Blog

Jan 26, 2026

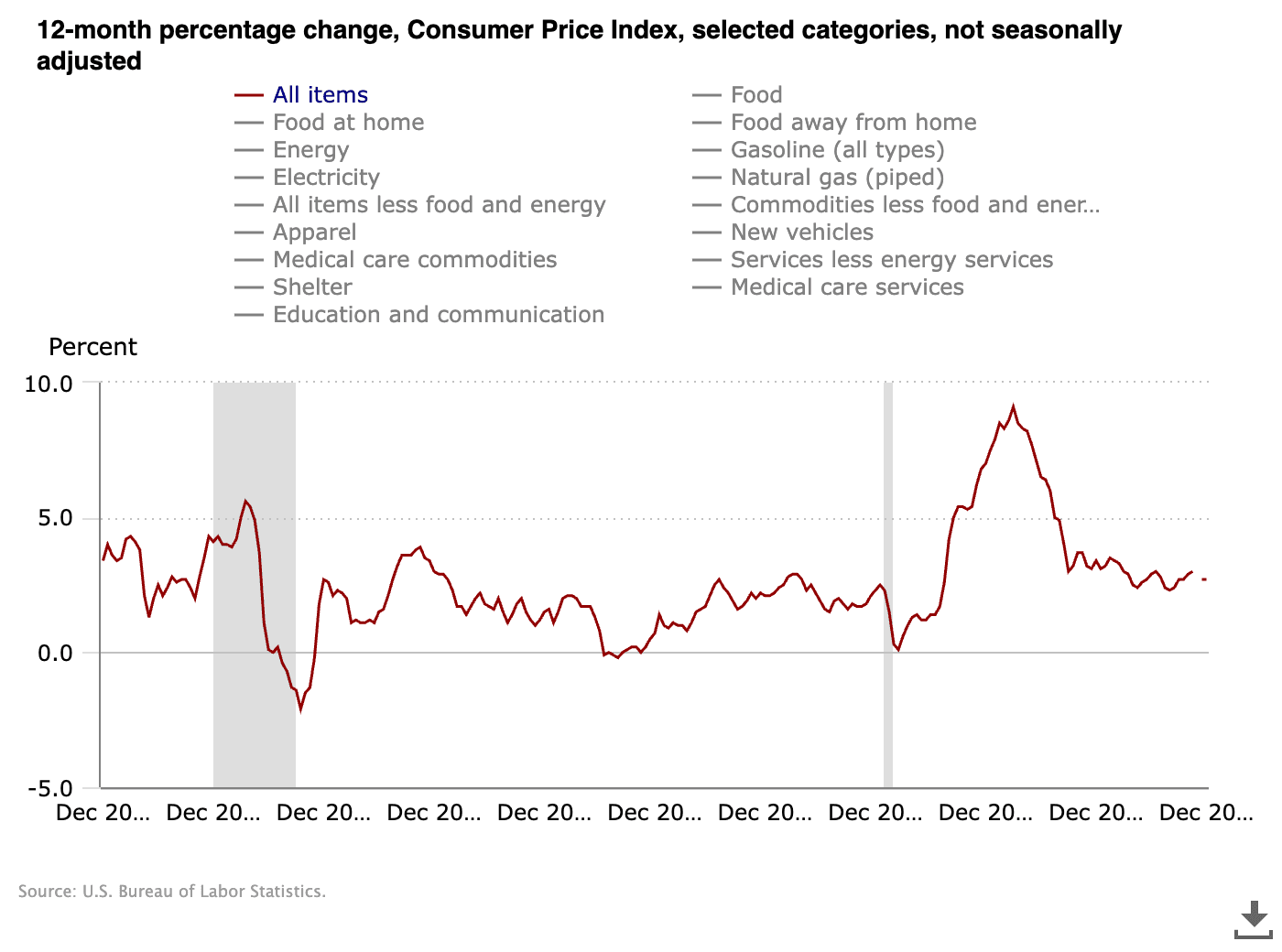

Your clients are confused, and rightfully so. They hear inflation has fallen from 9.1% in June 2022 to 2.9% by December 2024, yet their grocery bills remain 25% higher than three years ago. Their insurance premiums keep climbing. Housing costs haven't budged. The gap between what economic data says and what daily life feels like has become a source of legitimate frustration—and a critical advisory opportunity.

The confusion stems from a fundamental misunderstanding of what "cooling inflation" actually means. Lower inflation means prices are rising more slowly, not falling. A 2.9% inflation rate means costs continue increasing, just at a pace closer to historical norms. For prices to actually decline, you need deflation—which creates its own economic dangers. The challenge for advisors isn't explaining why prices remain elevated. It's helping clients navigate an environment where purchasing power erosion continues, albeit at a more manageable rate.

Why Price Levels Stay High Even as Inflation Falls

Inflation measures the rate of change in prices, not absolute price levels. When inflation drops from 9% to 3%, it means prices are still rising—just less aggressively. Think of it as a car slowing from 90 mph to 30 mph. You're still moving forward, covering more distance, just at a slower pace.

The categories that drove pandemic-era inflation tell the story:

Food prices increased 25% from 2020 to 2024, with grocery costs experiencing the sharpest gains in four decades

Shelter costs rose 22% over the same period, representing the largest component of most household budgets

Energy prices remain volatile but averaged 30% higher than pre-pandemic levels

Services inflation—from healthcare to car insurance—accelerated as labor costs increased

These price increases don't reverse when inflation cools. Grocery stores don't mark eggs back down to $2.50 a dozen once supply chains normalize. Landlords don't voluntarily reduce rent after raising it 20%. The new price level becomes the baseline from which future inflation compounds.

Wage Growth Helps—But Not Evenly

The silver lining in elevated price levels is that nominal wage growth averaged 4.5% annually from 2022-2024, outpacing inflation for the first time in years. Real wages—adjusted for inflation—turned positive in 2023 and continued improving through 2024. This matters enormously: if incomes rise faster than prices, purchasing power expands even as absolute price levels stay high.

But wage growth distributes unevenly across income levels and industries:

Lower-wage workers saw the strongest percentage gains, with median wages for the bottom quartile rising 6-7% annually

White-collar professionals experienced more modest gains of 3-4%

Retirees on fixed incomes faced the harshest purchasing power erosion

Investment income and capital gains followed market performance rather than inflation

For clients still working, the question becomes whether their individual wage trajectory exceeds inflation in categories they actually consume. For retirees, the question is whether portfolio returns and Social Security adjustments—which increased 3.2% for 2024—keep pace with their personal inflation rate.

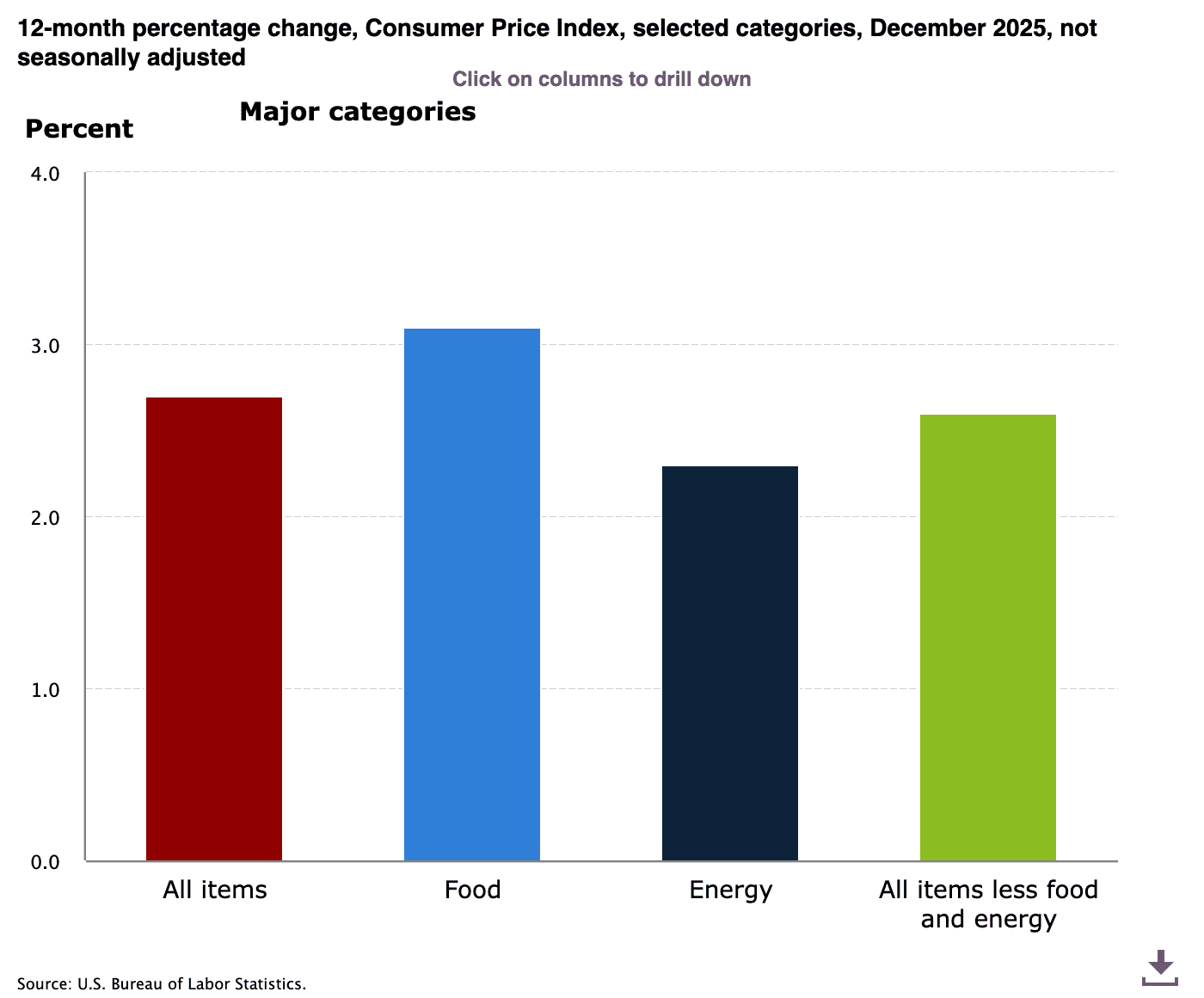

The Personal Inflation Rate Matters More Than CPI

The Consumer Price Index measures average price changes across a standardized basket of goods and services. But no household consumes the average basket. A retiree spending 40% of income on healthcare experiences vastly different inflation than a young family allocating 35% to childcare and housing.

Healthcare costs, which represent a disproportionate share of retiree spending, increased 4.1% year-over-year through 2024—well above headline inflation. Childcare costs rose even faster in many markets. Meanwhile, goods prices actually declined for categories like electronics and used vehicles.

This dispersion creates advisory opportunities. Rather than anchoring on headline CPI, calculate your client's personal inflation rate based on their actual spending categories. A client spending heavily on categories with above-average inflation needs a different portfolio strategy than one with more balanced consumption patterns.

Understanding personal inflation rates also reframes withdrawal rate conversations. A 4% withdrawal strategy designed for 2% average inflation underperforms if your client's spending basket inflates at 4%. The same retirement portfolio that seemed adequate three years ago may require adjustment not because markets failed but because the cost structure changed.

Asset Allocation Remains the Primary Defense

When purchasing power erosion persists, the fundamental question becomes how to position portfolios to preserve and grow real wealth. This isn't about tactical trading or market timing—it's about systematic exposure to assets that compound ahead of inflation over time.

Equities provide the most reliable long-term inflation hedge through several mechanisms:

Revenue growth that compounds with nominal GDP: As prices rise, corporate revenues rise in nominal terms

Pricing power in quality companies: Firms with competitive advantages pass costs to consumers, protecting margins

Operating leverage: Fixed cost structures mean revenue growth flows disproportionately to profits

Historical data shows equities returned 10% annually from 1926-2024, substantially outpacing inflation's 3% average. Even accounting for elevated current valuations, equity exposure remains essential for clients with multi-decade time horizons.

Fixed income serves different purposes in inflationary environments. Traditional bonds suffered during 2022's rate surge, but Treasury Inflation-Protected Securities (TIPS) gained 4.3% while nominal bonds fell 13%. The lesson isn't to abandon bonds—it's to match bond exposure to the specific risks you're hedging.

Real assets—including real estate, commodities, and infrastructure—provide direct inflation linkage but with significant complexity. REITs offer inflation sensitivity through rent escalations but trade with equity-like volatility. Commodity exposure requires careful implementation to avoid roll yield drag. For most advisors, tactical real asset allocations make sense only when integrated into comprehensive portfolio strategies, not as panic responses to inflation headlines.

Tax Efficiency Amplifies Real Returns

Inflation doesn't just erode purchasing power—it interacts perniciously with the tax code to reduce after-tax real returns. Capital gains taxes apply to nominal returns, not inflation-adjusted gains. If your portfolio gains 6% in a year with 3% inflation, you've earned 3% real return. But taxes apply to the full 6% nominal gain, reducing your after-tax real return below 3%.

This dynamic makes tax-efficient implementation critical in persistent inflation environments:

Tax-loss harvesting captures real losses while maintaining market exposure, offsetting future tax liabilities

Asset location places tax-inefficient holdings in sheltered accounts while keeping tax-efficient equity exposure in taxable accounts

Long-term capital gains management ensures rebalancing occurs in ways that minimize tax drag

Municipal bonds become more attractive for high-income clients as tax rates compound with bracket creep

The advisor who delivers 7% gross returns with 2% tax drag provides materially worse outcomes than one delivering 6.5% gross returns with 0.5% tax drag. In 3% inflation environments, those seemingly small efficiency gains determine whether clients maintain purchasing power or gradually erode wealth.

Automated systems that continuously monitor for tax-loss harvesting opportunities, optimize asset location across account types, and execute rebalancing with tax awareness deliver measurable value that manual processes cannot match at scale. This operational leverage becomes increasingly important as client complexity grows.

Systematic Rebalancing Captures Volatility Premium

Elevated inflation creates market volatility as investors reprice assets for changing rate expectations. This volatility represents opportunity for disciplined portfolios. Rules-based rebalancing—mechanically returning portfolios to target allocations as market movements create drift—forces buying assets that have fallen and trimming positions that have risen.

The behavioral challenge is that rebalancing feels wrong in the moment. Buying bonds when yields spike and prices fall contradicts recent experience. Adding to international equities after underperformance defies recency bias. Yet these countercyclical trades capture the volatility premium that drives long-term outperformance.

Research from Vanguard's advisor's alpha framework estimates disciplined rebalancing adds 35 basis points annually to net returns. In high-volatility environments created by inflation uncertainty, that value increases as price dispersions widen.

The alternative—allowing portfolios to drift based on market movements or adjusting allocations based on inflation forecasts—introduces timing risk that overwhelms the benefit of any tactical insight. Markets are forward-looking. By the time inflation data confirms a trend, asset prices have already adjusted.

What Clients Actually Control

Media narratives about inflation create learned helplessness—the sense that external forces dictate financial outcomes. Yet clients control more than they realize:

Spending flexibility: Inflation rates are averages, but consumption is discretionary in many categories

Asset allocation discipline: Maintaining appropriate equity exposure through volatility compounds over time

Tax optimization: Harvest losses, locate assets efficiently, manage gains strategically

Behavioral consistency: Avoid panic selling during volatility or return-chasing after rallies

The advisor's role isn't to promise inflation protection that eliminates all purchasing power risk—no portfolio does that without introducing other risks. It's to build systematic approaches that keep clients invested appropriately, rebalance mechanically, and optimize implementation details that compound into material differences over decades.

Clients who understand why their portfolio is structured as it is, who see evidence of systematic management through tax reporting and rebalancing activity, and who receive clear communication about what's actually happening in markets stay invested through the volatility that causes others to abandon sound strategies at precisely the wrong time.

Related

Get Started

Experience the full power of our SaaS platform with a risk-free trial. Join countless businesses who have already transformed their operations. No credit card required.

FAQs