured in hours or days, not months or years.

Short-term noise that dominates headlines:

Policy announcements that get revised or watered down

Economic data that gets revised three times after initial release

Geopolitical tensions that escalate and de-escalate rapidly

Corporate earnings that beat or miss by pennies, moving stocks 5% on information that changes valuations by fractions of a percent

Fed commentary that markets over-interpret and subsequently correct

What actually moves markets over meaningful timeframes:

Earnings growth: Corporate profits compound over years and decades, not news cycles

Interest rate regimes: Monetary policy shifts matter, but markets price them months in advance

Economic cycles: Expansions and recessions unfold over years, with warning signs that develop gradually

Technological disruption: Fundamental shifts in productivity and business models take decades to fully manifest

Demographic trends: Population aging, workforce participation, and consumption patterns change slowly

None of these fundamental drivers change based on daily headlines. Yet daily headlines consistently trigger portfolio changes that disrupt exposure to these fundamental drivers.

Research from the CFA Institute on market timing shows that even institutional investors with sophisticated models rarely add value through tactical allocation changes. If professionals struggle to time markets based on news and data, retail investors reacting to headlines face even worse odds.

Volatility Represents Opportunity, Not Risk

The financial industry's biggest semantic failure is conflating volatility with risk. Volatility measures price fluctuation. Risk measures permanent capital loss. They're related but distinct concepts, and confusing them leads to costly mistakes during chaotic news cycles.

Understanding the critical difference:

Volatility: Your portfolio falls 10% over three months, then recovers to new highs—no permanent loss

Risk: Your portfolio permanently loses value because you invested in fundamentally flawed assets or sold during temporary volatility

Historical context matters enormously:

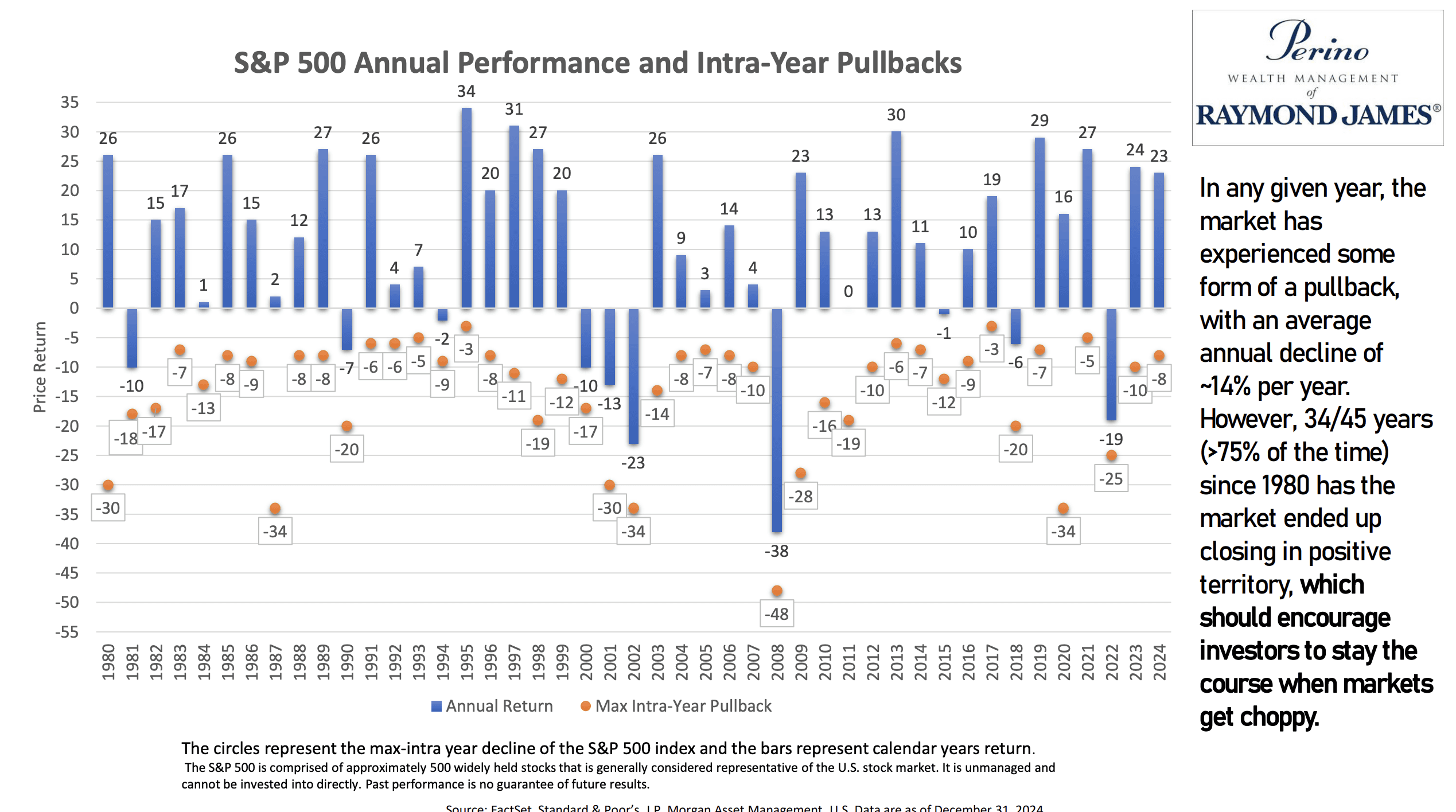

According to data from S&P Dow Jones Indices, the S&P 500 has experienced significant intra-year declines regularly since 1980:

Average intra-year decline: approximately 14%

Years ending positive despite declines: 33 out of 44 years

Maximum intra-year declines ranged from 3% to 49%

Average annual return: approximately 10% despite consistent volatility

Volatility is normal. Reacting to it is optional—and expensive.

Rules-based rebalancing transforms volatility into advantage:

When news-driven selloffs push equity allocations below targets, mechanical rebalancing forces buying at depressed prices

When euphoria drives allocations above targets, rebalancing enforces selling into strength

This countercyclical discipline captures the volatility premium without requiring predictions about market direction

The rebalancing math:

Portfolio target: 60% stocks, 40% bonds

After market decline: 55% stocks, 45% bonds (drift below threshold)

Rebalancing adds 5% to stocks at lower prices

Recovery generates outperformance from incremental exposure purchased cheaply

This only works if you execute it systematically, without subjective judgment about whether "this time is different" or whether the news justifies abandoning the process.

Build Decision Frameworks, Not Reaction Protocols

The solution to chaotic news cycles isn't better news consumption—it's decision frameworks that prevent news from triggering portfolio changes in the first place. Effective frameworks separate legitimate strategy adjustments from behavioral reactions disguised as rational decisions.

Establish clear criteria for portfolio changes:

Life event triggers: Retirement, inheritance, major expense needs—circumstances that change actual financial requirements

Rebalancing thresholds: Pre-defined drift from target allocations (e.g., 5% deviation), executed mechanically without discretion

Tax optimization: Systematic loss harvesting and gain management based on tax circumstances, not market views

Strategic reviews: Annual or semi-annual assessment of whether target allocations still match long-term goals and risk tolerance

Explicitly exclude emotional triggers:

Market declines of any magnitude

Policy announcements or political events

Geopolitical tensions or conflicts

Economic data releases

Media predictions about market direction

Recent performance of any asset class

"Expert" opinions or financial pundit commentary

This framework doesn't prevent clients from feeling anxious during market chaos—it prevents anxiety from destroying their financial outcomes. The conversation shifts from "should we do something about this news?" to "does this news change your retirement timeline, tax situation, or financial goals?" The answer is almost always no.

The Illusion of Control Costs Real Money

Behavioral finance research identifies a persistent illusion: people believe they can improve outcomes through activity, even when evidence proves otherwise. This illusion is particularly destructive in investing because markets are complex adaptive systems where individual actions rarely produce intended consequences.

The evidence against market timing is overwhelming:

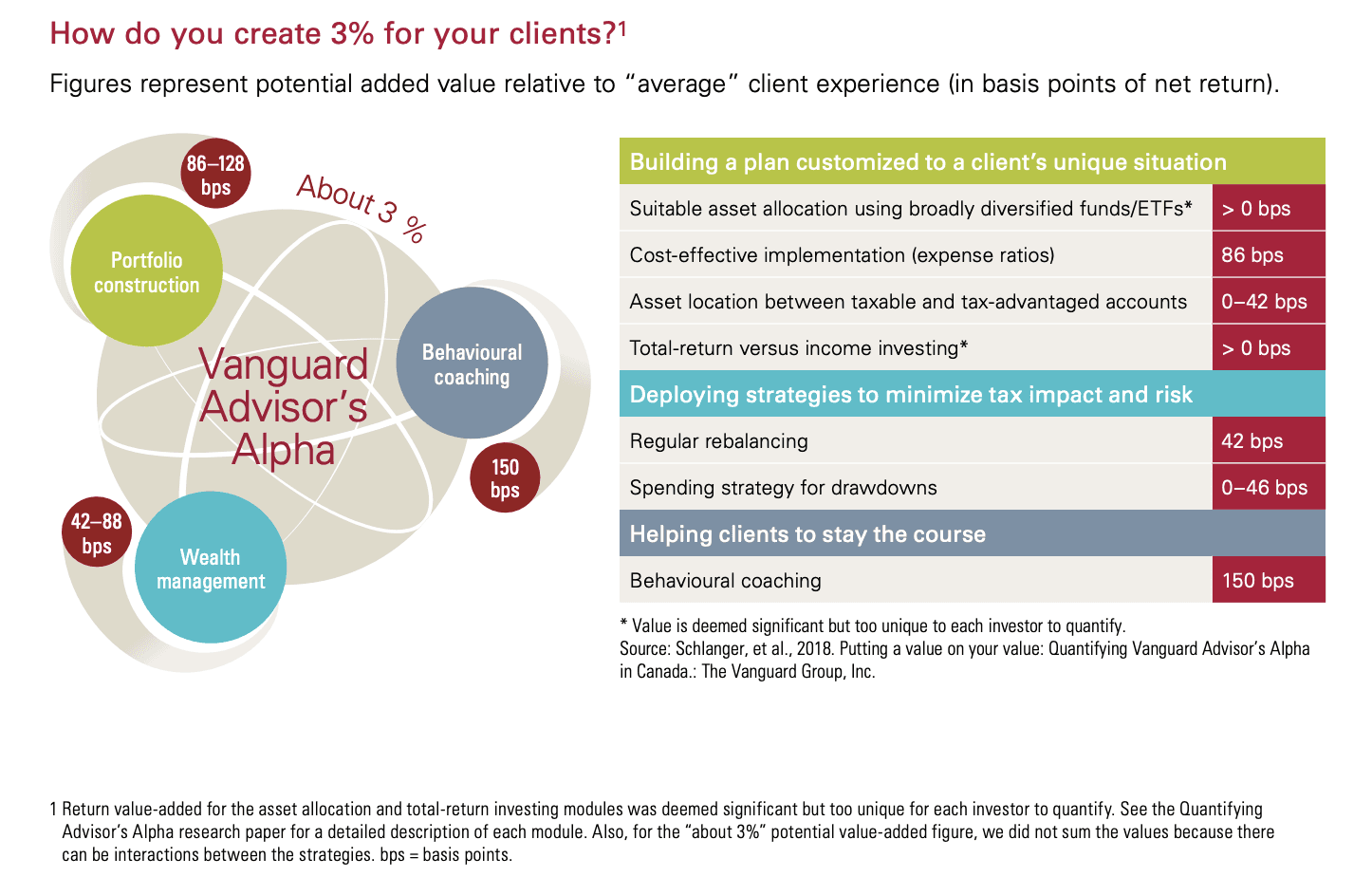

Research from Vanguard's Advisor's Alpha study quantifies the cost of behavioral mistakes:

Attempting to time markets reduces returns by approximately 1-3% annually compared to staying fully invested

Missing just the 10 best market days over 20 years cuts returns nearly in half

Those best days often occur during volatile periods when investors are most likely to be on the sidelines

The best and worst days cluster together, making market timing practically impossible

The compounding impact is devastating:

Portfolio growing at 8% annually: $1 million becomes $4.66 million over 20 years

Same portfolio with 1% annual drag from trading costs and behavioral mistakes: grows to only $3.31 million

Difference: $1.35 million lost to activity that felt productive but destroyed value

Systematic approaches eliminate the illusion of control:

Target allocations established once, changed only for legitimate strategic reasons

Automated rebalancing based on drift thresholds, not subjective judgment

Tax-loss harvesting executed systematically whenever opportunities arise

No manual intervention during market volatility or news events

Pre-committed rules that execute regardless of how you feel about current conditions

This doesn't mean ignoring markets—it means acknowledging that most market movements are noise, and the appropriate response to noise is disciplined inaction.

Information Overwhelm Versus Information Value

The explosion of financial information creates a paradox: more data makes worse decisions easier. Every data point feels potentially important. Every headline suggests action might be necessary. Yet research on decision-making shows that beyond a certain threshold, additional information reduces decision quality by increasing complexity without improving accuracy.

Distinguish between information types:

High-value information that warrants attention:

Changes in personal financial circumstances (job loss, windfall, health events)

Tax law modifications affecting planning strategies

Legitimate shifts in portfolio risk/return characteristics

Evidence-based research on long-term investment factors

Changes to financial goals or time horizons

Low-value noise to filter out:

Daily market commentary and predictions

Short-term economic data subject to revision

Geopolitical developments without clear transmission mechanisms to portfolio values

Individual stock recommendations based on recent performance

"Expert" predictions about market direction

Social media investing trends and memes

Create systematic information filters:

Quarterly portfolio reviews address everything that actually requires attention

Daily market monitoring adds anxiety without improving outcomes

Weekly or monthly check-ins focus on planning, not reacting

Client communication emphasizes long-term strategy over short-term noise

The discipline is surfacing what matters and suppressing what doesn't. For most clients, less information creates better decisions.

Systematic Processes Beat Discretionary Judgment

The defining characteristic of successful long-term investors isn't superior market insight—it's the discipline to follow systematic processes when discretionary judgment screams to do otherwise. This is why institutional investors increasingly embrace rules-based approaches that remove human emotion from execution.

Systematic advantages compound over time:

Consistency: Same response to same circumstances, eliminating behavioral drift

Scalability: Processes execute regardless of advisor bandwidth during chaos

Auditability: Clear documentation of why actions occurred, supporting fiduciary standards

Tax efficiency: Automated optimization captures opportunities human monitoring misses

Emotional detachment: Rules execute without fear or greed influencing timing

Repeatable excellence: Quality execution doesn't depend on having a good day or feeling confident

Compare two advisors during a market correction:

The discretionary advisor:

Agonizes over whether to rebalance

Calls clients to gauge sentiment

Debates whether "this time is different"

Makes scattered decisions influenced by recent news and client pressure

Treats each client situation uniquely based on who called when

Execution quality varies with stress levels and information overload

The systematic advisor:

Process automatically identifies drift thresholds

Executes rebalancing across all accounts simultaneously

Harvests losses where available

Generates client communications explaining what happened and why

All happens without subjective judgment or emotional interference

Consistent treatment regardless of market chaos

The systematic advisor's clients receive consistent treatment, optimal execution, and clear communication. The discretionary advisor's clients receive outcomes determined partially by which day they happened to call or which news the advisor saw that morning.

Client Communication Creates Behavioral Discipline

The most underrated aspect of managing through chaotic news cycles is proactive communication that reframes how clients interpret volatility. Clients who understand that volatility is normal, expected, and manageable stay invested. Clients who are surprised by volatility panic.

Effective communication strategies:

Pre-commit to volatility expectations:

Remind clients quarterly that 10-15% declines occur regularly

Explain that volatility doesn't change long-term strategy

Show historical frequency of corrections and recoveries

Set expectations before problems arise, not during them

Contextualize current events:

Explain why today's headlines resemble dozens of previous events

Show how past crises that felt equally significant proved temporary

Demonstrate market recovery patterns across different types of shocks

Reduce the sense that "this time is different"

Reframe portfolio changes positively:

Present rebalancing as capturing opportunity rather than defending against loss

Emphasize buying assets on sale during declines

Highlight tax-loss harvesting benefits during volatility

Transform anxiety into appreciation for systematic processes

Show historical patterns:

Demonstrate that staying invested through past crises produced better outcomes

Quantify the cost of missing recovery periods

Compare portfolios that reacted versus those that stayed disciplined

Use data, not opinions, to guide decisions

Research consistently shows that clients with more frequent communication from advisors make fewer behavioral mistakes. Not because the communication contains market predictions—but because it reinforces the plan and reduces the psychological need to take action during uncertainty.

The advisor's role during chaotic news cycles isn't to have better opinions about where markets are headed. It's to maintain the behavioral infrastructure that keeps clients executing their strategy when emotional pressure to deviate is highest. That infrastructure—systematic processes, proactive communication, and disciplined rebalancing—determines whether clients achieve their financial goals or become another statistic in the behavior gap.

Related

Get Started

Experience the full power of our SaaS platform with a risk-free trial. Join countless businesses who have already transformed their operations. No credit card required.

FAQs