Blog

Jan 24, 2026

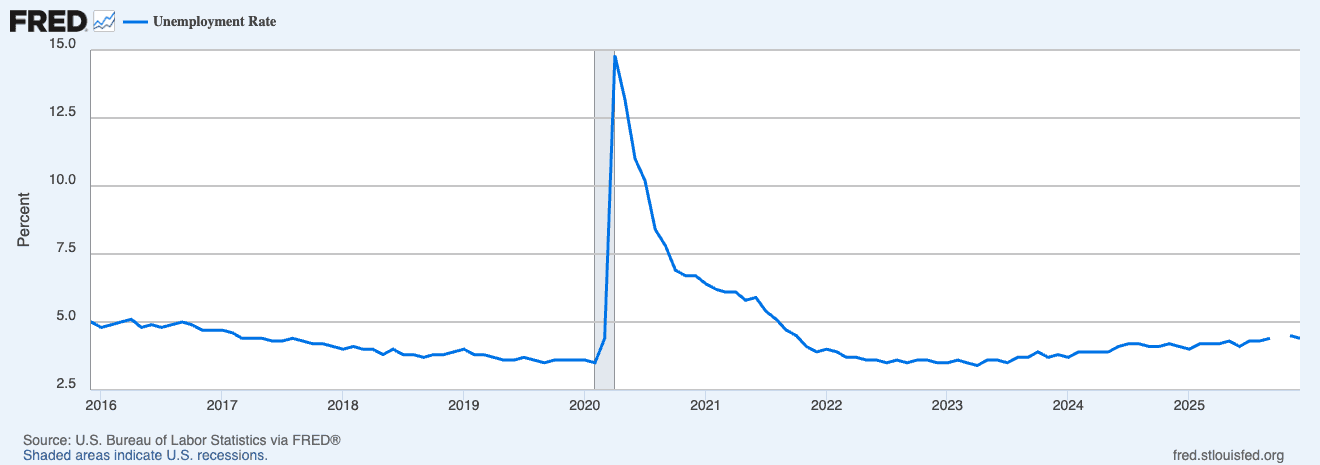

The persistence of "recession watch" in financial media has become almost ritualistic. Yet for advisors managing client portfolios through 2025, the question isn't whether headlines will continue predicting downturns—it's whether the underlying economic architecture supports those predictions. With unemployment at 3.9% as of December 2024, inflation declining from its 2022 peak, and credit markets functioning normally, the conventional markers of imminent recession remain absent.

The challenge for RIAs isn't to forecast the business cycle with precision—an exercise that humbles even central bankers. It's to construct portfolios that remain resilient across multiple scenarios while maintaining the discipline to rebalance when others panic or chase performance.

Labor Markets Show Resilience, Not Weakness

The unemployment rate has remained below 4% for over two years, a streak historically associated with strong consumer spending and economic expansion. The narrative of a labor market "cracking" gained traction in mid-2024, but the data tells a different story:

Payroll growth averaged 186,000 monthly in 2024, consistent with an economy approaching full employment rather than contraction

Initial jobless claims stayed below 250,000, well beneath levels that typically precede recessions

The Sahm Rule trigger came from labor force expansion and immigration, not mass layoffs—dynamics economist Claudia Sahm herself noted made the traditional interpretation unreliable

What matters for portfolio construction isn't whether unemployment ticks up modestly from historic lows. It's whether job losses accelerate into feedback loops that characterize actual recessions: layoffs reducing income, cutting consumption, forcing more layoffs. That transmission mechanism remains absent.

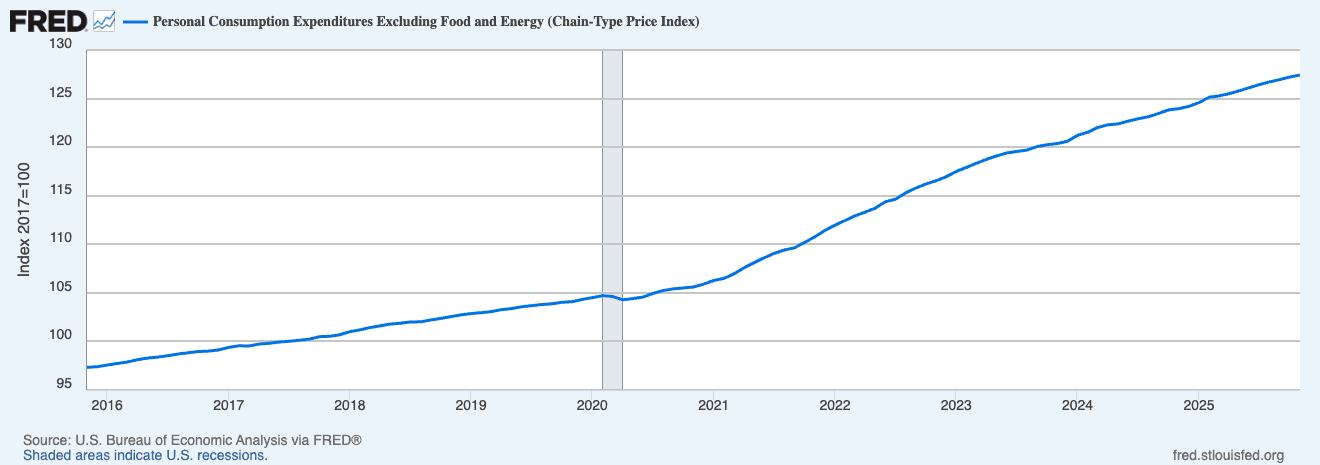

Inflation's Path Matters More Than Its Level

Core PCE inflation declined to 2.8% year-over-year by December 2024, down from 5.6% in early 2023. The disinflation occurred without severe economic contraction. The relevant question for 2026 isn't whether inflation reaches the Fed's 2% target on schedule—it's whether the path destabilizes economic activity.

Rapid disinflation through demand destruction creates recessions. Gradual disinflation through supply normalization and productivity gains doesn't. Current trajectories resemble the latter, with productivity growth exceeding 2% annualized through 2024, allowing wage growth and consumption to coexist with moderating price pressures.

For fixed income portfolios, this distinction changes everything. If inflation stabilizes near 3% without forcing additional monetary tightening, duration exposure carries less reinvestment risk than if rates must rise further.

Consumer Balance Sheets Remain Sturdy

Household fundamentals contradict recession narratives:

Debt service ratios stood at 9.8% in Q3 2024, near historic lows despite rising interest rates

Credit card delinquencies increased modestly but remained below pre-pandemic averages

Household net worth reached record highs driven by asset appreciation

Real wage growth turned positive, supporting ongoing consumption

The "excess savings depletion" narrative conflated aggregate savings levels with spending capacity. While checking account balances declined from stimulus-inflated peaks, ongoing income—not accumulated cash—drives consumption for most households. With employment strong and real wage growth positive, spending capacity persists even as pandemic-era cushions normalize.

Consumer spending accounts for 70% of U.S. GDP. Recessions require consumption to contract, not merely slow. Current credit conditions don't support contraction scenarios.

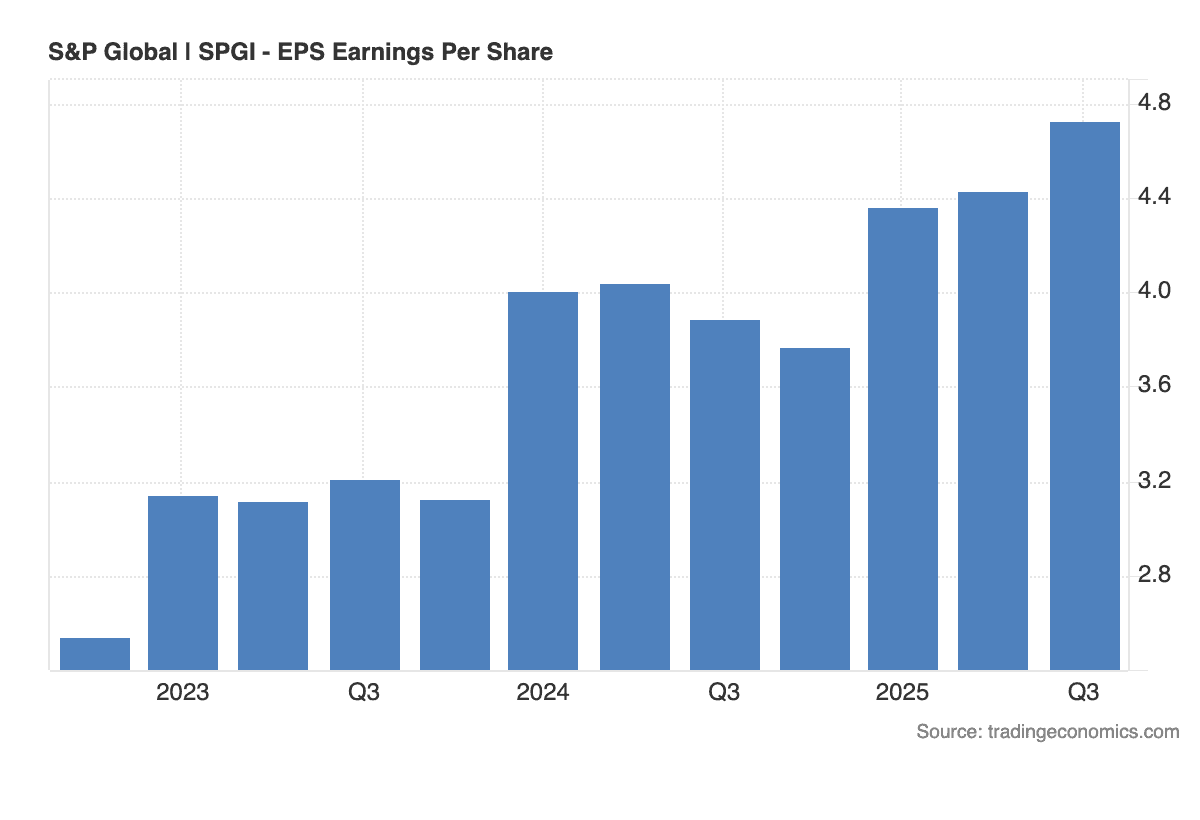

Corporate Earnings Growth Exceeds Pessimistic Forecasts

S&P 500 earnings per share grew 8% year-over-year in 2024, with 2025 consensus estimates projecting similar growth. Profit margins remained elevated despite higher labor costs and borrowing rates, as productivity improvements and pricing power offset expense pressures.

Revenue growth, not multiple expansion, explained most equity gains through 2024. This matters because earnings-driven rallies prove more durable than valuation-driven ones. Markets discount forward expectations, not current conditions. Persistent recession fears that never materialize create opportunities for disciplined rebalancing rather than validation for defensive positioning.

The relationship between corporate profitability and recession risk is direct: recessions require earnings to fall, not merely grow slowly. Unless margins collapse—which requires either demand destruction or cost explosions current data don't support—corporate earnings provide fundamental support for equity allocations.

Yield Curve Signals Require Context, Not Reflex

The yield curve inverted in mid-2022, with 2-year Treasury yields exceeding 10-year yields by as much as 100 basis points. Historically, inversions have preceded every recession since 1970, creating understandable concern. Yet the predictive mechanism functions differently in 2024's financial architecture.

More importantly, inversions typically precede recessions by 12-18 months, with recessions beginning when the curve steepens as the Fed cuts rates. The curve began normalizing in late 2024 as long-term yields adjusted to inflation persistence—this steepening hasn't been accompanied by weakening economic data.

Advisors treating yield curve signals as mechanical indicators miss critical context. Current curve dynamics reflect transition from emergency tightening toward neutral policy, not financial instability.

Systematic Rebalancing Matters More Than Macro Forecasting

The persistent gap between recession predictions and economic outcomes reveals a deeper truth: advisors add value through disciplined portfolio management, not macroeconomic forecasting. Every year since 2022 has featured recession calls from respected economists, with markets pricing various probabilities of contraction. Those who positioned portfolios around these forecasts missed substantial equity returns.

Rules-based rebalancing—returning portfolios to target allocations as market movements create drift—forces the behavioral discipline markets require:

When recession fears drive equity valuations down without fundamental deterioration, rebalancing captures the risk premium

When optimism pushes valuations beyond what earnings support, rebalancing reduces exposure

This approach doesn't require predicting whether 2026 brings recession or continued expansion

The alternative—adjusting allocations based on recession probabilities—introduces timing risk that even institutional investors struggle to manage profitably. Markets bottom before recessions end and peak before expansions conclude.

What Actually Deserves Attention

Rather than binary recession predictions, portfolio construction should address genuine risks the current environment presents. Equity valuations, while supported by earnings growth, leave limited margin for disappointment. Fixed income faces reinvestment challenges if inflation remains persistently above 2.5%, limiting the Fed's easing capacity.

Geopolitical risks—from trade policy uncertainty to geopolitical tensions—carry larger tail risks than domestic business cycle dynamics. Concentration risk in equity portfolios, with top-10 S&P 500 holdings representing over 30% of index weight, creates vulnerability to sector-specific shocks.

The most significant risk may be behavioral: clients abandoning well-constructed plans because recession fears feel more urgent than disciplined execution. Advisors who can communicate why systematic approaches outperform reactive ones provide value that transcends whether 2026 brings 2% GDP growth or modest contraction.

Related

Get Started

Experience the full power of our SaaS platform with a risk-free trial. Join countless businesses who have already transformed their operations. No credit card required.

FAQs