Blog

Feb 3, 2026

A decade ago, alternative investments were the domain of institutional endowments and ultra-high-net-worth families. Today, retail investors can access private credit funds with $10,000 minimums, fractional real estate through mobile apps, and structured notes designed by the same desks that serve sovereign wealth funds.

The democratization narrative is compelling: why shouldn't everyday investors access the same diversification tools that helped Yale's endowment deliver 10.5% annualized returns over the past decade? But accessibility doesn't guarantee suitability.

For RIAs navigating client requests to allocate toward private credit, interval funds, or real estate crowdfunding platforms, the question isn't whether these products exist—it's whether they genuinely improve risk-adjusted outcomes or simply repackage complexity as diversification.

What Actually Qualifies as "Alternative"

The term has become meaninglessly broad, encompassing everything from venture capital to collectible wines. For RIA purposes, the accessible alternative landscape includes:

Private credit: Direct lending to middle-market companies through interval funds or closed-end structures

Private real estate: Crowdfunding platforms, non-traded REITs, syndicated property investments

Structured notes: Derivatives-based instruments offering principal protection, enhanced yield, or participation in specific market outcomes

Liquid alternatives: Mutual funds and ETFs employing hedge fund strategies like long-short equity or managed futures

What unites these products isn't asset class—it's the trade-off they demand. Alternatives typically offer higher expected returns or lower correlation to public markets. In exchange, they extract costs through fees, illiquidity, complexity, or all three.

Private Credit: Higher Yields, Hidden Constraints

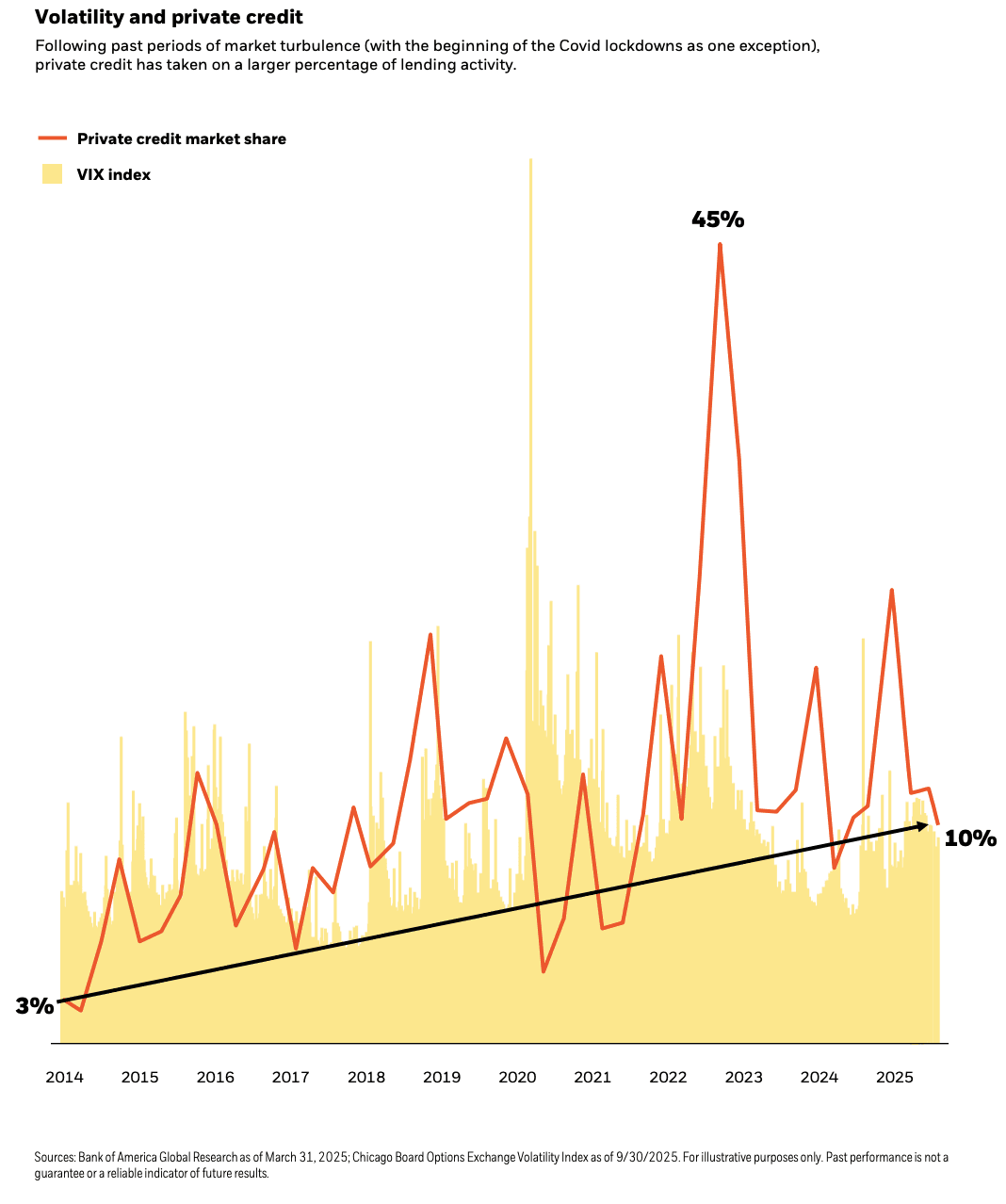

Private credit has exploded from $875 billion in assets under management in 2020 to over $1.5 trillion by 2024, according to McKinsey. The pitch is straightforward: lend directly to mid-sized companies at yields of 8%–12%, capturing a premium that compensates for illiquidity and credit risk.

The appeal for clients:

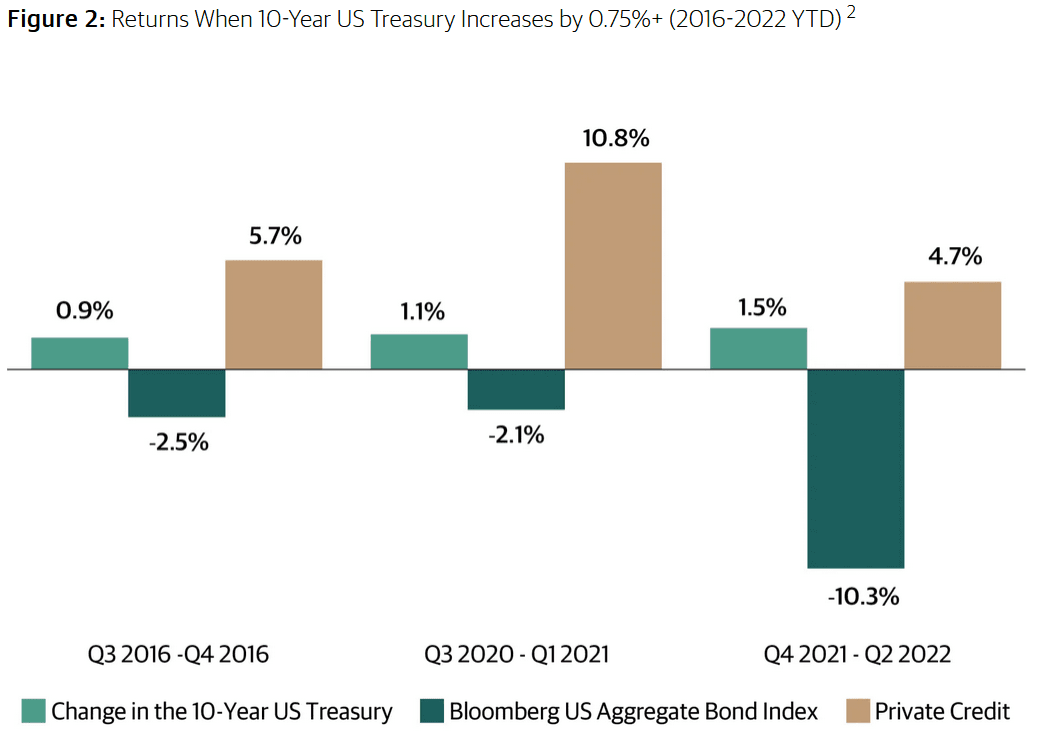

Yields significantly above investment-grade bonds

Floating-rate structures provide inflation protection

Historically lower default rates than high-yield bonds

Perceived diversification from public credit markets

The structural realities:

Most retail-accessible vehicles are interval funds with quarterly redemption windows capped at 5% of NAV

Valuations rely on manager-reported marks, not daily market pricing

During stress periods (March 2020, Q4 2022), redemption queues formed as investors couldn't exit

Fee structures often layer management fees (1.5%–2%) atop performance fees (10%–20%)

Research from Preqin's 2024 Global Private Debt Report shows top-quartile managers outperform public credit by 200–300 basis points annually. Bottom-quartile managers underperform significantly. For retail investors accessing these strategies through interval funds, manager selection becomes everything.

The question isn't whether private credit offers attractive yields. It's whether clients understand they're trading daily liquidity for those yields, and whether their portfolio can absorb that trade-off when liquidity becomes valuable.

Real Estate Platforms: Fractional Ownership, Full Complexity

Crowdfunding platforms have made direct real estate investment accessible with minimums as low as $500. The narrative mirrors private credit: capture institutional-quality returns without operational burden.

What these platforms provide:

Exposure to diversified property portfolios (multifamily, industrial, retail)

Projected yields of 8%–12% through rental income and appreciation

Lower correlation to equity markets than REITs

Access to deals historically reserved for accredited investors

The friction points:

Liquidity is often worse than private credit—many platforms offer no secondary market

Redemption windows can be suspended entirely during market stress

Valuations lag real-time pricing, creating illusion of stability during drawdowns

Platform risk: if the intermediary fails, recovering capital becomes legally complex

SEC guidance highlights that many retail investors underestimate concentration risk—allocating 20%+ of portfolios to illiquid real estate through a single platform without understanding redemption restrictions.

Publicly traded REITs provide real estate exposure with daily liquidity, transparent pricing, and regulatory oversight. The premium yield offered by crowdfunding platforms compensates for giving up all three.

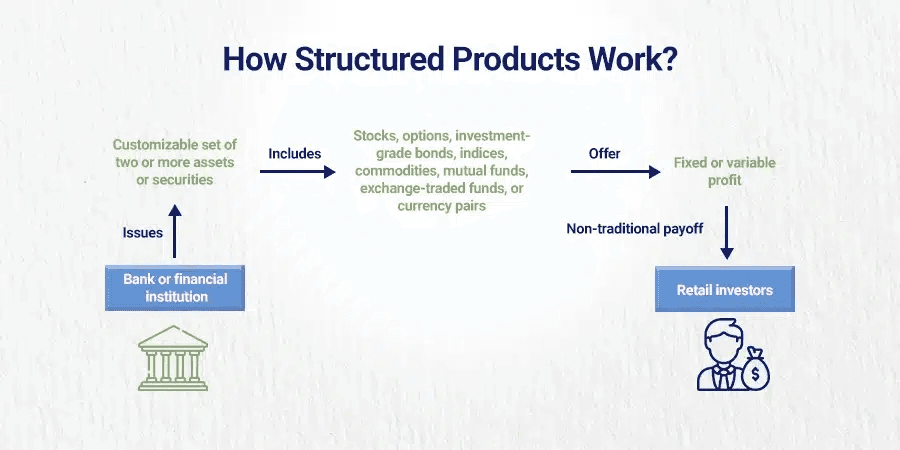

Structured Notes: Engineered Outcomes or Engineered Fees?

Structured notes combine bonds with derivatives to create customized payoff profiles. FINRA data shows issuance remains robust, with billions issued annually.

Common structures:

Autocallables: Pay enhanced coupons if underlying index stays within range

Buffered notes: Participate in equity upside while providing 10%–20% downside protection

Reverse convertibles: Offer high coupons but convert to equity if underlying drops below strike

The transparency problem:

Structured notes embed multiple cost layers that rarely appear as explicit fees:

Underwriting spreads (1%–3% at issuance)

Embedded option premiums priced to issuer's advantage

Credit risk of the issuing bank (if bank defaults, note value collapses)

Bid-ask spreads on secondary markets often 5%–10% wide

For most client portfolios, replicated payoffs using exchange-traded options cost 30%–50% less than comparable structured notes. The appeal stems from packaging complexity as simplicity—but advisors capable of executing option strategies directly deliver better economic outcomes.

The Illiquidity Premium Reconsidered

A core argument for alternatives is the "illiquidity premium"—extra return earned by locking up capital. Academic research shows this premium exists for institutional investors with permanent capital. But retail-accessible alternatives often fail to deliver it.

Why the premium compresses:

Interval funds maintain quasi-liquid structures, sacrificing the full premium

Manager fees consume much of the theoretical excess return

Retail investors frequently attempt to exit during stress, forcing managers to hold cash buffers (drag on returns)

Mark-to-model pricing creates artificial stability, not genuine risk reduction

Bank for International Settlements research from Q4 2023 highlighted that retail alternative vehicles exhibited redemption pressure during 2022's drawdown, forcing some funds to gate redemptions—the opposite of diversification.

The illiquidity premium is real for investors who genuinely don't need capital access for 7–10 years. For clients maintaining 60%+ of wealth in alternatives because "the returns look good," the premium becomes a penalty during unexpected liquidity needs.

When Alternatives Actually Add Value

Alternatives make sense when:

Client has genuinely long time horizon (10+ years) with no intermediate liquidity needs

Portfolio already holds substantial liquid core (70%+ in stocks/bonds/cash)

Manager selection includes operational due diligence, not just performance screening

Fee structures are transparent and competitive with institutional share classes

Client understands worst-case scenarios, including gated redemptions

Alternatives introduce risk when:

Used as "diversification" without defining what risk they're diversifying from

Allocated to because recent performance looks attractive (return chasing)

Total illiquid allocation exceeds 20% of portfolio without explicit liquidity modeling

Advisor hasn't stress-tested redemption scenarios during market dislocations

The Infrastructure Question

Managing alternatives introduces operational complexity legacy platforms weren't built to handle. Private investments don't rebalance automatically. Valuations update quarterly. Tax reporting arrives late. Capital calls occur unpredictably.

Advisors need infrastructure that:

Aggregates illiquid holdings with liquid portfolios in unified reporting

Models total portfolio liquidity across staggered lock-up periods

Automates rebalancing around non-tradable positions

Tracks capital commitments and unfunded obligations

Platforms designed around public securities treat alternatives as edge cases requiring manual intervention. Purpose-built systems treat them as first-class portfolio components with integrated workflows.

What the Evidence Shows

The rise of retail-accessible alternatives represents genuine innovation in availability, not necessarily in strategy quality. The question isn't whether they're "worth the hype"—it's whether they're being deployed with institutional discipline or simply sold because they're novel.

For clients with appropriate time horizons, liquidity cushions, and fee-conscious implementation, alternatives offer legitimate diversification benefits. For clients chasing yield, adding complexity for its own sake, or misunderstanding liquidity constraints, they introduce risks that compound silently until stress periods.

Advisors who treat alternatives as specialized tools—allocated deliberately, monitored systematically, and integrated into holistic portfolio construction—deliver value. Those who add them because "clients are asking about it" create exposure without compensation.

The hype isn't the problem. It's the implementation.

Related

Get Started

Experience the full power of our SaaS platform with a risk-free trial. Join countless businesses who have already transformed their operations. No credit card required.

FAQs