Blog

Feb 5, 2026

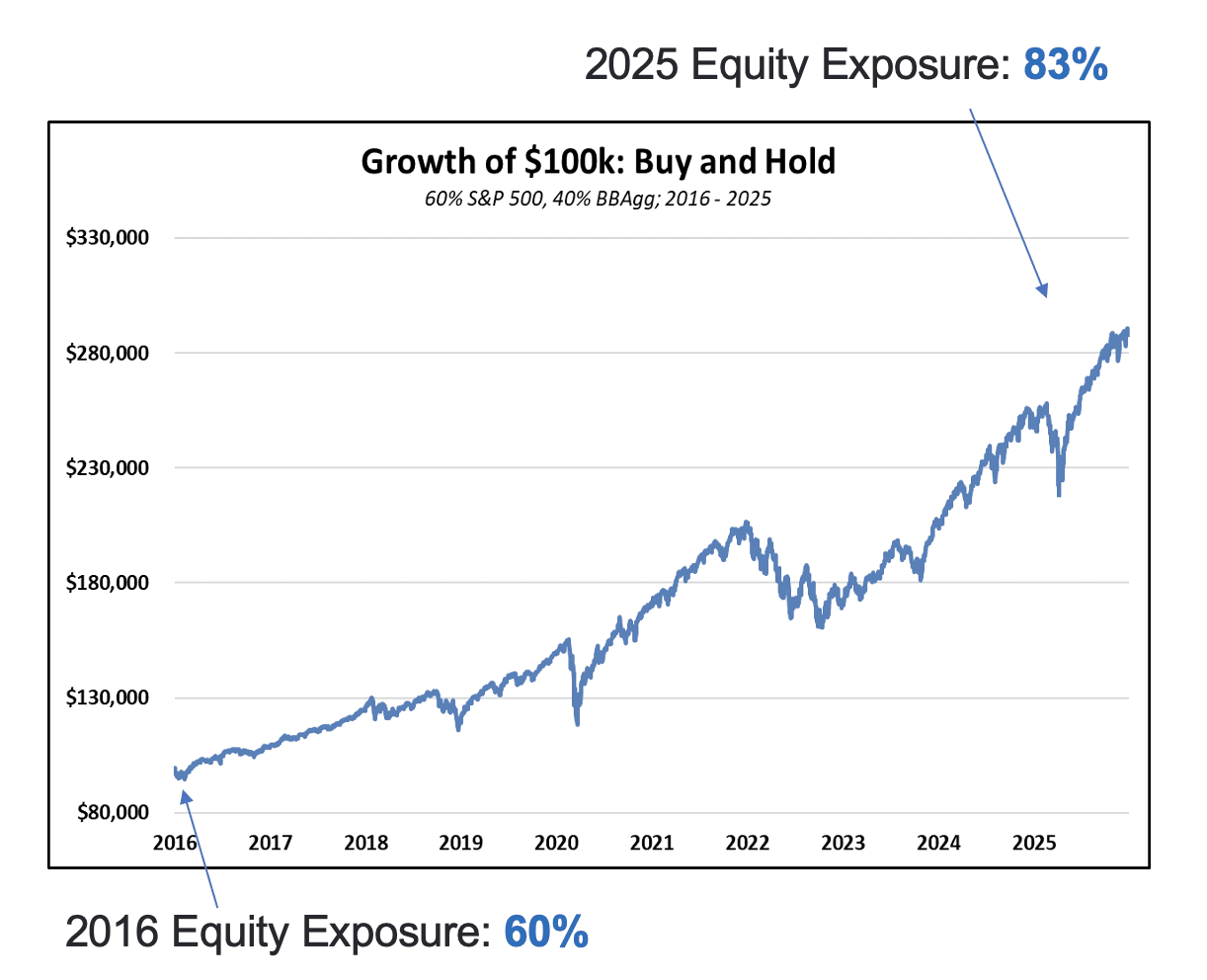

A client starts 2023 with a 60/40 portfolio: $600,000 in equities, $400,000 in bonds. Twelve months later, equities have rallied 26% while bonds returned 5%. Without intervention, the portfolio now sits at 63/37—$756,000 in stocks, $420,000 in bonds.

The drift seems modest. But that 3% equity overweight represents $36,000 in unintended risk exposure. If equities correct 20% in year two, the unrebalanced portfolio loses an additional $7,200 compared to one maintained at policy targets.

This is the quiet erosion rebalancing prevents—not through market timing, but through systematic risk management that compounds across decades. Yet research from Vanguard shows only 43% of investors rebalance annually, and fewer than 20% do so systematically.

For RIAs, rebalancing isn't optional portfolio maintenance—it's a core fiduciary obligation. The question isn't whether to rebalance, but how to do it in ways that maximize after-tax, after-cost outcomes.

What Rebalancing Actually Accomplishes

At its simplest, rebalancing returns a portfolio to target allocations. But the mechanism accomplishes multiple objectives:

Risk control: Prevents portfolios from becoming inadvertently more aggressive as winning assets compound

Return enhancement: Forces "buy low, sell high" discipline by trimming appreciated assets

Behavioral governance: Removes emotion from tactical decisions through rules-based adjustments

Tax optimization: Creates opportunities for strategic loss harvesting

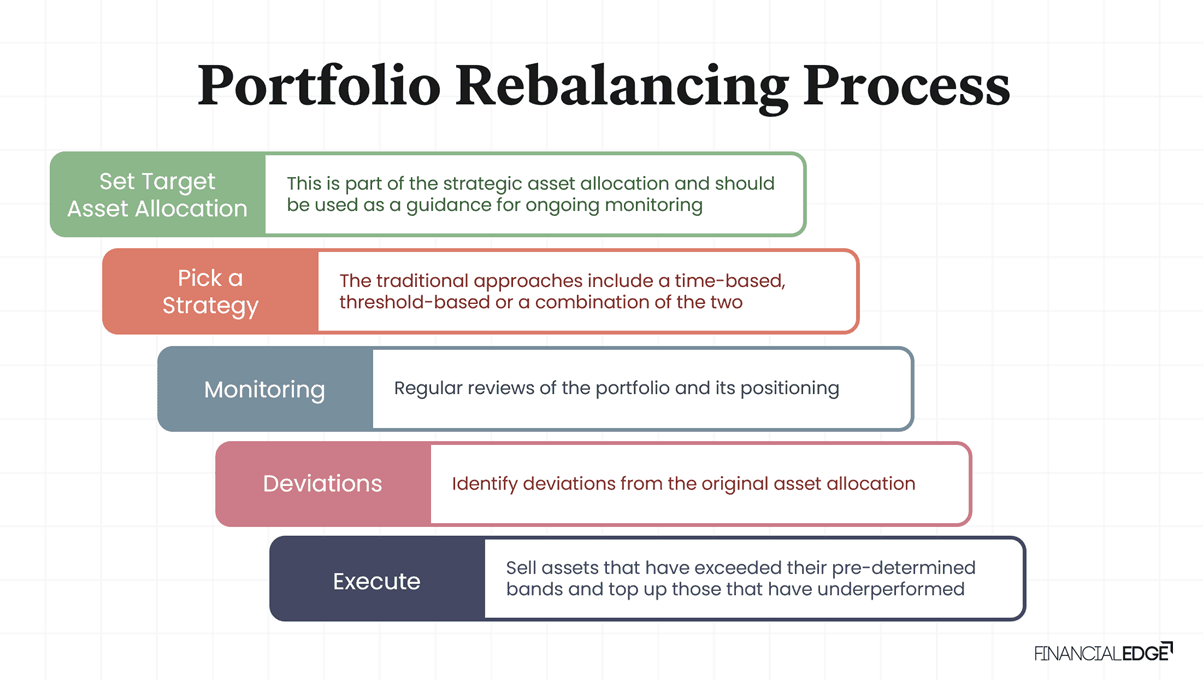

The Three Rebalancing Methodologies

Calendar-Based Rebalancing

Rebalance on fixed schedule (monthly, quarterly, annually) regardless of drift magnitude.

Pros: Simple to implement, predictable costs, removes all discretion

Cons: May trigger unnecessary trades, ignores significant drift between dates

Threshold-Based Rebalancing

Rebalance only when allocation drifts beyond predetermined threshold (typically 5% relative or 20% relative).

Pros: Responds to actual drift, reduces unnecessary transactions

Cons: Requires continuous monitoring

Hybrid Approach

Rebalance annually if drift exceeds threshold (e.g., annual review, trade only if 5%+ drift).

Pros: Combines predictability with efficiency, industry standard

Cons: Requires asset-class-specific calibration

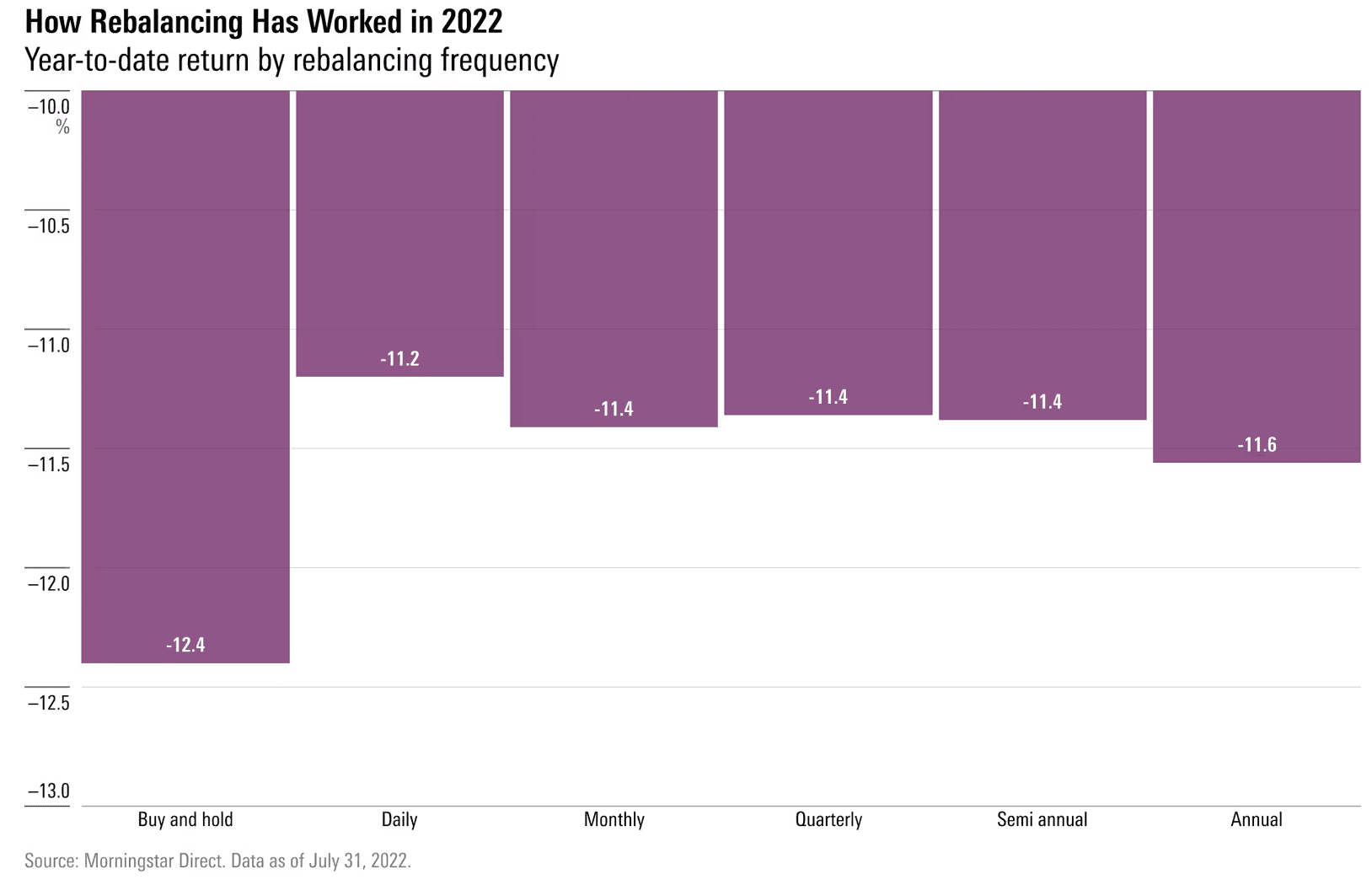

Morningstar's 2022 analysis showed that portfolios without rebalancing suffered the deepest losses during market corrections—the buy-and-hold portfolio's stock position climbed to over 74% by end of 2021, leaving it overexposed to the 2022 downdraft.

The Frequency Question: What the Data Shows

Vanguard's comprehensive study examined rebalancing frequencies and found:

Monthly rebalancing generated marginally lower returns than quarterly or annual due to increased transaction costs

Annual rebalancing with 200 basis point thresholds produced optimal risk-adjusted returns

No rebalancing resulted in 20%+ equity drift over 10 years, significantly increasing volatility

The study concluded that annual or semi-annual rebalancing with relative thresholds delivered the best balance of risk control and cost efficiency.

But frequency must account for portfolio-specific factors:

Tax status: Taxable accounts benefit from less frequent rebalancing to defer capital gains

Volatility: Higher-volatility portfolios drift faster and may require quarterly monitoring

Transaction costs: Smaller accounts incur proportionally higher trading costs

Tolerance Bands: The Critical Variable

While frequency gets attention, tolerance bands—the drift thresholds that trigger rebalancing—matter more.

Common approaches:

Absolute bands: Rebalance when any asset class deviates ±5 percentage points from target

Relative bands: Rebalance when any asset class deviates ±20% from target weight (e.g., 60% equity target triggers at 72% or 48%)

Asset-class-specific bands: Different thresholds for equity (±5%), bonds (±3%), alternatives (±2%)

Research from Kitces analyzing Vanguard data found that relative bands outperformed absolute bands for portfolios with unequal weights—maintaining proportional risk control across all positions.

The Tax Dimension: When Not to Rebalance

For taxable accounts, rebalancing must balance risk control against tax efficiency.

Strategic considerations:

Harvest losses first: Identify depreciated holdings for tax-loss harvesting before selling appreciated positions

Defer small gains: Wait for positions to age to long-term capital gains status when possible

Use cash flows: New contributions provide rebalancing opportunities without triggering taxable events

Asset location matters: Rebalance tax-inefficient positions (bonds, REITs) in qualified accounts

Schwab's research on tax-aware rebalancing demonstrated that coordinating rebalancing with tax-loss harvesting improved after-tax returns by deferring current tax liabilities and leaving more capital invested.

Behavioral Finance: Why Automation Wins

The most significant rebalancing challenge isn't methodology—it's execution. Discretionary rebalancing fails because it requires acting against instinct.

The behavioral barriers:

Selling winners feels wrong: Trimming equities after strong performance triggers loss aversion

Buying losers feels risky: Adding to bonds during equity rallies contradicts recency bias

Market timing creep: Advisors delay rebalancing to "wait for clarity"

Studies show that portfolios managed with automated rebalancing rules outperformed discretionary approaches—not because the rules were superior, but because they removed behavioral interference. Systematic rebalancing enforces contrarian positioning precisely when it's most uncomfortable and most valuable.

Best Practices: What the Evidence Says

Synthesizing the research, optimal rebalancing for most RIA clients involves:

Frequency: Annual or semi-annual calendar review with 5% relative (or 20% relative) tolerance bands

Methodology: Hybrid approach—scheduled reviews, trade only if drift exceeds thresholds

Tax awareness: Prioritize loss harvesting, defer small gains, use cash flows first

Automation: Rules-based execution removes behavioral interference

Account-level customization: Adjust frequency and thresholds based on portfolio volatility, size, and tax status

The difference between best-practice rebalancing and ad hoc approaches compounds to 50–100 basis points annually after accounting for risk reduction, tax optimization, and behavioral governance.

Why Infrastructure Determines Outcomes

Rebalancing theory is settled. Execution is where most advisors struggle—not because they don't understand principles, but because their systems don't enforce them.

Manual rebalancing across hundreds of client accounts becomes operationally prohibitive. Advisors default to annual rebalancing even when quarterly would add value, or skip rebalancing during volatile periods when it matters most.

Modern infrastructure automates the workflow: monitors drift continuously, identifies rebalancing opportunities, optimizes trade execution for tax efficiency, and documents fiduciary rationale.

The advisor's role shifts from executing trades to overseeing systematic processes—intervening only when client-specific circumstances warrant deviation from policy. That's not abdication of judgment. It's leveraging technology to ensure best practices are applied consistently, not just to portfolios advisors have time to review manually.

Related

Get Started

Experience the full power of our SaaS platform with a risk-free trial. Join countless businesses who have already transformed their operations. No credit card required.

FAQs